Australian sharemarket powers to new record high, Commonwealth Bank closes above $100 for first time

Records tumbled on the ASX, with the two key indices reaching new heights while Commonwealth Bank closed above $100 for the first time.

The Australian sharemarket rocketed to a record high on Friday, fuelling expectations May will cap off the longest monthly winning streak in about 14 years, while Commonwealth Bank closed above $100 for first time.

The S&P/ASX200 closed 1.19 per cent stronger at 7179.5 while the All Ordinaries Index surged 1.09 per cent to 7424.

That respectively compares to 7172.8 and 7419.8, both reached on May 10.

CommSec analyst Steve Daghlian said the local bourse cracked a 15-month high in early trade after a mixed lead from Wall Street, with a swag of data showing “quite robust” economic growth and a higher than expected fall in unemployment in the US.

“It makes it more likely May is going to end up being the eighth straight month of gains … the longest winning streak we’ve had in about 14 years,” Mr Daghlian said.

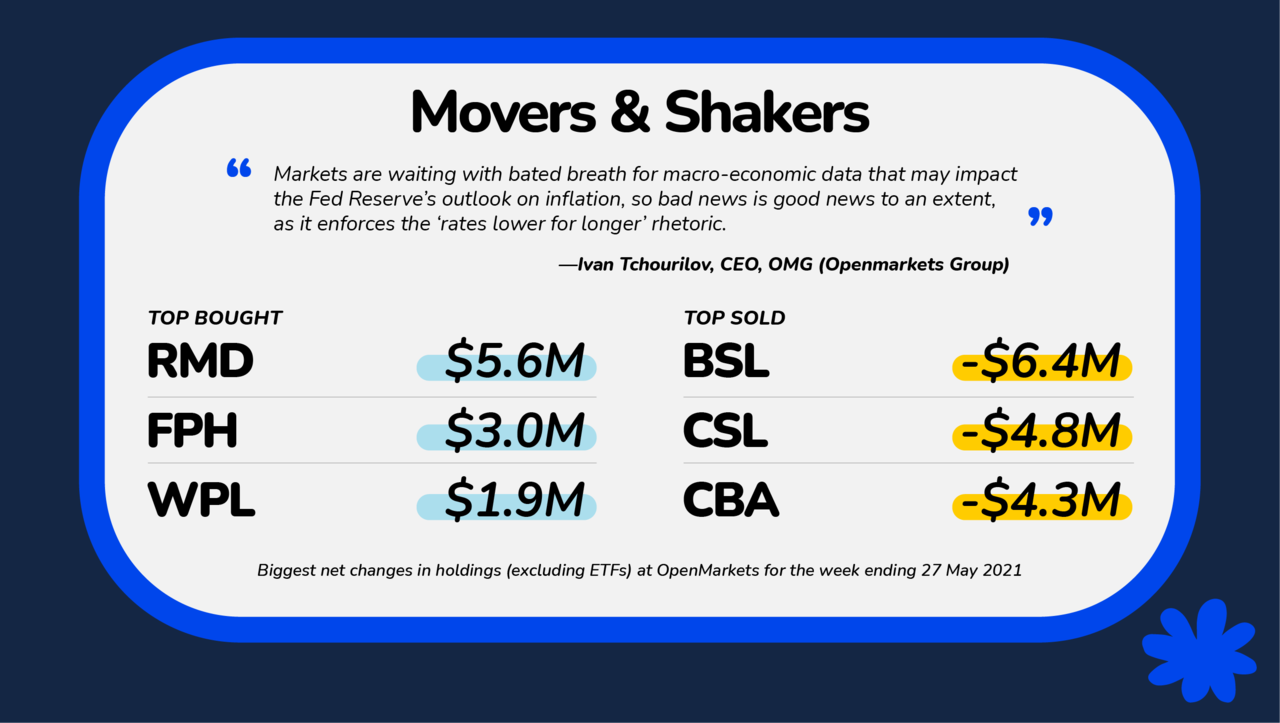

OMG chief executive Ivan Tchourilov said resources stocks outperformed the market, ending a volatile week on a positive note.

Rio Tinto rose 2.63 per cent to $123.02 and BHP gained 2.9 per cent to $48.16.

“The materials sector was the most sold sector this week among Openmarkets clients, although buying the dips has been a recurring theme for good quality, low cost producers throughout the course of this year, and today is particularly evident of that,” Mr Tchourilov said.

OZ Minerals jumped 4.74 per cent to $25.42 while Fortescue dropped 0.67 per cent to $22.12 after reporting the development cost estimate for its Iron Bridge magnetite project in Western Australia had again blown out, now $US3.3-$US3.5bn ($A4.27-4.53bn).

Fortescue said it was on track to produce first concentrate in December 2022, with a ramp-up over 12-18 months.

Macquarie Research said the increase was expected.

“The increase in capital expenditure compared to the investment decision in early 2019 reflects project-specific and market factors impacting materials and installation costs, including inflation, foreign currency exchange rates and labour constraints,” it said.

“This is in line with our forecasts.”

In the energy sector, Oil Search put on 2.2 per cent to $3.72, Origin added 2.26 per cent to $4.08, Santos advanced 2.23 per cent to $6.88 and Woodside appreciated 1.89 per cent to $22.11.

Commonwealth Bank yet again climbed to a new record high, finishing 1.61 per cent stronger at $100.56, the highest level it reached all day. CBA pierced the $100 mark twice this week but this is the first time it has ever closed above $100.

ANZ firmed 1.12 per cent to $28.86, National Australia Bank lifted 1.42 per cent to $27.09 and Westpac improved 1.42 per cent to $26.46.

As Victoria’s Covid outbreak continued to worsen, Mr Daghlian said it was somewhat surprising travel stocks also performed well.

Corporate Travel Management jumped 5.12 per cent to $21.55, Qantas rose 2.56 per cent to $4.81, Webjet gained 2.37 per cent to $5.19 and Sydney Airport appreciated 2.78 per cent to $5.92.

“This is despite the fact that Victoria entered a seven-day circuit breaker lockdown, of course, at midnight overnight,” Mr Daghlian said.

“This is perhaps the fact that Victoria only reported four new locally acquired cases rather than 11 a day earlier … it might be hopefully heading in the right direction.”

Tabcorp received another offer to acquire its wagering and media business, this time from BetMakers Technology Group, bringing the number of suitors to three and beating the other two proposals.

Shares in Tabcorp firmed 2.17 per cent to $5.17 but BetMakers shares plunged 16.25 per cent to $1.34.

Poultry company Inghams upgraded its full-year earnings guidance, based on a review of the most recently available analyst research.

“It expects to make as much as $87m over the year and that’s about twice what it made a year earlier,” Mr Daghlian said.

Shares in Inghams surged 8.6 per cent to $3.41.

Downer EDI won a $900m contract to operate and maintain bus services on Sydney’s northern beaches, sending its shares 1.6 per cent higher to $5.68.

One of the poor performers was almond farmer Select Harvests after it booked a big first-half profit plunge, with lower global prices for the nut taking the shine off a good growing season.

Shares in the company slipped 1.01 per cent to $5.90.

The Aussie dollar was fetching 77.23 US cents, 54.41 British pence and 63.37 Euro cents in afternoon trade.