Happy 30th birthday to our floating Aussie dollar

FOR 30 years now the floating Aussie dollar has been an important shock absorber for our economy, writes Jessica Irvine.

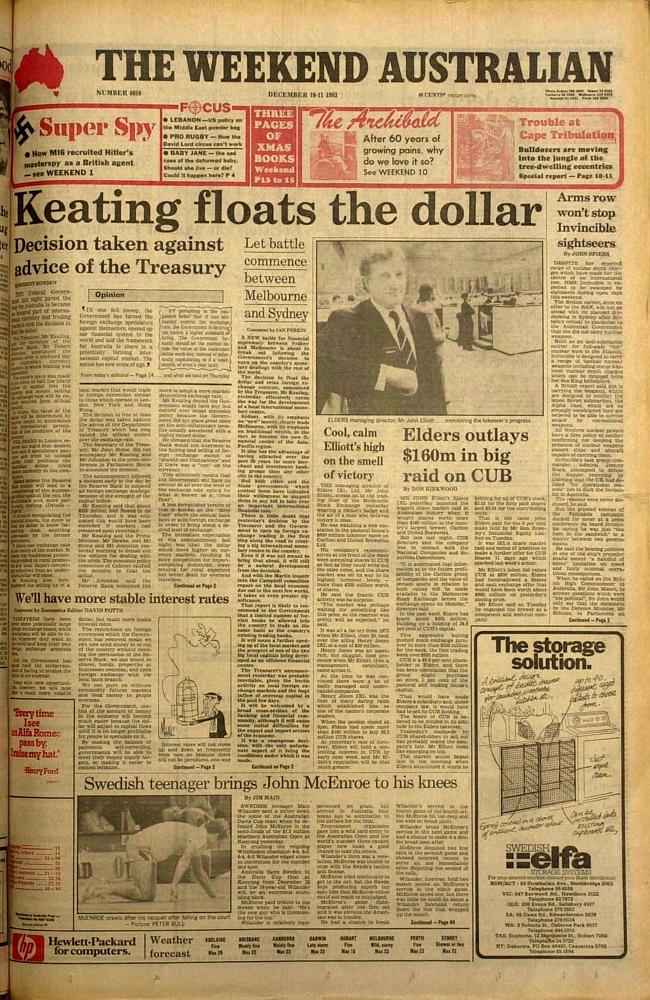

BIRTHDAYS are always a good time to reflect. On December 12, it will be time to celebrate 30 years since the Hawke and Keating government floated the Australian dollar.

Before that, our dollar had always been pegged in value to another currency, first the British pound, then the US dollar, then a moving peg against a basket of currencies.

It seems hard to believe now, but a morning meeting was held between the governor of the Reserve Bank and the heads of Treasury, Finance and Prime Minister and Cabinet to decide the level of the dollar. The Reserve Bank would then use its foreign currency reserves to intervene in the market and influence the level of the Australia dollar.

But by 1983, amid recession and double digit unemployment, the task was becoming increasingly difficult. Large investment flows from overseas were making it hard for the Reserve to keep a lid on the currency.

Just months into the new Hawke government, it was crunch time. It fell to the party of workers to implement the most radical free market move in Australia's history.

Then prime minister Bob Hawke and treasurer Paul Keating have been bickering ever since about who should get the credit.

In his 1994 memoirs, Hawke painted a picture of himself as champion of the float and of Keating as a young and inexperienced treasurer, too heavily influenced by then Treasury Secretary John Stone, who was opposed to the move.

Not only would the float diminish the influence of the Treasury Secretary, Stone legitimately feared that, if left to international forces, the Australian dollar could gain in value, worsening the economy downturn underway.

In a meeting held on October 27, 1983, Stone's view prevailed with the support of Keating, and a decision to float the dollar was put off.

But by December 8, the last day of parliamentary sitting, it became clear the dollar had become unmanageable. Meetings were held late into the night. Hawke recalls in his memoirs sending a message to Keating at 1am: "We've just got to do it." Keating has since fervently challenged Hawke's account and cabinet documents released since shown Keating playing a key role in pushing for the eventual float.

Either way, the two men made history the following Monday when the dollar was set free for the first time, its value purely determined by market forces.

The rest as they say is history, and recalled in fabulous detail by a commemorative wall chart produced by CommSec chief economist Craig James.

Interestingly, the floating dollar began life pretty much where it is now - in the low US90c range.

It soon fell to US57c after Keating's 1986 "banana republic" comment, before gaining to almost US90c again during 1988 Bicentennial tourist boom.

It sank again to below US60c during the Asian Financial Crisis before reaching a record low of US47.7c in April 2001. In the wake of the tech boom, Australia was seen as an "old economy" with little to recommend it.

But fortune is fickle.

The September 2001 terrorist attacks, and the Iraq war that followed, weakened the US dollar, pushing up the Australian currency. The Chinese economic dragon began to stir, increasing demand for commodities and buoying Australia's economic fortunes. The dollar climbed back to the mid-US90c as rising interest rates increased our dollar's appeal to investors.

Then the GFC struck.

Once again, the dollar was to act as an important shock absorber, falling to the mid-US60c and cushioning exports. Since then, Australia has survived the GFC better than most, keeping interest rates here relatively high, increasing investor appetite for our dollar.

The little Aussie dollar - once derided as the "pacific peso" - reached parity with the US dollar for the first time since the float, peaking at US110.8c in July 2011.

Today, we're back where we began - hovering about US93c again. And once again, the dollar's fate is in the hand of the market. Reserve Bank governor Glenn Stevens, who has complained the dollar is "uncomfortably high", will deliver his own reflections on 30 years of a floating dollar tomorrow in a speech to the Australian Business Economist's annual conference.

There wouldn't be a person in the room who would seriously recommend turning back the clock to fix the exchange rate again. If the high dollar continues to keep a handbrake on the economy, there is only one way for the Reserve Bank to counter it: with lower interest rates.

So if you want to know where interest rates are heading, it still pays to keep an eye on the dollar.

###