Aussie shares dip lower on big bank fall

The Aussie sharemarket dipped lower on Wednesday as bank stocks tumbled.

The Aussie sharemarket dipped lower on Wednesday as bank stocks tumbled.

The sharemarket dipped lower on Tuesday as the RBA delivered some hawkish rhetoric on interest rates, even as the miners boomed on fresh Chinese support.

The Australian sharemarket tumbled on Monday as supermarket giants Coles and Woolworths retreated on the ACCC’s bombshell legal move.

More and more Australians are taking on multiple jobs to keep their heads above the water, but the issue runs deeper than just cost of living.

The world’s biggest economy has just cut interest rates by a “jumbo” 50 basis points. Here’s what that means for Australia.

The Australian sharemarket booked a fresh record high on Thursday as investors celebrated the US Fed’s “jumbo” rate cut.

The local sharemarket traded flat on Wednesday as investors moved cautiously before Thursday morning’s pivotal Fed rate cut decision and the release of key jobs data.

The rate cut rally in Australian shares continued on Tuesday, with the local bourse hitting fresh highs once again as it booked a fourth consecutive session in the green.

Australia has signed a massive new trade deal with a Middle-Eastern powerhouse, but the agreement has sparked controversy.

Growing jubilance around this week’s interest rate cut in the world’s largest economy propelled Aussie shares to a record high.

Aussie homeowners have been smashed with interest rate pain for years now and a leading economist warns the stress isn’t going to end anytime soon.

Economic activity jumped last month, but Australia’s biggest bank warns the frothy spending could be temporary.

The Australian sharemarket lifted on Tuesday on the back of a rally in energy stocks and some relief from a rattled Wall St.

Aussies and business are growing increasingly fearful of a stagnating economy, with new concerns about potential job losses.

The Aussie share market finished the week, and the reporting month of August, in the green as it marked the third straight week of gains.

The Australian share market fell again on Thursday, after a poor start thanks to Wall St, as several big name companies report results.

The Australian Stock Exchange ended Wednesday flat after some of the country’s biggest companies reported some less than stellar results.

The Australian share market finished down on Tuesday, following sagging results from jeweller Lovisa and sluggish performance from Zip and Johns Lyng.

The local sharemarket lifted on Monday as buoyant investors cheered the prospect of a September rate cut in the world’s largest economy.

The Australian sharemarket advanced for a 10th consecutive session on Thursday, marking the longest rally in stocks since 2015.

Making $100,000 a year used to be a kind of salary holy grail for a lot of Aussies, but the country’s cost-of-living crisis has changed that completely.

The Australian economy is growing at its slowest rate since a sharp recession in the early 1990s and it’s particularly bad news for white-collar workers.

Australia’s biggest mining company is reportedly looking at Indonesia’s nickel industry following the shut down of its vast nickel operations in Australia.

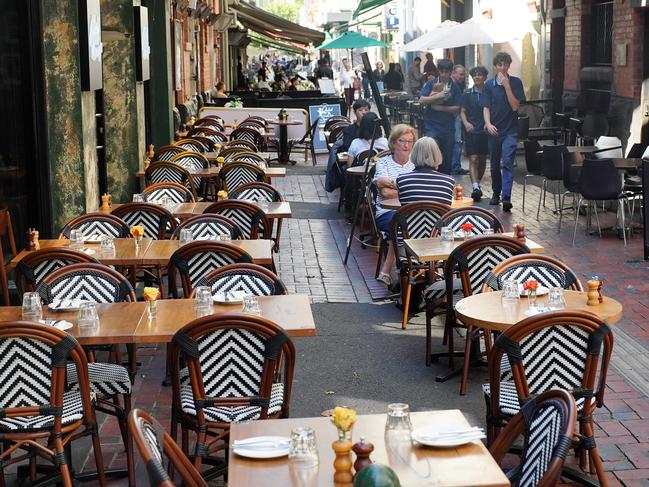

With the rising cost of living stretching budgets further than ever, cost-conscious Aussies are cutting back. It’s left one key industry in a battle to survive.

Shocking claims about the controversial CFMEU have been made at a hearing into Australia’s cost-of-living crisis.

The latest employment figures beat expectations, with the Australian economy adding tens of thousands of new jobs.

Australia’s biggest bank has just delivered some heartening news for struggling mortgage holders.

A massive employment platform has just delivered some bleak news to Aussie job hunters.

Wages are exploding across Australia, but there’s a downside to the money bump.

Bumper results from a bellwether retail giant injected renewed confidence into the Aussie sharemarket on Monday.

Original URL: https://www.news.com.au/finance/markets/australian-dollar/page/11