AUD: Australian dollar hits highest level since July 2019

The local currency has surged to an 11-month high aided by an underappreciated factor but the rise could be short lived.

A slightly improved global sentiment on the belief the worst of the pandemic is in the rear-view mirror helped lift the Australian dollar to a value not seen since the middle of last year.

It was buying 70.41 US cents this morning to its highest level since July last year.

The local currency has held on to these gains throughout today, offering a rare glimpse of positivity for the dollar which fell to a low of 55.10 US cents in mid-March.

Stocks in the United States and Australia, where the ASX200 is more than 2 per cent higher today, have surged higher over the last week as investors scramble to get back into the market.

RELATED: Follow coronavirus live updates

RELATED: The people worst off in a recession

RELATED: World on brink of ‘enormous shock’

Indices on Wall Street soared to pre-coronavirus levels as the world’s biggest economy added 2.5 million jobs in May after stripping more than 20 million in April.

And as Australian markets follow its US counterparts higher, the dollar is being dragged along with it.

“The Aussie is positively correlated with global sentiment, that’s the relationship we’ve seen over the years and decades, and it makes some sense of Australia benefiting from a healthy global economy and suffering from a global slowdown,” Westpac senior currency strategist Sean Callow told news.com.au.

But the leading currency commentator said an underappreciated factor strengthening the local dollar is the closing of international borders which was introduced to contain the spread of the deadly virus.

Australians spend more overseas than international travellers spend on its shores, meaning its value is hindered because it’s sold off more each year than it is bought.

This was further enhanced today by the indefinite grounding of international flights from Qantas and Virgin Australia, pausing the skeleton fleet of services to London, Auckland, Los Angeles and Hong Kong.

The Aussie dollar remains above 70 US cents & continues to firm on global economic optimism & higher commodity prices, pushing it back into positive territory for 2020 so far. The #AUDUSD is buying 70.27 US cents #ausbiz #fx pic.twitter.com/aOGQYLu0zy

— CommSec (@CommSec) June 8, 2020

“Effectively the closing of airports for arrivals and departures looks to be a clear positive for the Aussie dollar because it traps money at home that was going to be spent on international tourism,” Mr Callow said.

In 2018/19, $46 billion was spent overseas as opposed to $22 billion being spent by tourists here, according to the government’s composition of trade report.

“It shows that the immediate impact of effectively no outbound or inbound tourism was to keep Aussie dollars here,” the currency expert said.

“This time last year, Australians were flooding the airports heading overseas selling their Aussie dollars in order to buy foreign currencies.

“Right now, all that money that would have been spent abroad is staying in Australia. It removes one source of selling the Aussie dollar.”

This will be largely undermined by an expected correction in stock markets, however, with a number of analysts believing the recent surge in equities will be short lived.

And because the currency has proved to be closely correlated with the rise and fall of shares, Mr Callow says investors believing another fall is imminent would “definitely be regarding 70 cents as very overpriced”.

“Big picture, the Aussie dollar is still weak,” he said.

DEEPEST RECESSION SINCE WWII

The World Bank has warned the pandemic will see the global economy plunge into its deepest recession since WWII, forcing “many millions” more into extreme poverty, according to its latest economic outlook.

Global output will shrink by 5.2 per cent in 2020, economic activity among advanced economies is expected to shrink 7 per cent, and emerging economies will contract by 2.5 per cent – the steepest fall in 60 years.

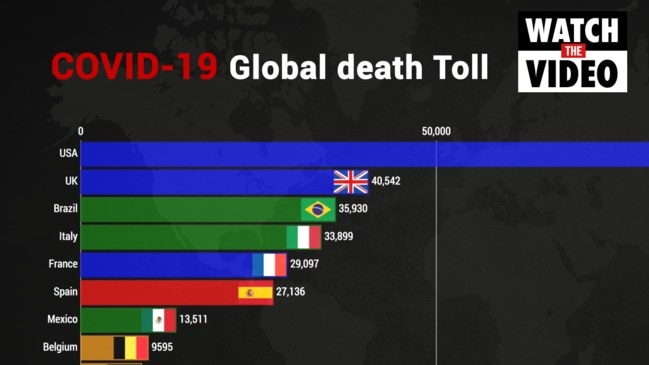

This is a direct result of the COVID-19 pandemic, which just saw a record new high in daily cases.

“COVID-19 has delivered an enormous global shock, leading to steep recessions in many countries,” the report said. “The baseline forecast envisions a 5.2 per cent contraction in global GDP in 2020 – the deepest global recession in decades.

“Per capita incomes in most emerging and developing economies will shrink this year.

“The pandemic highlights the urgent need for policy action to cushion its consequences, protect vulnerable populations, and improve countries’ capacity to cope with similar future events.”

The grim forecast comes as Australia enters its first recession in close to three decades.

The Reserve Bank predicts our economy will contract by 6 per cent in 2020, with World Bank economists saying that under a worst-case scenario global GDP could shrink by almost 8 per cent.