ASX bounces higher after last week’s slump, utilities the best performer

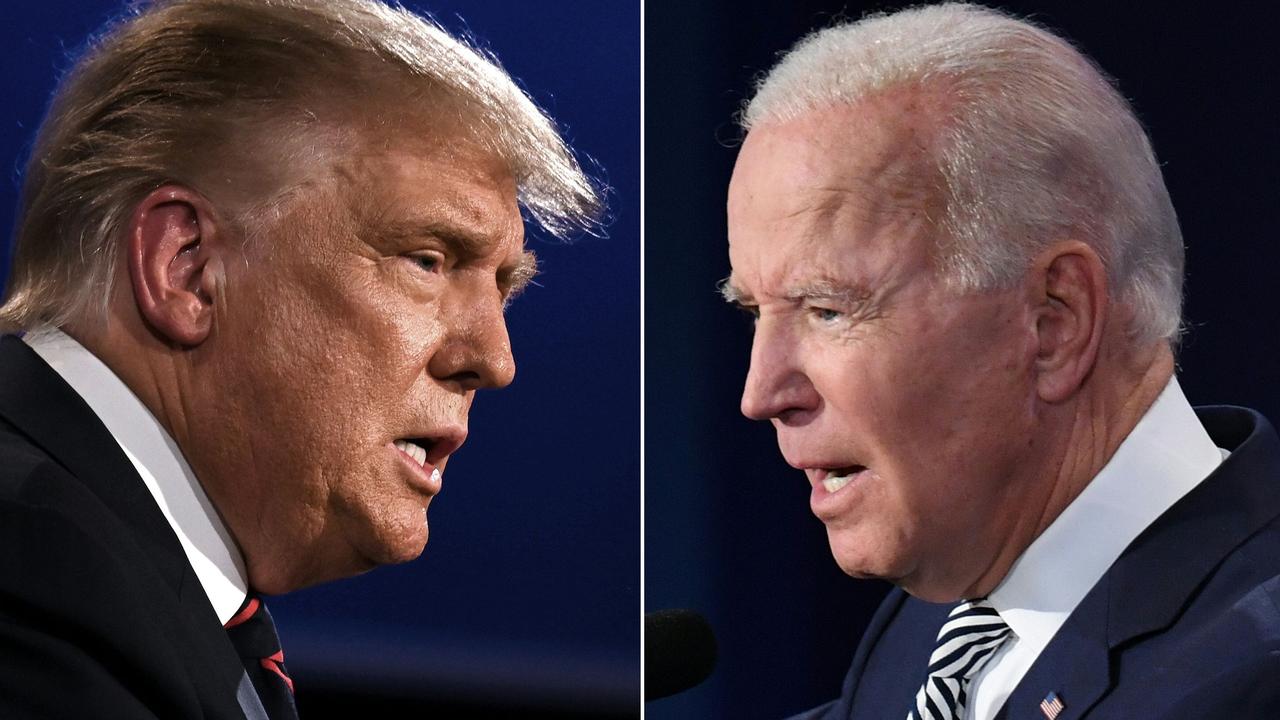

The Australian sharemarket seesawed before recouping a fraction of last week’s losses in an ‘unconvincing’ session as US election uncertainty remains.

The Australian sharemarket bounced higher after last week’s roughly 3 per cent fall, which was the worst since April, with the utilities sector the best performer.

The S&P/ASX200 closed 0.3 per cent firmer at 5951 while the All Ordinaries Index added 0.2 per cent to 6147.

CommSec analyst James Tao said the market seesawed in unconvincing trading as investors mulled over the close call that is the US Presidential election, with results to start flowing on Wednesday morning Australian time.

That left defensive sectors such as utilities in favour, Mr Tao said.

ThinkMarkets Australia analyst Carl Capolingua said it wasn’t a huge rally but a solid performance considering ASX200 futures got as low as 5847 on Saturday morning.

“I’d like to think the fundamentals for the local market are sound enough to help us avoid any further steep losses, but it’s hard to see us shooting away to the upside either,” he said.

“Unless of course, we get a clear winner for President and control of the senate before the end of the week.”

While an interest-rate cut by the Reserve Bank of Australia on Tuesday would be nice, no movement would not be a deal-breaker, Mr Capolingua said.

“The market can afford to wait another month there,” he said.

“We don’t want to wait another month to discover the result of the US elections.”

Among utilities stocks, those that maintained or increased their dividends in the past 6 months all gained ground, suggesting the market was chasing yield, Mr Capolingua said.

AGL Energy appreciated 1.72 per cent to $12.70, APA Group rose 2.91 per cent to $10.80, AusNet put on 0.5 per cent to $2.01 and Spark Infrastructure added 2.52 per cent to $2.04.

Amaysim agreed to sell its mobile business to its long-term wholesale partner Optus for $250 million in cash, a divestment that lifted its shares more than 11 per cent to 74.5 cents.

Ailing financial services giant AMP revealed the takeover price offered by New York Stock Exchange-listed global asset manager Ares Management Corporation was significantly higher than expected at $6.36 billion, sending its shares 8.5 per cent higher to $1.66.

CSR reported a 15 per cent fall in half-year net profit, but analysts applauded its building products division’s strong cost control. The company’s shares jumped 6.35 per cent to $4.69.

Westpac posted a 2019-20 net profit of $2.29 billion, a 66 per cent plunge on the previous financial year, after the financial impact of the coronavirus pandemic and a money-laundering scandal hit Australia’s second largest bank.

Shares in Westpac dropped 0.56 per cent to $17.81.

ANZ put on 2.55 per cent to $19.29, Commonwealth Bank eased 0.25 per cent to $68.85 and National Australia Bank was up 1.34 per cent at $18.85.

Rio Tinto inched 0.1 per cent higher to $92.53 and BHP gained 0.27 per cent to $33.87.

The Aussie dollar was fetching 70.06 US cents, 54.26 British pence and 60.19 Euro cents in afternoon trade.