Australian sharemarket slips lower, with big banks, biotech giant CSL among losses

The ASX again slipped lower, with the big surprise being CSL’s hopes of producing a locally developed COVID-19 vaccine dashed.

The Australian sharemarket slipped lower for the second straight day, with biotech giant CSL and the big four banks among the losers, but iron ore miners surged along with the price of the steelmaking commodity.

The S&P/ASX200 finished 0.61 per cent lower at 6642.6 while the All Ordinaries Index retreated 0.44 per cent to 6886.4.

“Over the past 30 sessions, the market has actually improved 21 times, so that’s 70 per cent,” CommSec analyst Steve Daghlian said.

“Since the start of November, the market has been in an uptrend, with plenty of momentum ... the market hitting nine-and-a-half month highs on two occasions just this week.”

For the week, the ASX was still up - the sixth straight week that has happened.

CSL backtracked 3.24 per cent to $291.53 after announcing the federal government will not progress its COVID-19 vaccine developed with the University of Queensland to phase 2/3 clinical trials, despite eliciting “a robust response towards the virus” and “no serious adverse events”.

Also in the health sector, hearing aid pioneer Cochlear gave up 3.83 per cent to $199.52.

ANZ slid 0.99 per cent to $22.94, Commonwealth Bank shed 0.84 per cent to $82.39, National Australia Bank backtracked 0.89 per cent to $23.33 and Westpac inched 0.2 per cent lower to $19.95.

Mr Daghlian said the iron ore price had risen close to its best level in eight years, sending Fortescue Metals to a fresh record high of $22.95, up 1.96 per cent while Rio Tinto firmed 0.53 per cent to $116 - its best price since May 2008.

BHP advanced 0.8 per cent to $42.82 - its best level since April 2011.

Energy stocks were mixed despite a higher oil price overnight, with Santos up 2.77 per cent at $6.68, Woodside Petroleum lifting 2.55 per cent to $23.31 and Beach Energy appreciating 0.8 per cent to $1.88 but Oil Search was steady at $3.73 and Origin fell 0.59 per cent to $5.04.

“They’ve got a very long way to go to get back to where they were pre-COVID,” Mr Daghlian said.

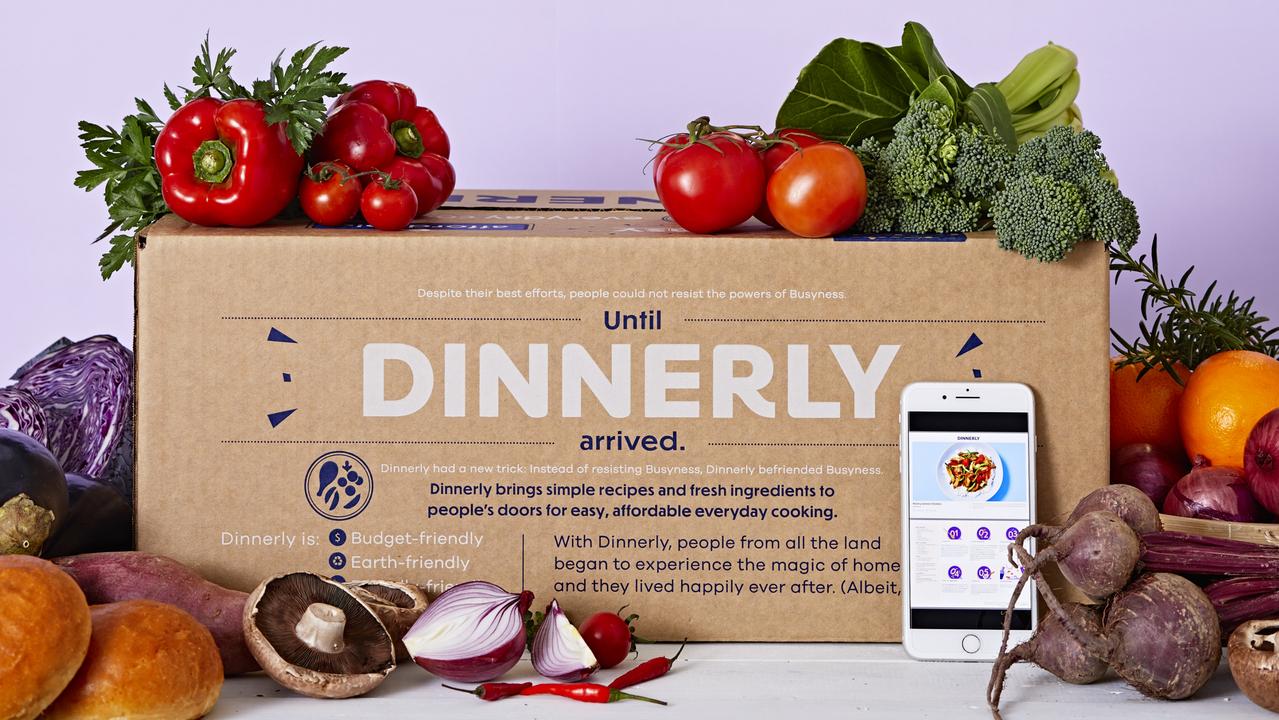

HelloFresh rival Marley Spoon launched in the West Australian market through its budget brand Dinnerly, making it the first meal kit provider to deliver to every Australian state and territory.

Shares in Marley Spoon, which also announced other expansion plans, rose 4.84 per cent to $2.60.

Personal care products company Asaleo, which produces Pura toilet paper and Libra sanitary pads, jumped 4.88 per cent to $1.29 after receiving a takeover offer from its major shareholder.

Buy now pay later provider Zip Co put on 1.94 per cent to $5.25 after announcing a partnership with Facebook.

Outdoor advertising firm oOh!Media was up 3.45 per cent at $1.80 after reporting a strong recovery in out-of-home audiences post-lockdown and a significant fourth quarter revenue rebound.

The Aussie dollar was buying 75.59 US cents, 56.76 British pence and 62.16 Euro cents in afternoon trade.