Australian sharemarket closes flat, with retail in spotlight as lockdowns curb spending

The ASX closed flat to finish the week, with Bunnings owner Wesfarmers losing ground despite a blockbuster full-year result.

The Australian sharemarket has barely budged to finish the week, with Bunnings owner Wesfarmers losing ground despite a knockout full-year result.

The S&P/ASX200 finished just 2.9 points lower at 7488.3 while the All Ordinaries Index dipped 10.3 points or 0.13 per cent to 7760.1.

CommSec analyst James Tao said the local bourse largely recovered from a weak start, with healthcare stocks among the winners.

After posting record full-year results, including a more than doubling of net profit, Clinuvel soared 17.96 per cent to $34.49.

The company is developing a range of drugs but has made most progress with a product for a rare light intolerance disorder.

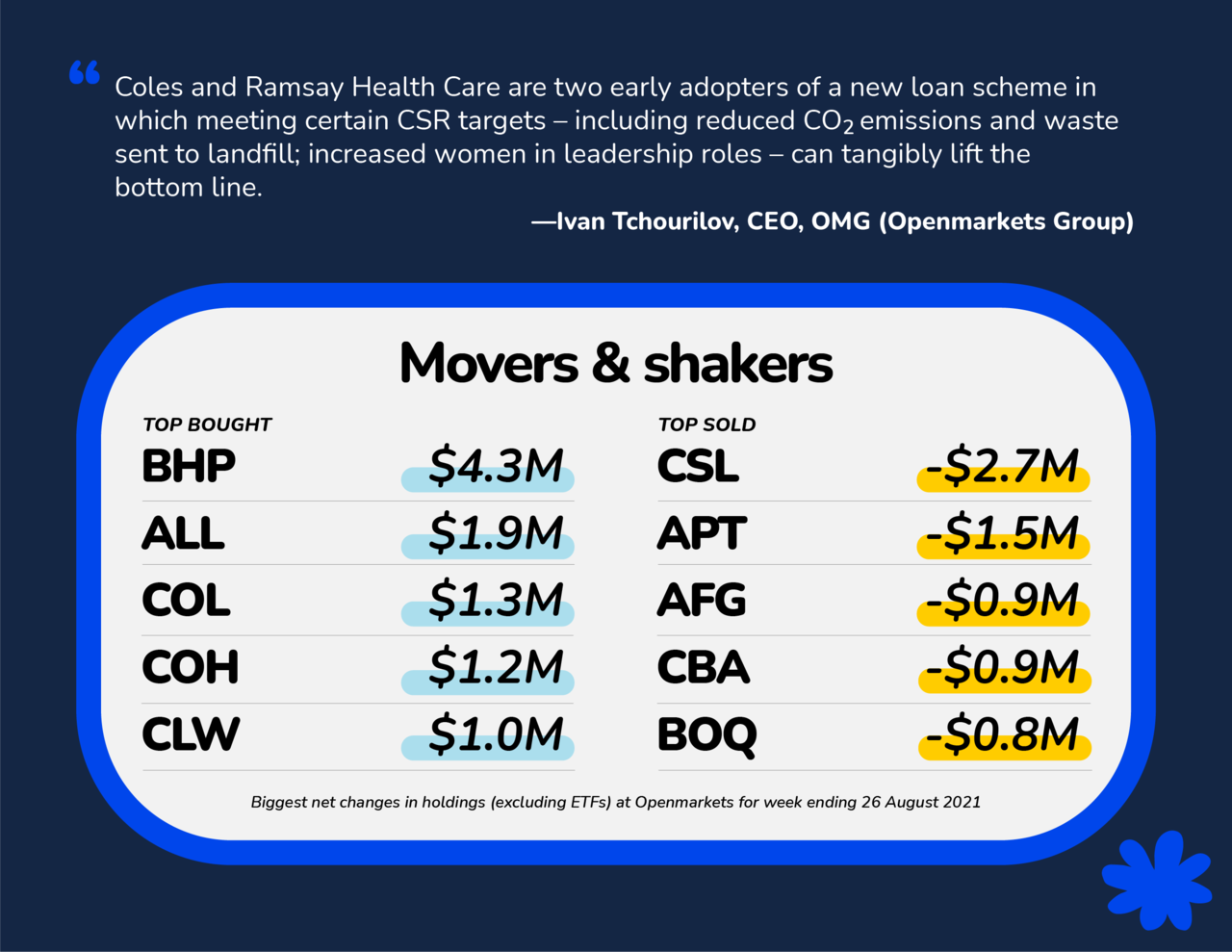

“Today’s momentum seems to have come from the release of a financial summary and a nice upgrade from the analysts,” OMG chief executive Ivan Tchourilov said.

“Clinuvel has been able to roll out in the US without any significant increase to cost margins, meaning they can pay out leftover cash to shareholders to further sweeten the deal.”

Biotech giant and market heavyweight CSL put on 0.96 per cent to $311.06.

Consumer discretionary stocks were lower, with Harvey Norman retreating 0.72 per cent to $5.54 and JB Hi-Fi backtracking 1.06 per cent to $45.57, while consumer staples were mixed, with Woolworths easing three cents to $40.96 and rival Coles putting on 1.42 per cent to $17.89.

Wesfarmers booked a 40.2 per cent surge in full-year statutory net profit to $2.38bn and declared a $2 per share return of capital to investors - amounting to $2.3bn.

That’s on top of a final dividend of 90 cents per share, bringing the total dividends for the year to $1.78 per share.

The Kmart and Officeworks owner said those two businesses and Bunnings delivered strong sales and earnings growth for the year as more time spent working, learning and relaxing at home boosted demand for some products, while government stimulus measures also helped.

Disruptions and capacity constraints in global supply chains led to some inventory delays and higher ocean freight charges.

CommSec senior economist Ryan Felsman noted Wesfarmers and Australia’s other biggest retailer Woolworths had delivered bumper full-year earnings and rewarded shareholders, but cautioned that sales were down so far in fiscal 2022 due to lockdowns, with no guidance provided amid global supply chain issues.

“In fact, Wesfarmers reported that Bunnings’ sales have declined 4.7 per cent so far in financial year 2022 on the corresponding period last year, with combined Kmart and Target sales 14.3 per cent lower over the period,” Mr Felsman said.

Citi said Bunnings missed consensus by 2 per cent, Kmart was in line with expectations and Officeworks performed slightly better than expected.

Wesfarmers shares declined 2.75 per cent to $62.20.

The Australian Bureau of Statistics unsurprisingly reported a 2.7 per cent seasonally adjusted fall in retail turnover in July - the biggest monthly fall this year - due to lockdowns and stay-at-home orders in many parts of the nation.

The retail sector was particularly hit hard in NSW, where the first full month of lockdown resulted in a near 9 per cent slump in turnover. It was the largest fall of any state and territory since August last year and the third biggest monthly decline on record.

“Retail spending is likely to continue to fall in August and September as lockdowns drag on in NSW and potentially Victoria,” Mr Felsman said.

“Additionally, global supply chain disruptions, rising unemployment and potentially reduced housing goods-related demand could also weigh on consumer spending.”

Candles retailer Dusk posted a 130 per cent spike in full-year net profit to $21.8m, saying its record numbers came despite forced store closures and stand downs, while it opened 10 new stores during the period.

About 35 per cent of potential trading days were lost during the first seven weeks of this financial year, however, shaving 28 per cent off top line sales.

Dusk shares gave up 2.74 per cent to $3.19.

Vegemite owner Bega Cheese booked a 24 per cent rise in normalised net profit to $39.6m, saying its acquisition in November of Lion Dairy and Drinks from Japanese alcohol giant Kirin had been “transformational”.

The deal added Masters milk, Big M, Yoplait yoghurt, Pura Milk, Farmers Union, Dairy Farmers, Juice Brothers, Daily Juice and Dare brands to its product stable.

Shares in Bega Cheese closed steady at $5.51.

Lynas Rare Earths booked a record full-year profit, up eight-fold from the prior year at $157m, but did not declare a final dividend.

Its shares dropped 3.6 per cent to $6.42.

In the tech sector, Appen sank 6.08 per cent to $10.20 and Zip slipped 2.27 per cent to $6.90.

Rio Tinto added 0.3 per cent to $109.70 and BHP fell 0.56 per cent to $44.70.

ANZ slid 0.46 per cent to $28.32, Commonwealth Bank appreciated 0.55 per cent to $101.54, National Australia Bank lifted 0.4 per cent to $27.64 and Westpac inched two cents lower to $25.99.

The Aussie dollar was fetching 72.55 US cents, 52.91 British pence and 61.63 Euro cents in afternoon trade.