‘Worse for Australia’: Grim warning as brutal financial crisis engulfs China

China is in the middle of a full-blown financial crisis of its own making – and there will be dire consequences for Australia as a result.

The financial crash of 2008 is remembered as a once-per-century economic calamity in which imploding house prices bankrupted banking systems worldwide.

During that period, the world relied very heavily on Chinese growth to avert a depression.

But that growth was itself heavily debt-dependent – and those chickens are coming home to roost in China today.

You may not think it is a financial crisis in China, but it is, with peculiarly Chinese characteristics.

The great Chinese debt binge

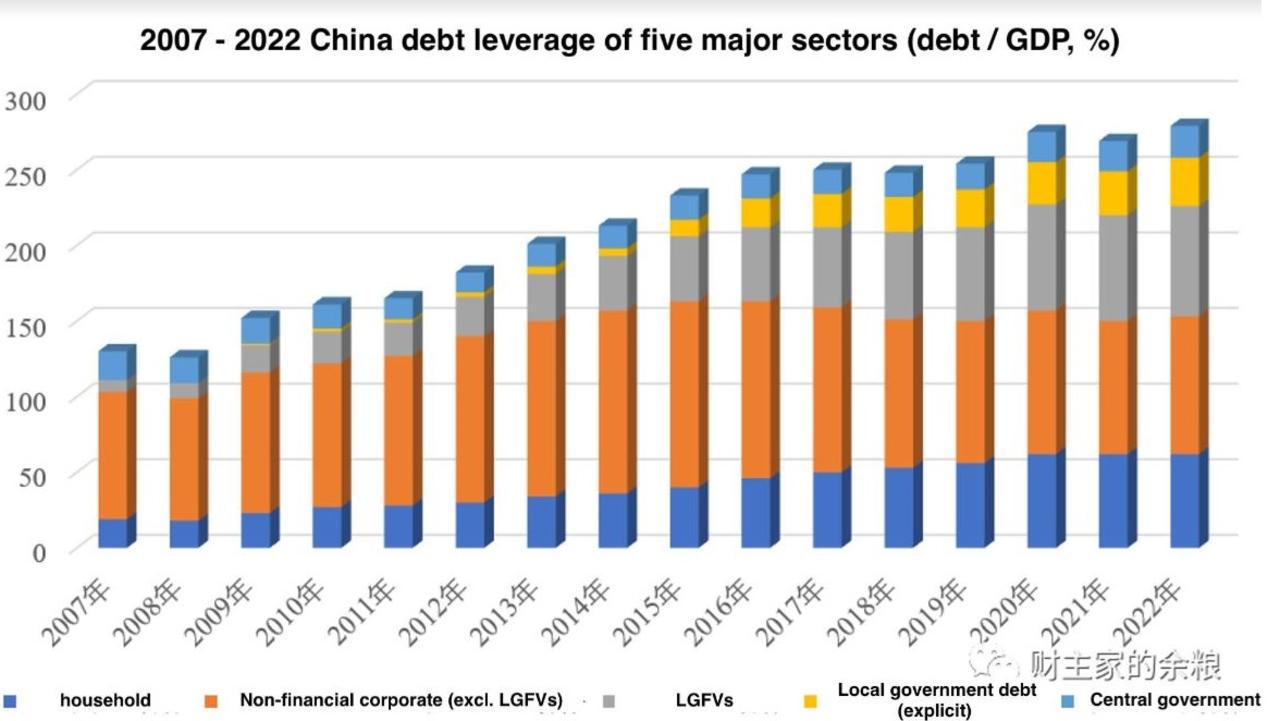

Between 2008 and 2022, Chinese debt-to-GDP ratios doubled to 300 per cent of GDP (and worse on some measures).

Much of this debt expansion, and growth, was in sectors beneficial to Australia.

An enormous apartment build-out consumed impossible amounts of steel as household debt inflated.

This was augmented by even larger growth in Local Government Financing Vehicles (LGFV) which mostly targeted infrastructure – again, very steel intensive.

These twin debt engines powered immense demand for Aussie iron ore and coking coal.

From productive to Ponzi

However, China overcooked this growth model.

It hugely overbuilt apartments for a population that was no longer growing as expected.

Likewise, local governments were building uneconomic infrastructure for years to meet growth targets rather than any useful purpose.

When completed, these projects could not service their debt and, over time, this accumulated into a kind of Ponzi scheme in which more and more LGFV debt was used to repay old debt, not renew infrastructure.

Making matters even worse, the land sales feeding the apartment boom were also underpinning much of the LGFV borrowing.

So, when it all came to an end a few years ago, the two debt engines went into reverse together in what economists call a pro-cyclical bust.

The great Chinese deleveraging

That crash is today’s Chinese financial crisis.

It is not like that of developed markets, because the Chinese banks and markets that fuelled the debt binge are government-owned or guaranteed.

That has meant that there has been no sudden stop of credit, because private solvency rules do not apply.

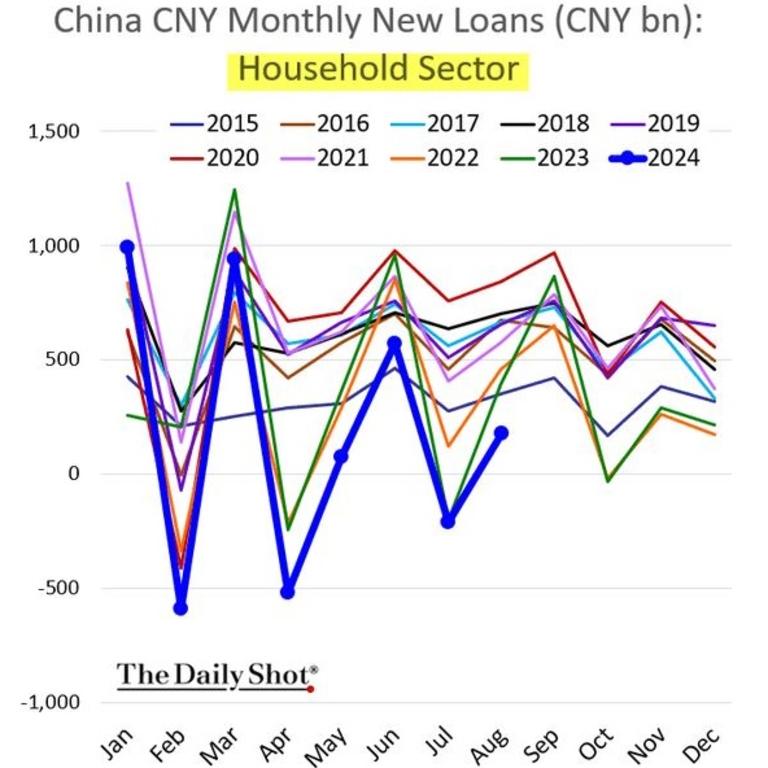

But the crisis is transpiring nonetheless, most obviously in falling demand for debt as asset prices deflate.

For instance, household debt, which is mostly mortgages, is galloping backwards as house prices fall.

Local government debt isn’t falling quite so fast, but it is still shrinking and will likely continue to do so, as well as be channelled uselessly into repaying itself.

The central government is trying to offset this with deep deficits. But the headwinds are immense, and, worse for Australia, Beijing is more focused on financing new industries like technology, chips and services to transition away from local government construction.

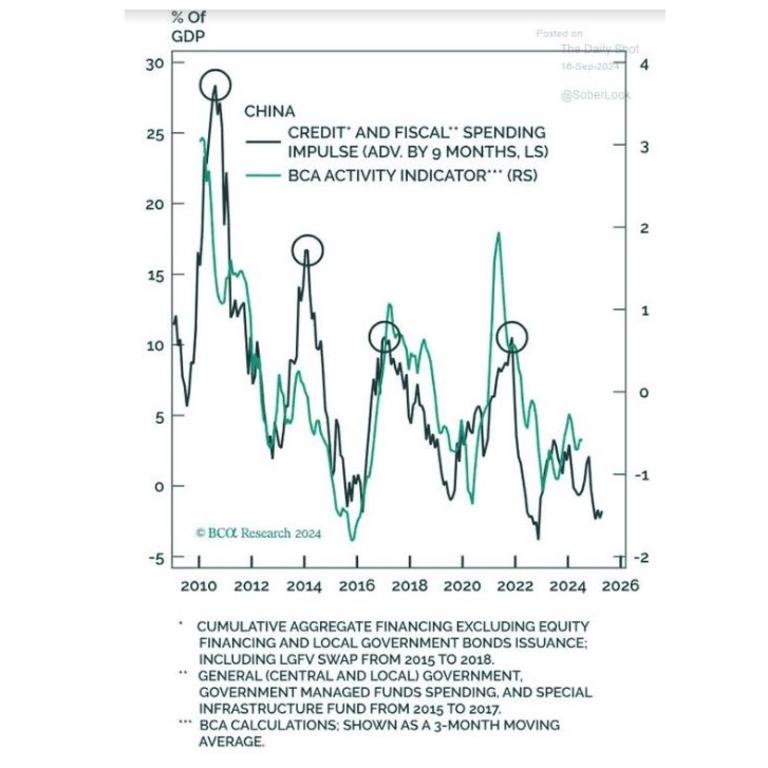

The net result is that Chinese debt issuance is collapsing and its credit impulse, which is the rate of change in new debt in reference to growth, is very weak.

Indeed, China is about to miss its dubious 5 per cent growth target.

Financial crises of this nature do not resolve quickly. The prices paid for the “extend and pretend” of bad debt are time and opportunity.

For years to come, anyone banking on China coming to the rescue of Aussie commodities like iron ore and coking coal will be sorely disappointed.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.