$415 billion wiped from Nvidia in biggest single day crash

After a stratospheric rise, a global tech giant has suffered an excruciating bloodbath with investors running for the hills in a day of losses.

One of the world’s biggest companies suffered the largest ever fall in a day of trading, wiping more than $400 billion in value as investors ran to the exits.

Concerns over a bubble in the artificial intelligence space has led to a continued sell-off of shares as the Nasdaq sank 3.3 per cent on Tuesday US time.

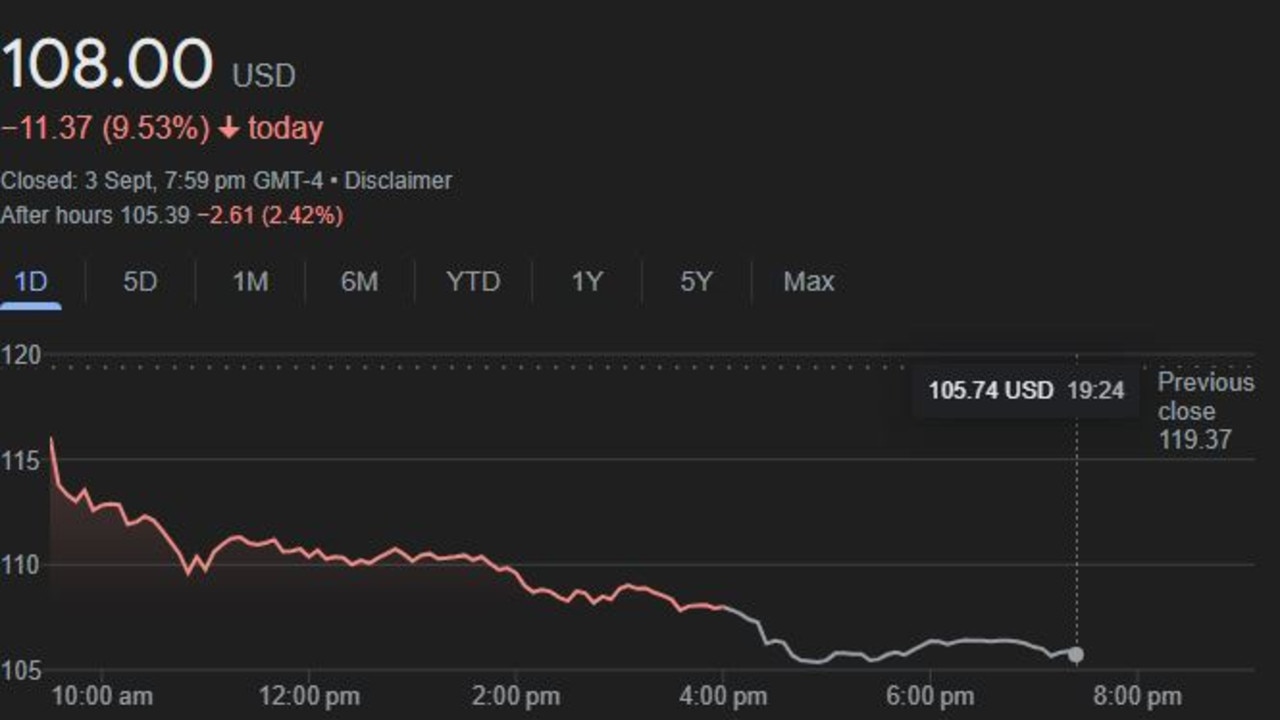

The biggest loser was AI tech chip manufacturer Nvidia, with its share price falling 9.5 per cent in a single day, racking up a loss of US$278.9 billion (AU$415.5 billion).

The company’s nearly 10 per cent drop is the largest single day fall in the history of the stock market, and comes after it lost $646 billion in the space of three days in June.

Its value rebounded quickly but has been fluctuating in the months since, and now sits at US$108 per share – down from a high-point of US$135.58 on June 18.

Tuesday’s plunge meant Nvidia lost the equivalent value of US energy giant Chevron in just one day.

Nvidia overtook Microsoft as the most valuable company in the world in June when it reached a market cap of AU$5.1 trillion.

It’s now sitting at about AU$3.95 trillion, while Apple has surged back to the top of the leaderboard at $5.05 trillion.

Despite being around for 30 years, Nvidia as a brand is not as well known to consumers as its rivals like Apple and Microsoft.

The company was a pioneer of GPU-accelerate computing for gaming and design, and has branched into AI microchips.

Its growth has been unprecedented, with its market value having risen 1000 per cent since October 2022.

Alec Renehan, co-host of the Equity Mates podcast, said Nvidia had been a “once-in-a-generation investment story”.

Although Wednesday’s fall was “massive”, he said, it was important for investors to keep perspective.

“Investors panicked today and shares were down more than 10 per cent but that doesn’t change the bigger story,” Mr Renehan said.

“Their technology is miles ahead of its competitors, it more than doubled sales this year, it has profit margins of more than 50 per cent and it’s central to the AI revolution we’re living through.

“So while slowing growth and the threat of an investigation by US regulators has people concerned at the moment, it’s important to keep a long-term perspective.”

The meteoric rise of Nvidia has seen 76 per cent of its employees become millionaires, and one-in-three are worth more than $20 million.

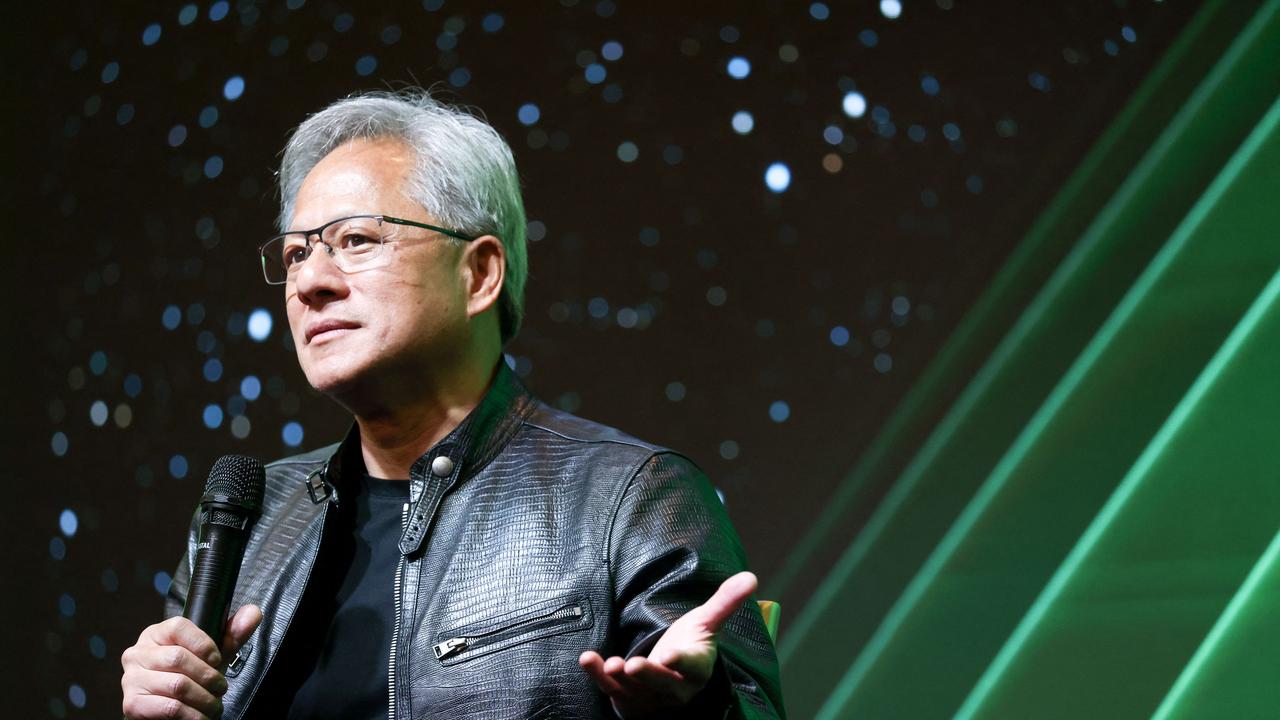

Chief executive Jensen Huang is worth a reported US$104 billion (AU$155 billion).

Nvidia is also facing a probe from the US Justice Department into allegations it has made customers changing to competitors difficult.

Bloomberg reported on Tuesday US time that the DOJ has sent subpoenas to Nvidia and other companies as it investigates whether the chipmaker violated antitrust laws.

In a statement, a spokesperson for the Silicon Valley-based company told AFP: “Nvidia wins on merit, as reflected in our benchmark results and value to customers, who can choose whatever solution is best for them.”

The Nasdaq index slumped more than three per cent Tuesday US time as Nvidia and other semiconductor equities retreated ahead of key jobs data later in the week.

The tech-focused Nasdaq finished down 3.3 per cent in the market’s first session in September following Monday’s holiday in the US.

The Dow Jones Industrial Average fell 1.5 per cent, while the broadbased S&P 500 shed 2.1 per cent.

Stocks spent the entire session in red, giving back a portion of the gains over the last month.

“I think there’s just profit taking, kind of rebalancing going on there,” said Sam Burns, chief strategist of Mill Street Research.

“And now that earnings season is over, there’s much less in terms of corporate news to drive things.”

– with AFP.