Stock market frenzy in China after shock Covid-19 backflip

China’s stock market is surging after authorities finally moved to ease one of the most restrictive Covid-19 crackdowns in the world.

China’s decision to scale back Covid-19 restrictions is literally paying dividends.

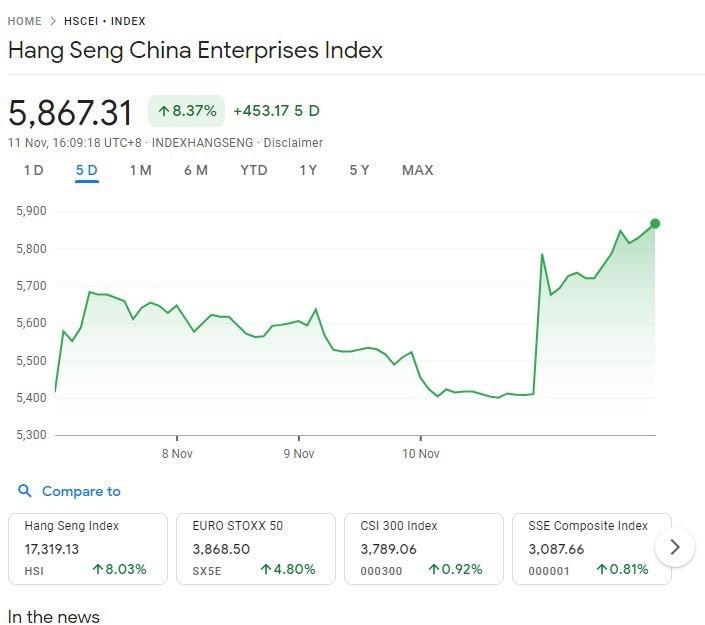

The Hang Seng China index has just experienced its best two-week gain in seven years as national authorities pull back on Covid Zero – China’s public health policy which dictates pandemic restrictions.

On Friday, China officially reduced quarantine times for travellers entering the country and abolished significant restrictions on international flights.

For traders, China – the second largest economy in the world – is back open for business.

Bloomberg reported traders had begun jumping onto signs of the policy relaxation, which could be behind a long-term rally.

It's a shock backflip in policy — before the market surge the last fortnight, China’s stringent restrictions had crushed growth in its economy.

Known for its prolonged periods of fickle trading followed by massive, short-lived surges, traders have swarmed on Chinese stocks out of “FOMO” [fear of missing out].

“As we get closer to the year-end, this volatility is likely to remain in place though there’s a genuine shift in tone from the Chinese government with respect to Covid,” Sat Duhra, a portfolio manager at Janus Henderson Investors, told Bloomberg.

“[There] appears to be a real sense of ‘FOMO’ with respect to a China rebound among Asian investors.”

US-listed Chinese stocks have also rallied across the board, while shares of Chinese property developers experienced double-digit gains as Beijing increased financial aid to the embattled sector by $US56 billion.

Brokers also reported a spike in margin lending and the openings of new accounts.

Bloomberg reported Saxo Capital said margin lending in Hong Kong stocks has doubled in the last week while Bight Smart Securities, one of Hong Kong’s largest brokers, experienced a 25 per cent spike in new accounts at the start of this week.

The country is the last major economy latched to a strategy of stamping out Covid flare-ups as they occur by continuing go use snap lockdowns, mass testing and lengthy quarantine periods.

Top leaders had pledged to stick “unswervingly” to the policy, which has forced business closures, roiled international supply chains and weighed heavily on growth.

But a notice from the country’s disease control agency on Friday said the Politburo Standing Committee – the apex of power in China – met Thursday to rubberstamp the relaxing of restrictions.

China has reopened far more slowly than most other countries, a move that has kept infections to a minimum. The country has recorded just over 5,200 Covid deaths, compared with more than a million in the United States.

But pandemic fatigue has begun to set in as the onerous curbs show little sign of letting up while grinding lockdowns of the kind that hit Shanghai earlier this year have sparked isolated public protests.

And the economic impact has been so severe that analysts now expect China to miss its stated annual growth target of around 5.5 per cent by a wide margin.

Despite the problems, Chinese state media reported this week that top leaders had vowed not to waver from the zero-Covid policy, echoing a vow last week to “unswervingly” stick to the strategy.

According to the National Health Commission, China recorded 10,535 new domestic cases on Friday, the vast majority of which were asymptomatic.