‘A perverse economic experiment’: Turkey’s currency is hitting record lows as inflation skyrockets

The wrong kind of Turkey is inflating this Thanksgiving as economists around the globe sit stunned at record numbers hit on Wednesday.

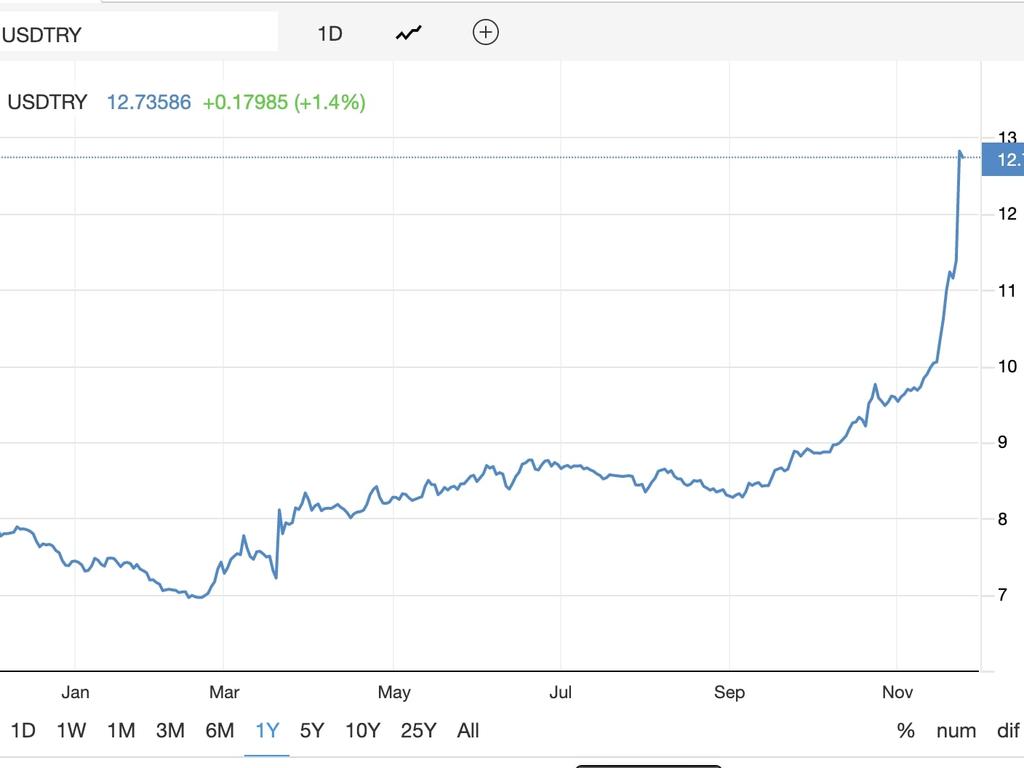

Economists in Turkey have been put on alert after the nation’s currency plunged an incredible 15 per cent in its second-worst day on record.

The Lira, which is now the worst-performing for any country in 2021, has shed 45 per cent of its value this year. Inflation has hit the Middle Eastern nation hardest in November, recording a near 26 per cent for the Lira since the beginning of last week.

Turkey's currency has been on the decline since early 2018 and the cause has been hard to pinpoint. Many believe the slide has been caused by a combination of geopolitical tensions with the West and radically mounting debt, caused by the inevitable economic strain the coronavirus pandemic has placed on nations.

Turkish President Recep Tayyip Erdogan’s ongoing refusal to raise interest rates to ease inflation has also courted heavy criticism, becoming an increasingly hot topic for critics of the government in recent months since the economic spiral.

Mr Erdogan recently defended recent sharp rate cuts and declared to his citizens the nation is fighting an “economic war of independence”. In his view, interest rates are “the enemy” and will worsen inflation.

“Insane where the Lira is, but it‘s a reflection of the insane monetary policy settings Turkey is currently operating under,” market strategist at Bluebay Asset Management Tim Ash said via CNBC.

“We are seeing a perverse economic experiment of what happens when a central bank has effectively no monetary policy. Erdogan has taken away the ability of the CBRT (Central Bank of Turkey) to hike policy rates.”

As of November 24th, the Lira sits at 13.44 to the US dollar, losing an incredible 30 per cent on the USD in 2021 alone. For perspective, the Lira’s decline was already making headlines in November 2019 when it was trading at around 5.6 to the USD which marked a massive drop from mid-2017 levels of 3.5 to the dollar.

Inflation in Turkey is currently sitting around 20 per cent, sending the price of basic goods skyrocketing as salaries devalue. The slowly deteriorating conditions for the middle and lower classes of the 85 million strong population have caused some worry among locals.

“Prices are rising too fast. I don‘t want to buy certain products because they’ve got too expensive,” Kaan Acar, a hotel executive in southern Turkey’s Kalkan resort, said via the online publication Rappler.

“The fault lies with President Erdogan, the AKP government, and those who for years turned a blind eye and supported them.”

Former bank deputy governor Semih Tumen, who was sacked last month in the latest round of Mr Erdogan‘s economic overhaul, called for regulation to be reintroduced to protect the currency’s value.

“This irrational experiment which has no chance of success must be abandoned immediately and we must return to quality policies which protect the Turkish lira‘s value and the prosperity of the Turkish people,” he said on Twitter.

According to several experts, the alarming plunge has been on the cards for years. An article published by Deutsche Welle in August 2020 predicted the continuous downfall of the Lira, warning decade-high levels of credit being granted would soon come back to bite.

“The president's ‘good intentions’ to lift the economic boat, however, fuelled a credit binge that saw loan growth rise 40 per cent in the past three months, peaking in May 2020 at 50 per cent, the fastest rate growth since 2008,” the publication wrote.

“The explosion of credit, including cheaper loans to households and businesses, has been stoking domestic inflation that was already standing at 11.76 per cent in July year over year. At the same time, the need for foreign currencies rose in line with rising imports, weakening the Turkish currency even further.”

Global market strategist at Brown Brothers Harriman Ilan Solot said the steadfast Mr Erdogan would likely wait until “breaking point” before making a drastic change.

“Right now locals seem content to keep their dollars in the local system. If they start to move money elsewhere, to Germany, to Austria, it‘s another story,” he said. “Then we will have a conversation about a real currency crisis.”