Australian sharemarket closes barely changed, with Kogan sparking retail sector sell-off

The ASX finished flat, with Kogan plunging after signalling the online shopping boom was waning, which proved contagious to other retailers.

The Australian sharemarket closed flat after a rollercoaster session, with retail stocks in the crosshairs after Kogan’s latest business update failed to impress.

The S&P/ASX200 finished just 5.3 points higher at 7060.7 while the All Ordinaries Index lifted a mere 8.7 points to 7320.7.

CommSec said the ASX200 was in the red for much of the day after negative leads from Wall Street and European markets, and ended the week down 2.8 points.

OpenMarkets Group chief executive Ivan Tchourilov noted the market was down as much as 2 per cent at one stage on Friday.

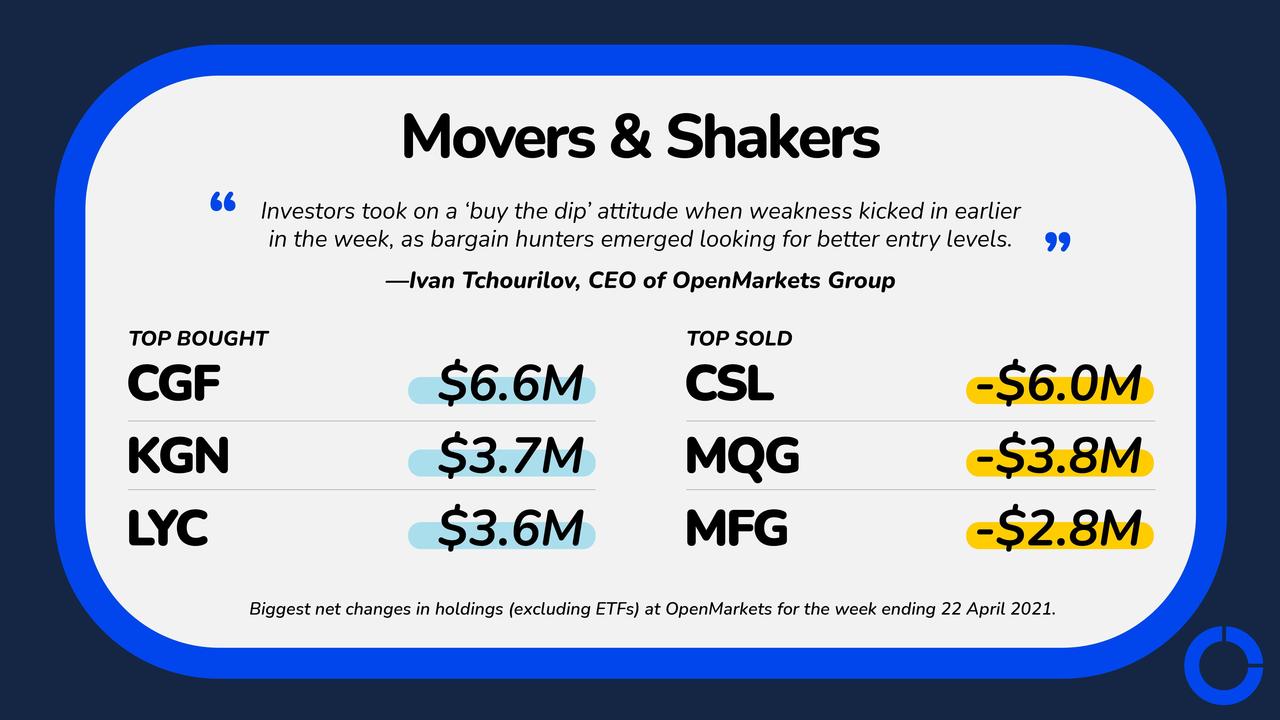

“Investors took on a ‘buy the dip’ attitude when weakness kicked in earlier in the week, as bargain hunters emerged looking for better entry levels,” Mr Tchourilov said.

“The retail space in particular has been in the firing line this week, with Redbubble and Kogan both releasing quarterly updates that clearly missed the mark.

“Both stocks were crucified by the market ... while JB Hi Fi is also lower purely by association it would seem.”

Kogan reported 65 per cent revenue growth but said customer demand fluctuated in the March quarter below the levels seen in the prior nine months so it had held larger than expected levels of inventory — incurring high storage expenses and demurrage fees.

Shares in the online-only retailer plunged 14.27 per cent to $10.69 and Redbubble, which customises t-shirts and gifts, and provides a marketplace for artists, dropped 3.77 per cent to $4.08.

Redbubble plunged 23 per cent on Thursday despite reporting a doubling in gross profit for the nine months ended March 31, with Mr Tchourilov saying: “It goes to show what can happen when valuations get ahead of themselves and earnings disappoint”.

JB Hi-Fi shares dropped 5.04 per cent to $50.14 and Harvey Norman shed 3.49 per cent to $5.53.

Bucking the trend in the retail sector was Accent Group, which owns shoe retailer The Athlete’s Foot.

Accent announced it would acquire the Glue Store - a youth apparel, shoe and accessory retailer “offering an aspirational range spanning global street, fashion and sport cultures” - and the wholesale and distribution brands business of Next Athleisure for $13m.

Shares in Accent leapt 11.15 per cent to $2.89.

Consumer staples stocks were also weaker, with Coles slipping 0.82 per cent to $15.71 while Woolworths eased 0.3 per cent to $42.24.

AMP announced the departure of Boe Pahari, the executive whose promotion - despite previous sexual harassment allegations - caused a massive headache for the financial services group.

The mooted sale of 60 per cent of AMP Capital’s private markets business to US private equity giant Ares Management Corporation was also abandoned.

AMP will instead spin off the business and list it on the ASX, a plan UBS analysts said was a “less than ideal outcome” of its portfolio review.

Shares in AMP lifted 0.89 per cent to $1.13.

Buy-now-pay-later market leader Afterpay retreated 1.18 per cent to $123.56 while smaller rival Zip Co added 0.11 per cent to $8.90.

Mr Tchourilov said Zip Co was the most traded overall on OpenMarkets.

ANZ put on 0.42 per cent to $28.70, Commonwealth Bank rose 0.28 per cent to $89.39, National Australia Bank gained 0.27 per cent to $26.46 and Westpac inched 0.04 per cent higher to $25.12.

Rio Tinto firmed 0.5 per cent to $121.15, BHP eased 0.19 per cent to $47.56 and Fortescue lifted 1.6 per cent to $21.66.

The Aussie dollar was buying 77.36 US cents, 55.71 British pence and 64.2 Euro cents in afternoon trade.