Iress share price nosedives amid shabby day on ASX

The Australian share market has started the week off on a low but one company has taken the cake in terms of stock price.

The Australian share market started the week poorly as nervous traders look ahead to what the US Federal Reserve will do at its summer conference later this week and China continues to disappoint.

The US central bank will hold its meeting in Wyoming from August 24 to 26, where it will decide whether inflation is under control or more interest rate hikes are needed to cool inflation, the Associated Press reported.

The People’s Bank of China on Monday lowered its one-year loan prime rate to 3.45 per cent from 3.55 per cent, as the economic powerhouse tries to rebuild its economy following the pandemic, where the real estate sector is struggling.

Wall St ended last week down, with the S&P 500 declining to 4,369.71 on Friday. The Dow Jones Industrial Average added 0.1 per cent to 34,500.66, while the Nasdaq composite slipped 0.2 per cent to 13,290.78.

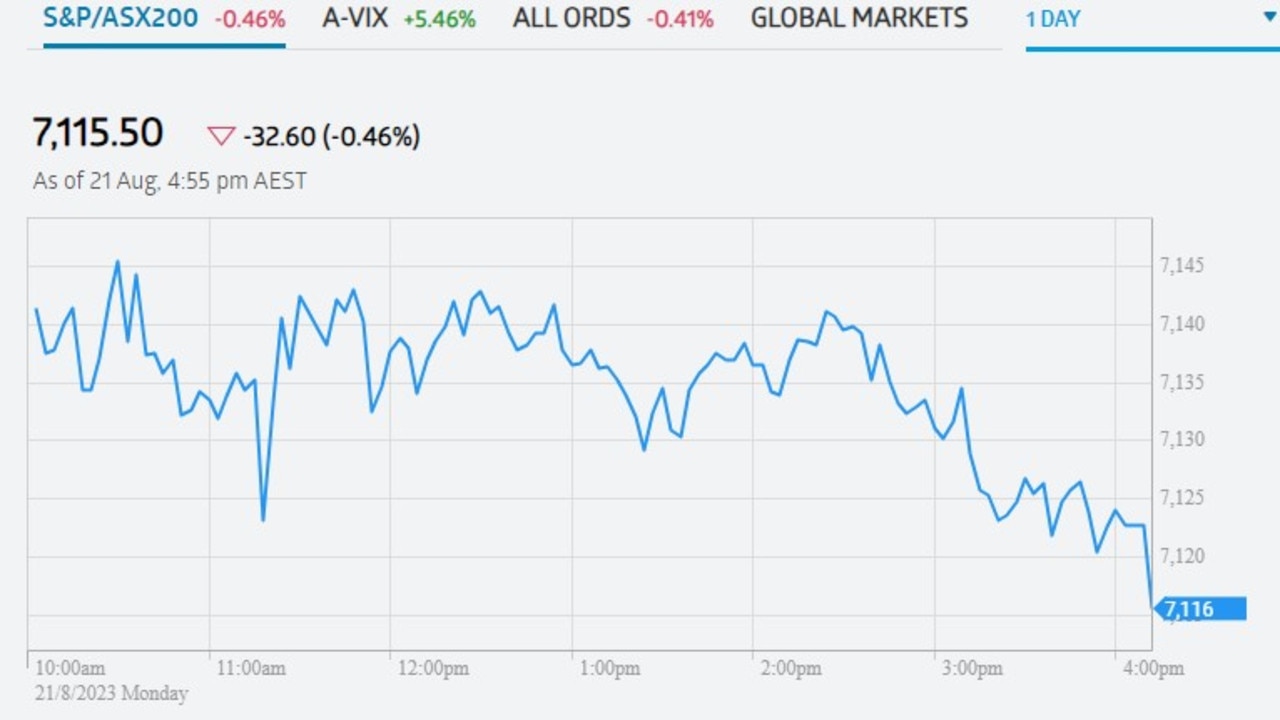

On the back of all that, the S&P/ASX200 ended lower on Monday, dropping 15.80 points or 0.22 per cent to 7,132.30.

Worst off by far on Monday was information technology company Iress which saw its share price plunge by a jaw dropping 32.43 per cent to $6.75 at the end of the day.

The plunge came as the company announced it would suspend its interim dividend on the back of completing its plan to sell its managed funds administration business.

The $52m sale to US software giant SS&C Technology will go toward paying down its debt

“As outlined to the market in April, we are committed to reducing costs, driving growth in our core Australian businesses, and managing our portfolio of non-strategic assets for value and the releases of capital,” chief executive Marcus Price said.

Iress reported a net loss of $139.8m for the past financial year while also reporting an EBITDA of $29.4m in the first half of 2023, a fall of 55 per cent compared to the corresponding period.

While revenue increased by 2 per cent to $315.3m, Iress expects the second half of 2023 to bring softer revenue growth due to cost headwinds, reduced market trading volumes and broader macro uncertainties.

“Our half-year results represent Iress mid-transformation … revenue increased in a challenging macro environment while EBITDA was impacted by cost pressures, including a significant uplift in tech infrastructure, market data and inflationary salary costs,” Mr Price said.

With Iress leading Monday’s losses, it’s no surprise that IT was one of the worst-performing sectors, dropping 0.69 per cent.

Fellow tech companies also saw a downturn, with Weebit Nano falling 4.85 per cent and Megaport down 5.63 per cent. Also performing poorly was the A2 Milk company which dropped by 13.56 per cent to $4.27 after reporting that it expected a more challenging year due to a lower birthrate in its biggest market, China.

Elders plunged 10.82 per cent to $6.35 after weaker-than-expected sales led to its profit forecasts being downgraded.

“Underlying EBIT is now expected to be between $165m and $175m, down from the previous guidance range of between $180m and $200m,” the updated guidance read.

It was not all doom and gloom on the markets today, with the biggest gainer Premier Investments increasing its share price by 12.23 per cent to $24.41.

The surge comes after Premier Investments announced it would undertake an operational review to unlock value in its various businesses.

Appliance company Breville managed to climb 8.98 per cent to $25.23 after it saw profit margins lifted from 11.00 per cent to 11.60 per cent.

The miners had mixed results today with Fortescue receiving a boost of 0.44 per cent to $20.42 while Rio Tinto dropped 0.82 per cent to $104.82 and BHP fell 0.39 per cent to $43.52.

The big banks all fell today led by Westpac which dropped 3.06 per cent to $20.62 and ANZ which fell 1.02 per cent to $24.24.

NAB and CommBank fared better, down 0.40 per cent and 0.61 per cent respectively.

Major retailer Coles will report its yearly earnings on Tuesday, while Qantas will do likewise on Thursday. Federal Treasurer Jim Chalmers will also release the government’s intergenerational report on Thursday.