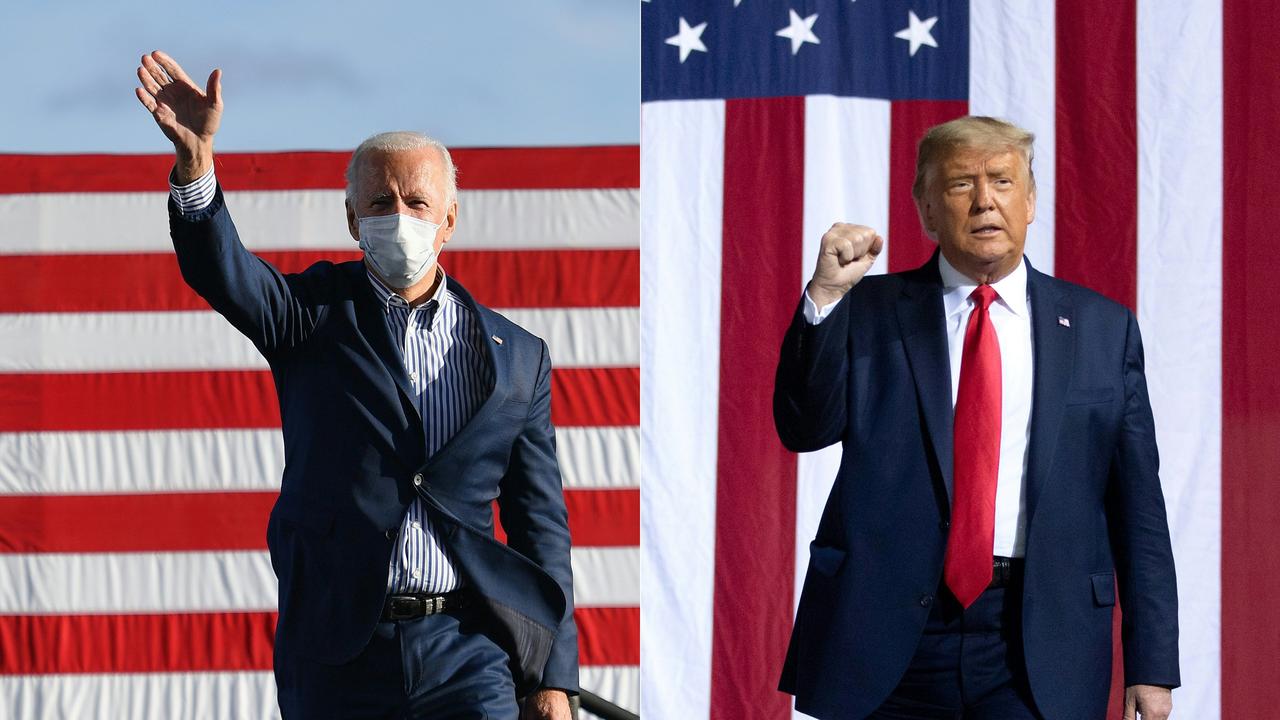

Australian sharemarket volatile as US results trickle in, futures point to Trump win

The Australian sharemarket finished almost unchanged after a rollercoaster session as the all-important US election results trickled in.

The Australian sharemarket closed almost unchanged after a volatile trading session as results from the US election trickled in.

The benchmark S&P/ASX200 index finished 0.07 per cent lower at 6062 while the All Ordinaries Index was flat at 6265.

CommSec analyst James Tao said the ASX200 traded in a wide range of 11o points throughout the day, down 80 points at one stage.

“It’s been quite a topsy turvy day, which is no surprise given the US election looking like a tight race,” Mr Tao told NCA NewsWire.

“It’s all been laser-focused on the US election.”

Mr Tao said US futures had also yoyoed but were markedly higher just before 4pm AEDT, suggesting a Trump win was expected given financial markets favour conservatives due to their stances on tax.

“As long at it is unconfirmed, we’re likely to see volatility over the next couple of days at least,” he said.

“If contested, it could last weeks or months in the worst case scenario.”

Banks and miners weighed on the local market, while travel stocks outperformed after NSW Premier Gladys Berejiklian announced the border with Victoria would open on November 23.

ANZ fell 0.87 per cent to $19.30, National Australia Bank slid 1.06 per cent to $18.70, Westpac backtracked 1.98 per cent to $17.35 and Commonwealth Bank gave up 2.02 per cent to $68.41.

CBA, NAB and Westpac slashed interest on fixed home loan rates but left variable rates the same after the Reserve Bank cut the cash rate to a historic low on Tuesday.

Rio Tinto lost 2.17 per cent to $92.73, BHP retreated 1.21 per cent to $34.28 and Fortescue slumped 4.6 per cent to $16.49.

Qantas put on 2.24 per cent to $4.57, Flight Centre soared 6.07 per cent to $12.93 and Corporate Travel Management appreciated 3.8 per cent to $16.06.

Supermarket giant Woolworths said a switch to eating at home and online shopping fuelled a 12.3 per cent rise in first quarter sales compared to the prior corresponding period, but its shares eased 0.67 per cent to $38.55.

Rival Coles dropped 2.29 per cent to $17.90.

The Aussie dollar was fetching 71.09 US cents, 54.72 British pence and 60.95 Euro cents in afternoon trade.