Australian sharemarket claws higher to fresh all-time peaks for second straight day

The ASX climbed higher to eclipse yesterday’s all-time record, despite the Covid crisis prompting the declaration of a national emergency.

The Australian sharemarket managed to rack up fresh record highs for a second straight day despite the worsening coronavirus crisis in NSW.

After finishing at record levels on Thursday, the S&P/ASX200 inched eight points higher to 7394.4 on Friday, while the All Ordinaries Index added 12 points to 7670.9.

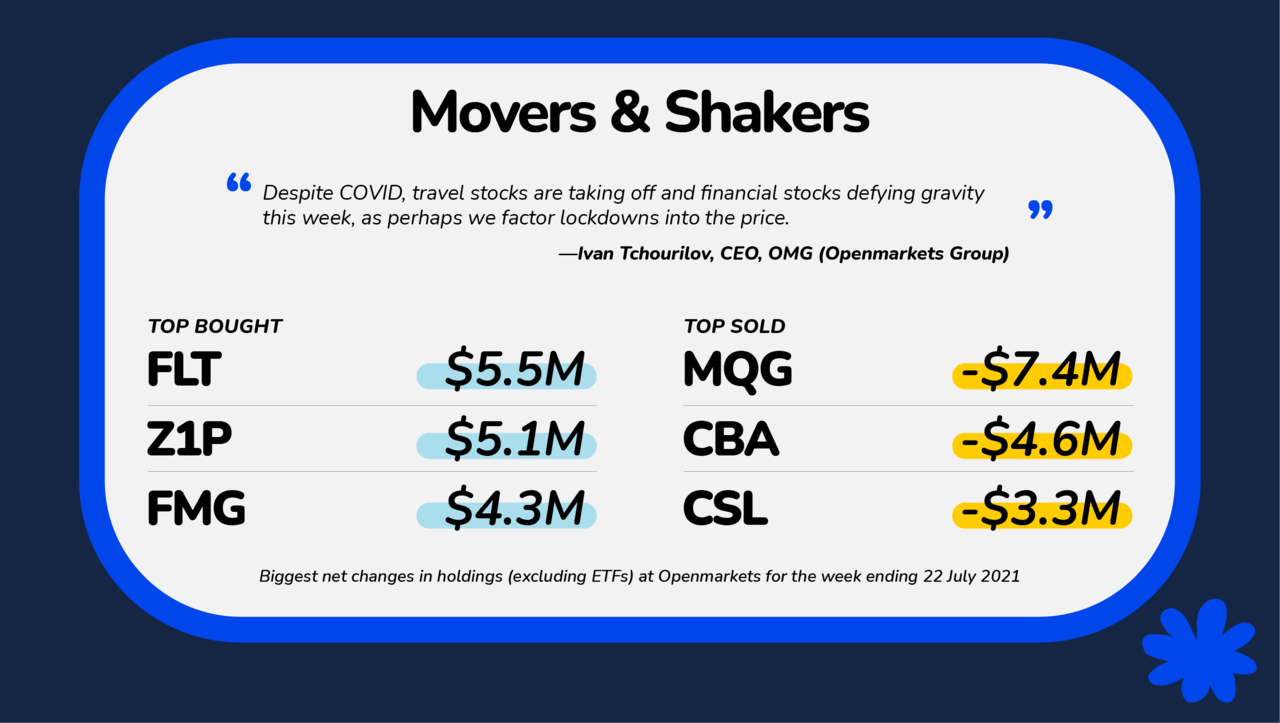

OMG chief executive Ivan Tchourilov said it had been a roller coaster week, but ended in the local bourse gaining ground overall, even as the country grappled with prolonged lockdowns in a number of major cities.

The coronavirus Delta variant outbreak continued to weigh on minds, with Greater Sydney recording 136 new locally acquired cases and one death, prompting the declaration of a national emergency and the suspension of New Zealand’s travel bubble with Australia.

It also caused the NSW premier to concede restrictions could be in place until October.

Some travel stocks suffered accordingly, with Qantas dropping 1.94 per cent to $4.55 and Flight Centre sliding 0.87 per cent to $14.90, but Corporate Travel Management rose 1.6 per cent to $21.44 and Webjet firmed 0.4 per cent to $4.92.

Interestingly, the latest lockdown had so far had “a very muted effect” on the share prices of Webjet and Flight Centre, Mr Tchourilov said, which had been the most purchased stock across the Openmarkets client base over the past five sessions.

“This may indicate a lot of the impact from the current lockdown is already factored into the price,” he said.

The healthcare sector was the star performer, with biotech giant CSL lifting 1.47 per cent to $293.48.

In the tech space, buy-now-pay-later market leader Afterpay gained 0.8 per cent to $106.70, while accounting software provider Xero advanced 2.4 per cent to $142.92.

Star Entertainment walked away from its bid for embattled casino giant Crown, citing concerns it may be stripped of its Melbourne venue gaming licence as a result of Victoria’s Royal Commission.

Star said it had so far “had limited engagement with Crown” but both companies left the door open to future talks.

Shares in Crown retreated 2.24 per cent to $10.02 while Star eased 0.56 per cent to $3.53.

The banks underperformed “but keep in mind they were some of the better performers on Thursday”, CommSec analyst Steve Daghlian said.

ANZ dipped 1.1 per cent to $27.69, Commonwealth Bank gave up 0.76 per cent to $99.12, National Australia Bank was steady at $26.04 and Westpac shed 0.88 per cent to $24.71.

“The financial sector has held up well (overall) given the current state we’re in, but it’s probably still too early to tell what impact this latest lockdown will have on the economy,” Mr Tchourilov said.

Insurer IAG said it expected its 2022 result would show an improvement in adjusted underlying performance, but there would be a reported net loss of $427m for fiscal 2021, largely driven by $742m in natural disaster claim costs.

IAG shares lifted 1.03 per cent to $4.91.

Myer reported it had secured a 10-year lease on a new 40,000 square metre facility in Victoria to be its national distribution centre for both stores and online fulfilment.

The department store chain’s shares slid 2.15 per cent to 45.5 cents.

“One of the benefits here is it includes improved efficiencies for the business, it centralises things a bit more, it’s better for inventory management and it expects to result in reduced markdowns, too,” Mr Daghlian said.

Gold miner Evolution rose 4.42 per cent to $4.25 after completing a $400m institutional placement to buy West Australian assets from Northern Star Resources, which it said were no longer needed to meet its objectives following an intense period of growth, including the mega-merger with Saracen.

Northern Star shares fell 6.23 per cent to $10.09 a day after outlining its five-year strategic plan and releasing its June quarter activities report, which showed it had hit its full-year forecasts.

RBC Capital Markets said all key medium-to-long-term guidance was maintained and more clarity was provided on the path forward, but the miner’s near-term guidance was underwhelming, with lower production and higher costs and capital expenditure.

Nonetheless, RBC has given the miner a $14 share price target and an outperform rating.

Nickel miner Western Areas gained five per cent to $2.52 after reporting a surge in quarterly production from its Forrestania operations in WA, achieving the best output and costs for the year.

It comes as mining at Flying Fox winds down and Odysseus increasingly becomes the lead deposit.

“Odysseus remains one of the few long-dated supplies of nickel sulphide to enter the market in the coming years, as the electric vehicle market continues to drive nickel demand for delivery into the EV battery supply chain,” managing director Dan Lougher said.

Rio Tinto eased 0.24 per cent to $127.10 and BHP softened 0.35 per cent to $51.27.

The Aussie dollar was fetching 73.75 US cents, 53.58 British pence and 62.6 Euro cents in afternoon trade.