Australian share market climbs as commodities rally ahead of fresh US inflation figures

A surge in crude oil and iron ore prices pushed the benchmark above the 7000 threshold on Tuesday as investors await fresh US inflation data.

The Australian share market closed higher on Tuesday following a rebound in commodity prices as traders await an update on US inflation numbers.

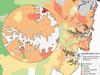

The benchmark ASX200 index added 0.8 per cent, or 57.9 points, to reach 7006.7 at the closing bell. The All Ordinaries finished stronger, rising 0.9 per cent to 7,207.1.

The Australian dollar is currently buying US63.7.

Nine of 11 industry sectors finished higher, with energy sector stocks the best performers, climbing 2.5 per cent.

The gains tracked a jump in global oil prices. Brent crude is trading near $US83 a barrel, while West Texas Intermediate is just below $US79 a barrel.

Sector heavyweight Woodside gained 3 per cent to $32.75, Santos added 2.8 per cent to $7.30, and Ampol climbed 1.3 per cent to $33.99.

Iron ore miners also performed strongly after prices for the commodity jumped to their highest level since March. On the Singapore exchange, iron ore prices sat at $US127.65 a tonne on the December contract.

Rio Tinto added 1.9 per cent to $122.43, BHP rose 1.2 per cent to $45.93, and Fortescue climbed 2.6 per cent to $24.30.

Telecoms and utilities stocks were the only industry sectors to finish in the red, dropping 1.1 per cent and 0.8 per cent, respectively.

New business activity data, released by National Australia Bank, showed that while conditions across industry in October proved resilient, a weaker outlook in forward indicators pushed business confidence lower.

“We have very weak forward orders in retail … Now we’re also starting to see some problems in wholesale and for the first time we’ve seen them in manufacturing as well,” NAB chief economist Alan Oster said.

In company news, Commonwealth Bank added 1 per cent to $102.28 after the nation’s largest lender announced a cash net profit after tax of $2.5bn for the September quarter, up 1 per cent.

However, CBA also announced that its loan book dropped to $4.5bn in the September quarter amid a squeeze on profit margins.

Telix Pharmaceuticals rose 1.4 per cent to $9.28. The oncology firm announced it would buy US-based therapeutic company QSAM Biosciences and its asset CycloSam for a total of $US123 million ($193 million) in cash and equity.

Laboratory services firm ALS surged 8.5 per cent, the most since November 2022, to $11.59 a share, after the company posted a net profit after tax of $158.4 per cent for its first half results.

NAB fell 3.2 per cent to $27.97 after shares traded ex-dividend.