The end of China and Australia as we know it

China is saying one thing but the real story is very different. And the impact on Australia could be so profound we’ll be feeling the impact for decades.

ANALYSIS

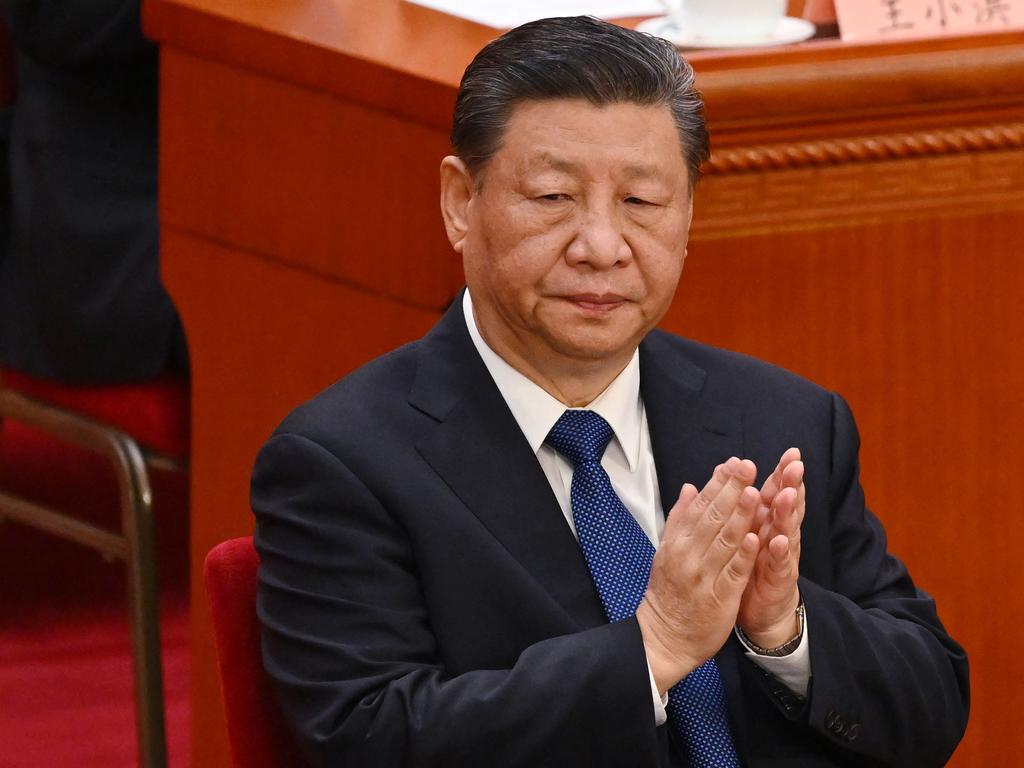

China has just set its exciting new growth target of 5 per cent.

We should all cheer the politburo!

However, a range of problems with the target illustrate the opposite.

China is slogging its way through a severe downturn more characteristic of the Great Depression, with Chinese characteristics, than business-as-usual growth targets.

The Five Ds

China is faced with five economic headwinds:

– Failing demographics as the nation ages at a very steep pace

– Accumulated debt from its historic urbanisation build-out

– Deflation that makes repaying the debt all the more difficult

– Deglobalisation that robs it of an external release valve and

– A dictatorship that dramatically exacerbates sovereign risk as capital flees the country.

Each of these is formidable in and of itself. Together, they are the end of China as we know it.

Property is the black hole

The easiest way to understand China’s depression economics is what is happening in its property market.

Only a few years ago, Chinese households invested in new apartments with gay abandon.

It was thought that the hoard of poor millions pouring into cities was endless, so buying and building apartments was a no-brainer for households.

But the flow was finite and has run out. The build-out was a decade ahead of an urban population that will never materialise.

This has left an immense debt overhang within the $60 trillion dollar property market, threatening to bankrupt the entire country.

Titanic developers are collapsing overnight. Households are deleveraging their mortgages and saving their butts off. Local governments that sold land to build diamond-encrusted roads and crystal bridges are busted.

The Chinese all know it, and today, real estate is radioactive. So much so that the scale of the prospective collapse in construction volumes is hard to describe:

Depression economics with Chinese characteristics

You might be getting a picture of what I am discussing by now.

Depression economics describes what happens when a bubble so large bursts that it threatens the country’s balance sheets.

It involves debt-deflation feedback loops and excess savings that denude the economy of private sector demand.

The way to treat it is to accelerate the balance sheet repair with rock-bottom interest rates while supporting economic activity with public spending.

But Beijing sees itself as above such considerations. In its mind, they are features of a Western decadence ignominiously on display in the Global Financial Crisis.

So, it is instead limiting interest rate easing and fiscal spending, guaranteeing that deflation is embedded in its economy.

This failure has already frozen the Chinese currency, sealed its capital account, smashed its stock market, and is now cratering its bond yields.

Beijing is withdrawing China from global capital markets rather than applying appropriate remedies for its mistakes.

Deflation nation

For Australia, this means just one outcome. The Chinese debt deflation is headed Down Under via two direct channels.

The first is crushed bulk commodity prices. Iron ore and coking coal have been remarkably strong but it’s unlikely to last. In part because more supply is also coming as demand is smashed.

Both look set to crash, delivering a huge national income shock that will kill nominal growth and the budget. Taxes will rise.

Second, a tsunami of dumped Chinese goods is headed our way. They will be cheap and help with inflation, but the unwary will see industries swept away in a storm of excess Chinese production.

A tariff war with other producer nations – such as the US and Europe – feels inevitable, which will only intensify Chinese dumping everywhere else, like Australia.

You might want to cheer this on. It means deep interest rate cuts are coming, much deeper than anybody thinks, just as they did during the practice run for this adjustment in 2015 after iron ore plunged to $37.

Canberra is likely to respond to this shock like in 2015, with wave after wave of mass immigration.

So, you might also spare a thought for the losers if this happens.

Wage growth will disappear with national income. The crush loading of all public services will intensify. The housing crisis will get much worse.

Like Beijing, Canberra will likely refuse to acknowledge its mistakes and population policies will be used to foist the entire adjustment onto workers, particularly youth.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.