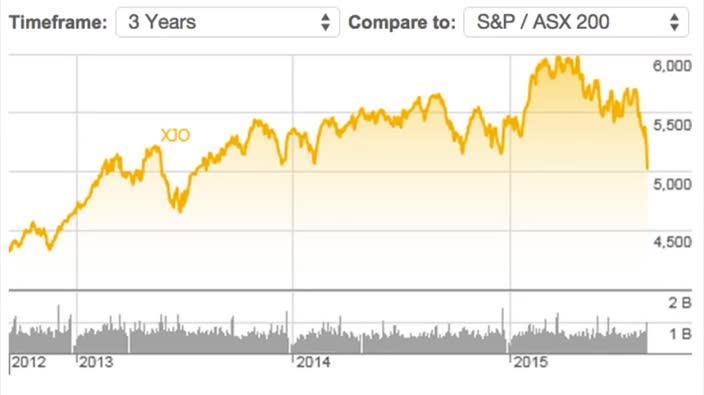

Chinese whispers turn into a scream with Australian sharemarket likely to fall further

CHINA’S fall is just one of several negative forces that have seen Australian shares take their biggest tumble since the global financial crisis.

CHINA’S growing economy helped Australia sail through the Global Financial Crisis in better shape than most countries. Our biggest trading partner’s economy is still growing three times faster than ours, but a few wobbles have helped cause havoc with Aussie shares.

The 4 per cent Australian sharemarket plunge on Monday took our total losses to almost 16 per cent since April, and worries about China are among several negative forces that have driven shares lower.

TERRY MCCRANN: THIS COULD GET SERIOUSLY BAD

Economists and share analysts don’t believe we are moving into another GFC scenario — where Aussie shares plunged more than 50 per cent — but warn that further falls are likely.

CHINA’S EFFECT

China has delivered a triple-whammy of unpleasant news in recent weeks. Negative economic data, sharp falls in its sharemarket, and a surprise currency devaluation by Chinese authorities have stoked investors’ fears and sparked a broad sell-off in shares in many countries.

CommSec chief economist Craig James said it appeared that the sharemarket slump was more of a “correction we had to have” rather than the start of a new major crisis.

He said China’s economy was growing at a 7 per cent annual pace and was “maturing and rebalancing” towards greater household spending.

“Adjustment is hardly easy or painless. The authorities have much work ahead. But they remain committed to growing the economy. If that wasn’t the case, there would be cause for concern.”

China’s sharemarket slump has grabbed headlines in recent weeks, but Mr James said there had been little mention of Chinese shares surging 151 per cent in the year to June 12 — a boom that could not last for long.

“There is clearly more to be played out on the correction of the Chinese sharemarket. The Shanghai composite index is still 57 per cent above levels of a year ago,” he said.

Chinese authorities devalued their currency against the US dollar by almost 3 per cent this month in an effort to promote growth. Mr James said the issue with investors was that it was a surprise, but it had been welcomed by the International Monetary Fund.

AMP Capital chief economist Shane Oliver said China was one of several factors affecting global sharemarkets but was the biggest.

OTHER FORCES

Adding to the China concerns are the sinking price of oil and other commodities, Greece’s ongoing debt crisis, worries that the US will soon start lifting its interest rates, and even political issues such as tensions on the Korean peninsula and last week’s bombing in Thailand.

“All these things have come together in almost a perfect storm,” Dr Oliver said.

Falling oil prices are hurting energy producers but are generally seen as good for consumers and businesses.

It had been expected that the US central bank would start lifting US interest rates in September, but Dr Oliver said that was looking less likely amid the turmoil in markets.

The other big factor affecting Aussie shares is our profit reporting season, which has disappointed many analysts. However, dividend payouts remain solid and Australian companies generally are in much better shape than they were before the GFC.

Dr Oliver said other pre-GFC ingredients — such as companies loaded up on debt, investors euphorically buying shares and rising interest rates — were not present today either.

He said the sharemarket fall could still have further to go “but is unlikely to be a long, grinding re-run of the GFC”.

WHAT’S NEXT?

Dr Oliver said he was sticking to his forecast of 6000 points for the ASX 200 index by the end of this year, even though it would be a big ask — up 20 per cent from yesterday’s close of 5001 points.

“Investor sentiment is deteriorating rapidly into the sort of pessimism that provides great buying opportunities,” he said. “I think we will end up a lot higher than we are now by year-end.”

Rivkin Securities CEO Scott Schuberg said Australian companies were not overvalued like US stocks were, and our biggest sectors — financial and resource stocks — had already taken big hits in recent months.

“But let’s not think for a second that it means it’ll turn around just yet,” he said.

“A good 20 per cent drop from 2015’s highs is what I think would really exhaust selling in Australia.”

CMC Markets chief market analyst Ric Spooner said the question about how far it could fall was difficult to answer.

“I would be surprised to see things move by more than at the worst 8-10 per cent from current levels, but that’s not saying I think it will do that either,” he said.

While joining the panic and selling out of shares now will lock in your losses, Mr Spooner said some good value might be emerging in some sectors, although it might be wise to wait a while until things settled down.

“My preference is to sell into good times and buy into bad times,” he said.