‘Total failure’: Slumping crypto eviscerated by respected author

It’s been a week from hell for crypto fans who are now being warned their investments are essentially “worthless” by a leading author.

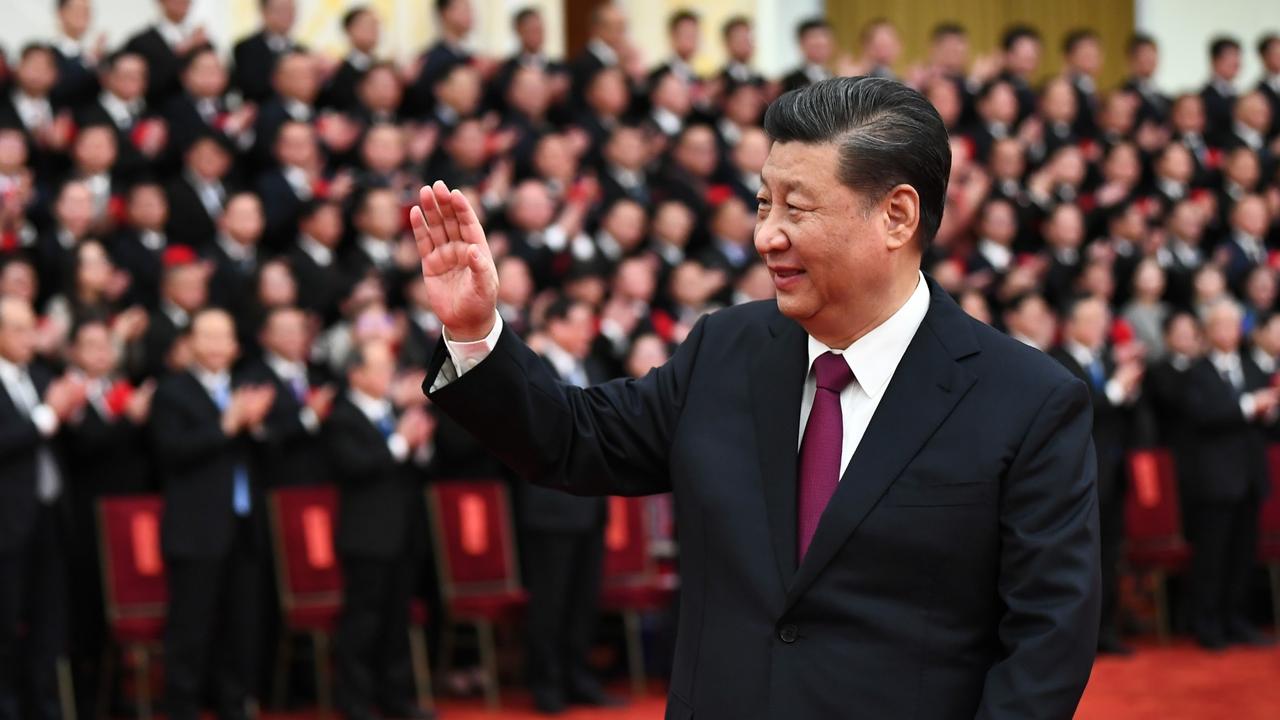

Cryptocurrency investors are having a week from hell as the market is crashing, the biggest token is in a “death cross” and China has cracked down hard on their assets.

Overnight, bitcoin slumped below a dreaded (USD) $30,000 threshold sparking fears of a major sell-off and a market collapse.

It recovered pretty well before Australian investors woke up for their morning coffee, but the overall trend over the past week has not been positive.

Digital tokens have taken a huge hit across the board after weeks of concerns about the environmental impact of mining coins and increasing government scrutiny.

It’s a recipe for disaster that has had some analysts warning the slump is reminiscent of the Black Tuesday crash that brought on the Great Depression in 1929.

One of those who is particularly scathing of the emerging tokens is Nassim Taleb — a highly respected mathematical statistician and author who has published a brutal take down on his website this week.

He has crunched the numbers and come up with the conclusion that the cryptocurrency is worth exactly zero, and that there is no evidence that blockchain — the process used to record transactions — is a useful technology.

A few years ago, he wrote that bitcoin is “an excellent idea”, but it appears he has changed his mind in a big way.

In a paper titled, “Bitcoin, Currencies, and Bubbles”, he said “In its current version, in spite of the hype, bitcoin failed to satisfy the notion of ‘currency without government’ (it proved to not even be a currency at all), can be neither a short or long term store of value (its expected value is no higher than 0), cannot operate as a reliable inflation hedge, and, worst of all, does not constitute, not even remotely, a tail protection vehicle for catastrophic episodes.

“The total failure of bitcoin in becoming a currency has been masked by the inflation of the currency value, generating (paper) profits for large enough a number of people to enter the discourse well ahead of its utility.

He then goes on to argue that bitcoin can neither be a short nor long-term store of value. He looked at the comparison of gold versus bitcoin – which he said was not wise – to illustrate his point.

“Gold and other precious metals are largely maintenance-free, do not degrade over a historical horizon, and do not require maintenance to refresh their physical properties over time,” he said. “Cryptocurrencies require a sustained amount of interest in them.”

Finally he argued that bitcoin is not a safe haven for investments in a volatile world — to protect against nefarious governments or other catastrophes.

“Not even remotely,” he said, pointing to the market panic in March last year when bitcoin sank lower than the sharemarket.

He also pointed to the ransom payments following the Colonial Pipeline cyber attack, which the FBI was able to track with ease.

“Government structures and computational power will remain stronger than those of distributed operators who, while distrusting one another, can fall prey to simple hoaxes,” he added.

He also hit out at the technology bitcoin relies on — blockchain,

“There is no evidence that we are getting a great technology – unless ‘great technology’ doesn’t mean ‘useful’,” he said.

However, crypto fans are keen to point out that Mr Taleb has changed his tune.

It’s a far cry from 2017, when Taleb wrote the foreword to “The Bitcoin Standard,” economist Saifedean Ammous’ book that made the case for the digital asset as a new form of sound money.

Bitcoin, Mr Taleb wrote then, is “an excellent idea. It fulfills the needs of the complex system … because it has no owner, no authority that can decide on its fate. It is owned by the crowd, its users. And it now has a track record of several years, enough for it to be an animal in its own right.”

What happened to bitcoin overnight?

Bitcoin may have rebounded slightly after it plunged below the dreaded (USD) $30,000 threshold overnight, but analysts are warning crypto investors they are headed towards a catastrophic crash.

The world’s most prominent digital currency lost value in the night’s trading, falling from close to $33,000 to $28,814.75, CoinDesk figures show.

After declining to this point, bitcoin was trading at its lowest since January 4 — wiping out all the gains it had made this year.

The fact that it dropped below $30,000 is concerning for investors because market analysts believed it would trigger a mass sell-off and send the market into a downward spiral.

Update: bitcoin officially erases all its 2021 gains https://t.co/sGhlu0tt1Upic.twitter.com/l315efaGxP

— Ryan Browne (@Ryan_Browne_) June 22, 2021

Bitcoin drops below $30k, lowest level since Jan 27th 👀

— Kate Rooney (@Kr00ney) June 22, 2021

Pretty much flat for the year (up 3%) after topping $60K in April pic.twitter.com/3G6Jbh101R

Breaking below that barrier would “basically put every long position since January 1 in the red, which I believe, will trigger another capitulation trade,” senior market analyst for Asia Pacific at Oanda wrote in a research note.

However, after suffering these losses, bitcoin bounced back, rallying more than 15 per cent to reach almost $32,627 this morning.

Other big coins have struggled though after a horrific day yesterday. As of around 6.30am this morning, ethereum took a 1.51 per cent hit, XRP dropped by 14.71 per cent and cardano lost 8.04 per cent of its value.

The bitcoin bounce back is being seen as a show of resilience by some.

Jason Lau, COO of cryptocurrency exchange OKCoin said the coin has dipped below the threshold several times and recovered.

“The $30k/BTC range has been tested and shown solid support dating back to early 2021, having been tested and bounced off multiple times now,” he said in a note.

He stressed that while temporary drops below $30,000 are not a huge cause for concern, if the digital currency trades “below $30k for a significant time,” he “will be tracking it closely.”

However, other analysts have offered far more sobering insights, and they are not pleasant reading for anybody who has skin in the game.

RELATED: Savage move from China cripples bitcoin and doge

Market experts at Shelly Palmer bleakly suggested the movement we’re seeing now is reminiscent of the “Black Tuesday” crash in 1929 that brought on the Great Depression.

“For anyone who invested at the top of the crypto hype cycle over the past few weeks, today is a reprise of Black Tuesday,” they said.

“By October 29, 1929, the Wall Street Crash had ended the Roaring 20s. This ‘very bad day’ in crypto is a day where the faint of heart and newbies will take a gigantic beating, while holders will welcome the buying opportunity at bargain basement prices.”

Death cross has formed

Technical data for bitcoin on Tuesday showed it had formed a “death cross”, a pattern of the token’s moving averages which would predict the beginning of a major downtrend.

A death cross appears when an asset’s short-term and long-term moving averages cross over one another, following a period where the short-term average was above the long-term. A downtrend in the average price will be confirmed if it stays that way.

Analysis from crypto research firm Quantum Economics showed bitcoin’s price had been trending upwards since October before slowing in February, causing the token’s short-term moving average to curve downwards.

“Bitcoin’s price had been trending up since October 2020, trading above the 50-day and 200-day moving averages that also sloped up in response,” said analyst Imran Yusof.

“The trend really started to change in April when bitcoin crossed below the 50-day MA,” he said, as bitcoin’s price began to swing more wildly in that time. “The token hit its all-time high of $64,829 that month, while also seeing lows of around $48,500.”