Australian sharemarket rockets to yet another record high, Wesfarmers among stocks hitting fresh all-time peaks

The ASX rocketed to yet another record high as various blue-chip and smaller stocks pushed to fresh all-time peaks.

The Australian sharemarket has once again climbed to a record high, with blue-chip stocks and plenty of other smaller companies also reaching fresh all-time peaks.

After being closed on Monday for a public holiday, the S&P/ASX200 closed 0.92 per cent higher at 7379.5, while the All Ordinaries Index rose 0.74 per cent to 7633.

“The ASX 200 has shot out of the blocks this week, almost hitting 7400,” OMG chief executive Ivan Tchourilov said.

“The market is breaking out and pushing to new highs again today and is technically looking very strong.

“Every stock in the top 20 is up, with the banks and CSL doing most of the heavy lifting.

“We’ve been outperforming the US for about a month now and we’ve definitely seen international money flow back into our market, helping push up to these record highs.”

He said Commonwealth Bank was the best performer of the majors, surging 2.06 per cent to a record close of $103.45.

ANZ put on 1.45 per cent to $28.66, National Australia Bank added 0.79 per cent to $26.67 and Westpac improved 0.99 per cent to $26.55.

Biotech heavyweight CSL appreciated 1.71 per cent to $301.72.

Bunnings owner Wesfarmers also broke records, jumping 2.38 per cent to $56.31.

So too did a swag of other companies including sleep device manufacturer ResMed (up 6.84 per cent at $30.31), retailer Premier Investments (up 4.45 per cent at $28.66), miner Mineral Resources (up 3.1 per cent at $50.96), Domino’s Pizza (up 2.4 per cent at $118.08), building products maker James Hardie (up 1.89 per cent at $45.38) and property group Charter Hall (up 1.65 per cent at $15.38).

Realestate.com.au owner REA Group, which is majority owned by the publisher of this title News Corp, also closed at a record high of $168.37, up 1 per cent, after announcing it had acquired a 34 per cent interest in Simpology, which provides mortgage application and e-lodgement solutions for the broking and lending industries.

Infant formula and milk producer A2 Milk was also a strong performer, rising 5.42 per cent to $6.03.

“The stock has been crucified recently, losing over 60 per cent of its value in just six months after a massive decline in Chinese-related sales,” Mr Tchourilov said.

“The stock has had a really tough past 12 months but is starting to present a bit of value at current levels.

“They still have a number of major headwinds to overcome, but after losing half their value, it looks like investors might be starting to dip their toes back in.”

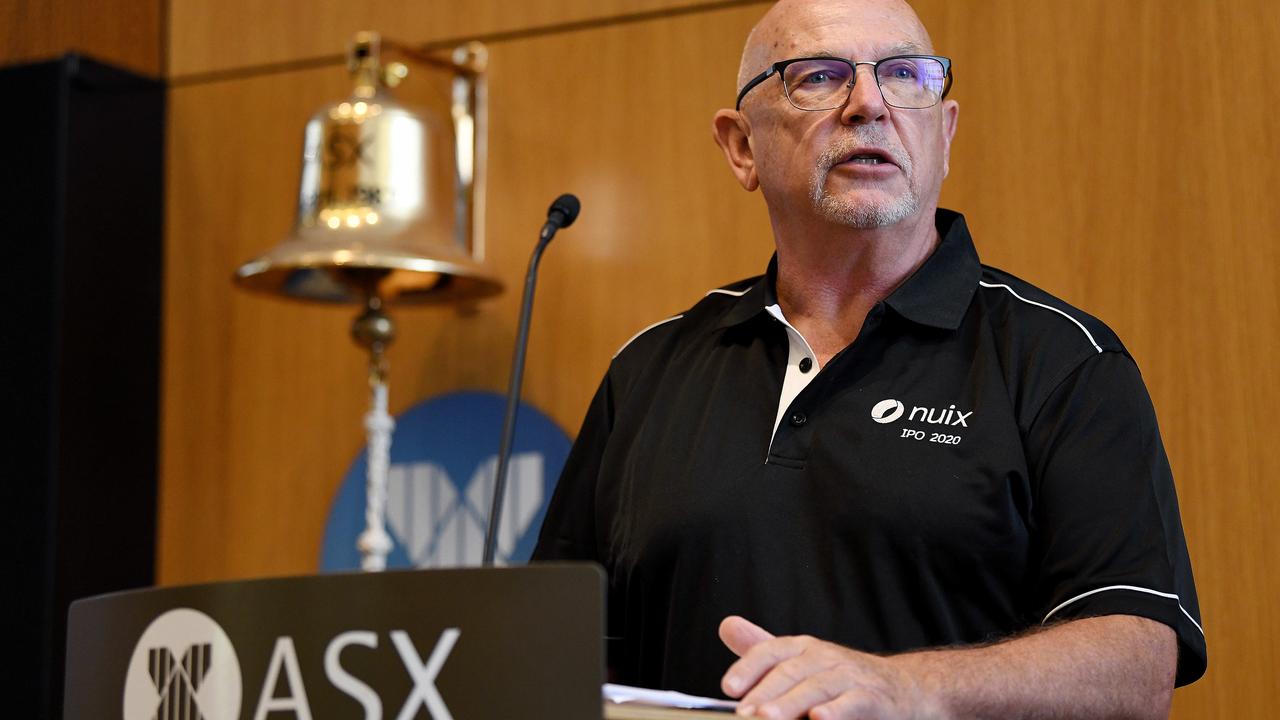

Investigative analytics and intelligence software provider Nuix gained 4.15 per cent to $2.76 after chief executive Rod Vawdrey gave notice.

“It has not been an easy decision to retire, but I believe now is an appropriate time to implement a succession plan to ensure the company has the right leader to take Nuix into its next phase of growth,” Mr Vawdrey said.

Nuix had a stellar ASX debut in December, with its shares closing at $8.01 compared with an issue price of $5.31, but they have since been battered amid negative news reports raising big questions about the company, while Mr Vawdrey has publicly apologised to investors about the stock’s performance.

Coles picked up 1.92 per cent to $16.99 after Macquarie analysts gave the supermarket giant an outperform rating and a 12-month price target of $18.20.

They said Coles should be a beneficiary from the unwinding of the Covid-19 local shopping trend.

“Coles supermarkets are over-indexed to shopping centres and CBDs, areas most impacted by the pandemic,” Macquarie said.

“With the federal government further urging workers to return to the office to revive CBDs and the broader economy, we expect a strong recovery in Coles supermarket sales driven by footfall improving.”

Rival Woolworths reached an all-time intraday high of $43.94 – close to its record closing high – before finishing at $43.50, up 1.38 per cent.

Crown Resorts shares slipped 0.57 per cent to $12.15 after private equity giant Oaktree Capital Management revised its offer to loan Crown cash so it can buy out its biggest shareholder James Packer and proposed acquiring a maximum 9.99 per cent stake in the embattled casino giant.

Rio Tinto lifted 1.23 per cent to $126.48 and BHP firmed 0.55 per cent to $49.22.

The Aussie dollar was fetching 77.06 US cents, 54.58 British pence and 63.45 Euro cents in afternoon trade.