‘Total failure’: Nation’s interest rates gamble blows up in its face, with inflation at 80 per cent

Australians are bracing for even more economic pain when interest rates rise again, but it’s nothing compared to the ordeal in this country.

Australia’s annual inflation rate has hit its highest level since Bob Hawke was prime minister in 1990, and is expected to keep increasing in the coming months.

That means the Reserve Bank is nearly certain to raise interest rates again when it meets next Tuesday, piling more pressure on cash-strapped households in an effort to keep inflation under control. Economists have forecast a hefty rate hike of 50 basis points.

So, a great deal more economic pain is coming. It certainly isn’t welcome. Yet a bold experiment conducted overseas (some might use a less flattering adjective) shows us why this tightening of monetary policy is necessary.

‘Illiterates or traitors’: Nation’s big gamble

While the rest of the world has tightened monetary policy to deal with the global surge in inflation, Turkey’s central bank has kept its cash rate stubbornly unchanged since January.

In fact it actually cut the rate significantly in the final third of 2021, lowering it from 19 per cent to the 14 per cent at which it now remains.

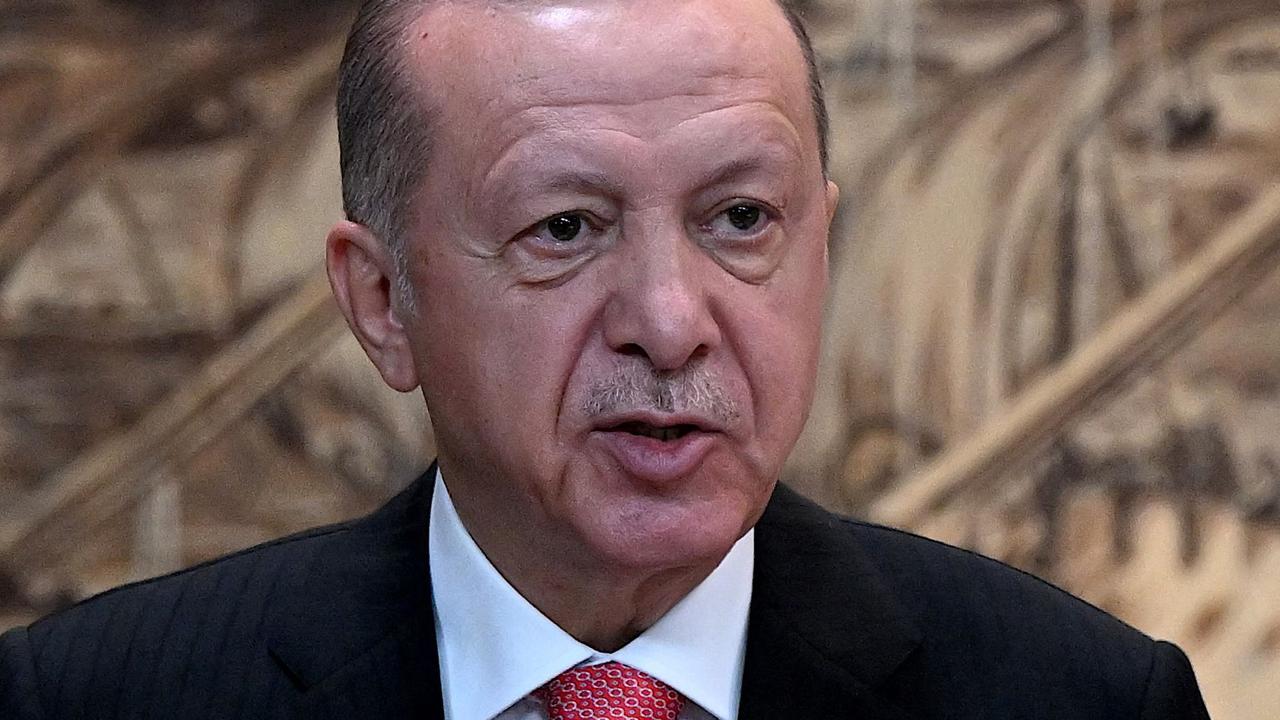

The central bank has adopted this approach under sustained pressure from Turkey’s President, Recep Tayyip Erdogan, who believes higher interest rates actually fuel inflation.

The conventional economic wisdom is the other way around. It holds that high interest rates restrain inflation, and looser monetary policy inflames it.

Speaking in May, the President defended his gamble and branded those who were concerned about Turkey’s monetary policy “illiterates”.

“Those who try to impose on us a link between the benchmark rate and inflation are either illiterates or traitors,” he said.

“Don’t pay attention to the ramblings of those whose only quality is in viewing the world from London or New York.”

Some of the alleged illiterates who opposed Mr Erdogan’s rate cuts were once members of the central bank. No longer. He has repeatedly sacked such voices from the body, and it is now being led by its fourth governor in four years.

The consequences of Mr Erdogan’s experiment have been stark.

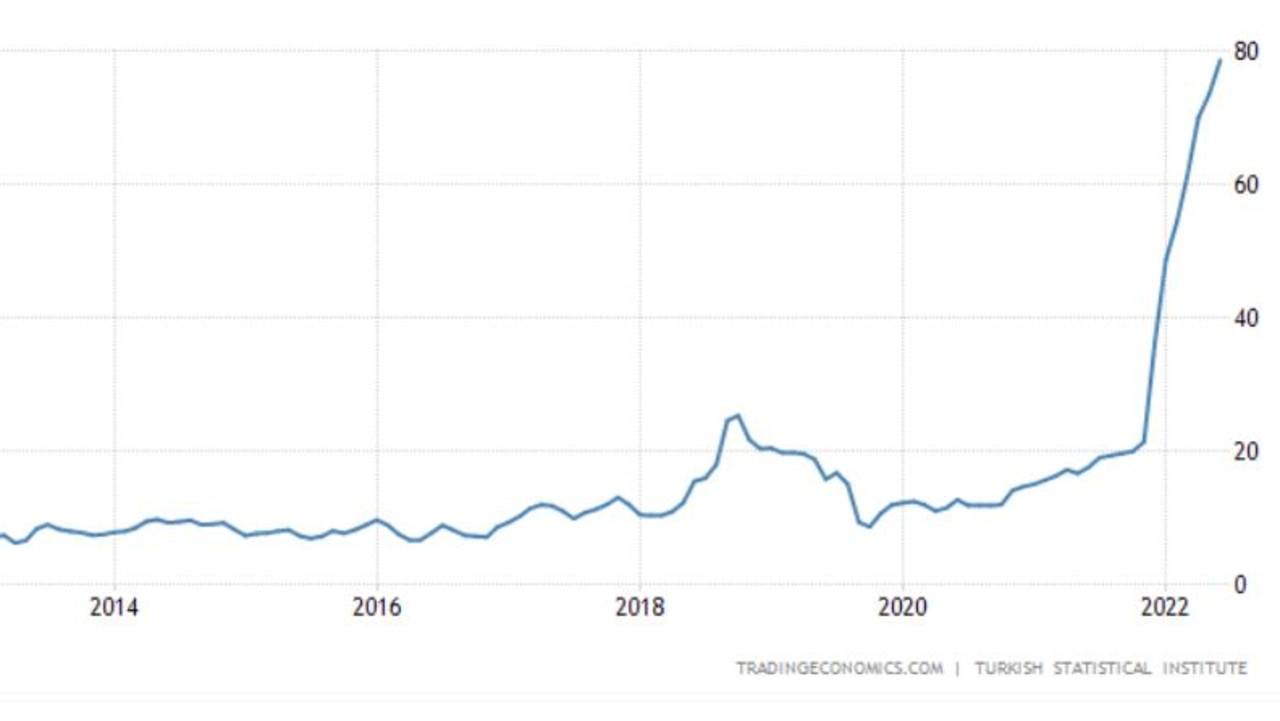

A year ago, Turkey’s inflation rate was an already troubling 19 per cent. By the end of last month, it had risen to a staggering 79 per cent, the highest it has been in 24 years, and 16 times the central bank’s inflation target of 5 per cent.

Some experts believe the official government estimate is in fact a gross underestimate, with the true inflation rate sitting somewhere well into the triple digits.

Professor Steve Hanke from Johns Hopkins University has labelled the official figure a “total fiction”, putting the true rate at 128 per cent.

‘Total failure’: Erdogan’s experiment backfires

Incidentally, those viewing the world from London are currently experiencing an inflation rate of 9.4 per cent. Over in New York it is 9.1 per cent.

That’s far more inflation than either country would like – hence, the US Federal Reserve is poised to announce a fresh interest rate hike this week – but it’s preferable to 80 per cent.

While the Turkish economy is still growing despite this runaway inflation, its currency has been decimated. The lira’s value plummeted by 44 per cent last year, and has fallen another 26 per cent this year to reach a record low against the US dollar.

Businesses are unable to make any long-term plans, such is the volatility of the economy. And while wealthy Turks are doing fine, most of the population is struggling.

A recent poll showed more than a third of Turks were unable to afford their basic needs, and a further 44 per cent were barely scraping by.

“The poor suffer most from inflation, but middle class Turks are also in pain,” The Economist noted in a column on the situation last week.

“As their purchasing power shrinks and their job security erodes, many are falling out of the middle class, and feeling both anguish and anger.”

Back in May, when the inflation rate was *only* 70 per cent, leading economists were already labelling Mr Erdogan’s experiment a “total failure”.

“It’s about food and energy price increases, but also the spectacular failure of monetary policy in Turkey,” said Timothy Ash, from Bluebay Asset Management, for example.

“It’s about the abject and total failure of Erdogan’s unorthodox monetary policy.”

The President remains unmoved. He has blamed his country’s rapidly surging inflation on foreign interference.

Australian inflation hits highest level in decades

According to data released by the Bureau of Statistics this morning, Australia’s consumer price index (CPI) rose by 1.8 per cent in the June quarter, with our annual inflation rate increasing to 6.1 per cent.

That sounds tame compared to Turkey. It is, in fact, the highest annual rate in this country since December of 1990. And it’s significantly higher than the RBA’s inflation target of 2-3 per cent. That increases the pressure on the RBA to raise the official cash rate again.

Speaking from Parliament House in Canberra at midday, Treasurer Jim Chalmers said he was “not surprised” by the fresh inflation data, though that made it no less “confronting”.

“It’s not news to millions of Australians who feel this inflation challenge every time they go to the supermarket, and every time the bills arrived. This inflation outcome mirrors the lived experience of Australians who are doing it tough right now,” he said.

“Inflation is high and rising. It will get tougher before it gets easier. The reality is, the quarterly outcome does not yet include the electricity price spike that came in July.”

Dr Chalmers said the government was focused on dealing with the supply chain issues.

He said the global economy was “treading a precarious and perilous path” and there was worse still to come.

“The inflation in the economy is primarily but not exclusively global,” he said.

“I think Australians understand when they’re at the supermarket, when prices are going through the roof, that this challenge is partly global and there are domestic components of this challenge as well.

“I wanted to reassure them that the government is very focused on those domestic factors.”

The Treasurer said the “illegal, immoral invasion of Ukraine has dire consequences for energy and food security and we are all feeling that around the world as well”.

He also pointed to China’s continued pursuit of a “Covid zero” policy as a key global factor.

Dr Chalmers told Australians to expect updated forecasts for inflation, wages and economic growth in his ministerial statement on the economy, to be delivered in parliament tomorrow.

“Inflation will get worse before it gets better. But it will get better,” he said.

“It’s going to be a difficult time ahead.

“My ministerial statement tomorrow will show the combined impacts of rising interest rates and slowing global growth on our own economic growth here in Australia. It will be confronting.

“What you can expect to see in the ministerial statement tomorrow is inflation revised up substantially, growth revised down, and all of the implications that that brings.”