Comedian Matt Hey reveals how much he just lost in superannuation

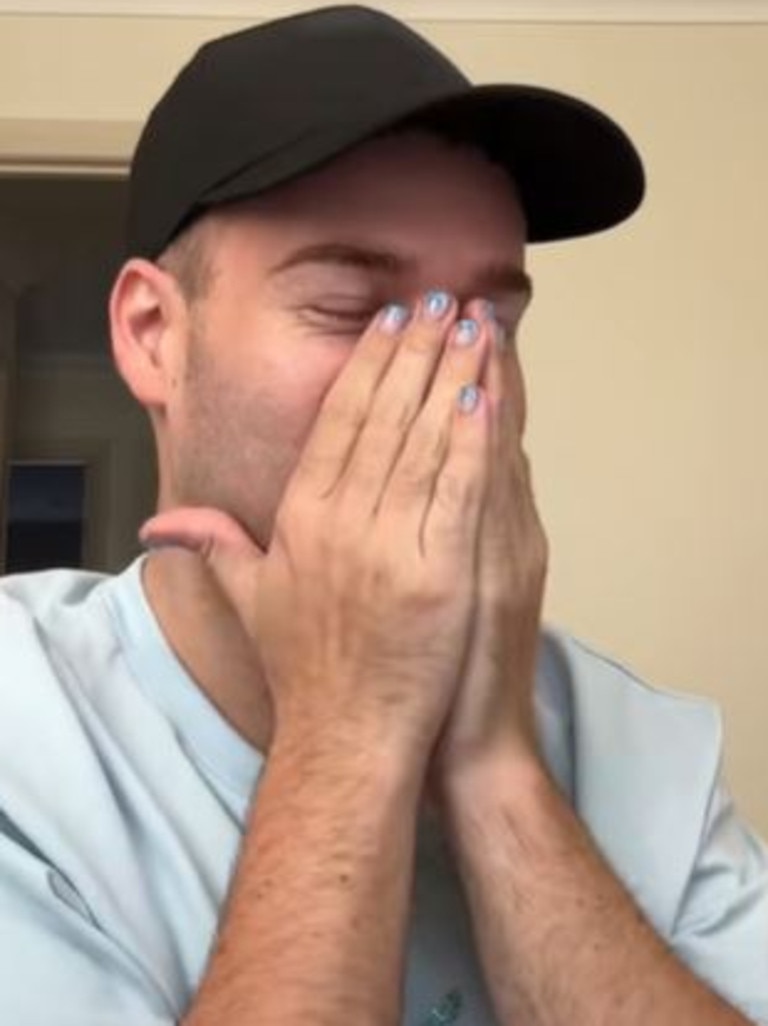

A 29-year-old Aussie been left with his head in his hands after discovering how much his superannuation plummeted overnight.

An Aussie comedian has opened up about the brutal moment he discovered his superannuation balance had plummeted $40,000 in 10 minutes.

Matt Hey, 29, took to social media to warn young Aussies to steer clear of looking at their super in the aftermath of US President Donald Trump’s sweeping new tariffs.

Mr Hey said he thought he’d check for “fun” after hearing the news that $100 billion was wiped off the value of Australian shares on Monday.

“It’ll come back eventually. Right?” he said after discovering his retirement fund had shrunk overnight.

The share market crash has hit Aussies’ super balances hard, particularly for people with high-growth portfolios and those close to retirement with less time to recover.

MORE: Can you use superannuation to buy a house?

Mr Hey’s horror story immediately prompted other young Australians to share how their super had been impacted.

“I lost $5000. How is this allowed?” one asked.

“Mine is down $16,000,” added another.

Another said 20 per cent of their super fund had vanished overnight, while one claimed the turbulent period was proof Aussies shouldn’t “rely” on superannuation for retirement.

It wasn’t all bad news.

Some Aussies shared that after checking their superannuation, they were relieved to see their balance hadn’t plummeted.

“Do not scare me like that. Mine is still there,” one claimed.

“Mine is still there,” another shared.

“Wait what happened? Mine is fine,” someone else confirmed.

Financial expert Alex Jamieson said there are a “couple of reasons” Aussies might have seen varying losses in their superannuation accounts.

“People that have not seen a downturn might have a more conservative risk portfolio. So the automatically selected investment options might not have been right for them,” he said.

Mr Jamieson said those who have experienced big losses in their superannuation accounts probably have a more “aggressive” risk investment strategy.

“They’ll likely have a high-growth investment option, and as a result, they’ve had more significant price movements,” he said.

MORE: $115bn wiped: Trump’s rich listers hefty fall

Mr Jamieson said that if you’re young you don’t need to panic too much about your superannuation taking a dive.

“They certainly can ride it out because they have a long time to recover, and as super contributions are going in, they’ll be picking up additional units at a much lower price point, which is fairly attractive,” he said.

“For young investors, you wouldn’t want to see them panic and move back to cash, because then you’re buying high and selling low.”

Mr Jamieson said his best advice for Aussies who have taken a hit and are preparing to retire is to consider changing plans.

“The strategy we’d be advising is to delay their retirements and let the markets recover. The other option is making sure they have the right risk portfolio,” he said.

Mr Hey’s superannuation reveal comes after he went viral last year for sharing how much more money he saved by withdrawing cash at the start of each week.

“I want to encourage everyone to go back to using cash because my savings have gone through the roof compared to what they usually are because I switched back to cash in January,” he said.

His rent, phone bill, and streaming services are still directly debited from his bank account but otherwise, he is in a cash withdrawal era.

“Anything recreational or anything where I can purchase in person. I will always use cash,” he said.

The Sydney local said using cash has been a game changer because it makes him more “conscious” about what he is buying.

When he would previously set himself a budget of $100, for example, to spend on whatever he wanted within a week, he constantly found that he went over that budget without even thinking about it. Since changing to cash, the result has been drastically different.

“When you actually pull out $100 from an ATM, you only use that $100 for the week. I have found that at the end of the week I’ll have $40 dollars over,” he said.