‘Strangely familiar’: Kamala steals iconic Australian economic ideas

When Kamala Harris unveiled her policy platform for the upcoming US election, many Aussies were left with a strange sense of deja vu.

When Kamala Harris unveiled parts of her policy platform for the upcoming US election, many Aussies were left with a strange sense of deja vu.

Not only had they heard some of these policies before, but from a source that is arguably her polar opposite, former Australian prime minister John Howard.

As part of the US Vice President and Democratic Party nominee’s economic policies to appeal to Middle America, she has promised up to $US25,000 ($A37,100) for a home down payment for each eligible first homebuyer, as well as an additional $US10,000 ($A14,900) tax credit. Ms Harris also unveiled a proposal to provide the parents of newborns with a $US6000 ($A8900) tax credit.

If this all feels strangely familiar, it’s because Ms Harris’s economic policy team has effectively fired up the old DeLorean from Back To The Future and gone back to the early 2000s to borrow the Howard government’s stable of economic policies.

I’ve seen this one

When it comes to comparing Ms Harris’s de facto first home buyer grant, there are no shortage of Australian versions to compare it to, from the extremely generous $A7000 First Home Owner Scheme of the Hawke government in 1983 to the Rudd government’s GFC-era $A14,000 First Home Buyer Grant in 2008.

Before we get into the relative size of Ms Harris’s proposed grant and tax credit compared with those of Australia’s past, it’s worth making an important distinction. The historic norm for Australian first homebuyer mortgages was to have a 20 per cent deposit, while in the United States in 2024, the average deposit for a first homebuyer is around 8 per cent.

Given the dramatically different deposit hurdle in the US compared with historic Australia, it’s possible the impact of Ms Harris’s grant could be significantly greater than it was in Australia historically.

In 2012, David Blight, Michael Field and Eider Henriquez of Deakin University authored a paper on the impact of first home buyer grants from the year 2000 to 2010.

They concluded they added $A57,321 to the cost of the median housing price, which was at the time of assessment $A360,000. In short, a little under 16 per cent of the total value of the median home at the time was concluded to be as a result of the First Home Buyer Grant, despite the grant itself being significantly smaller than that figure.

Given the relative size of the grant and the underlying conditions, Ms Harris’s proposed grants have more in common with the Howard-era $A14,000 grant than they do with Rudd’s or Hawke’s.

Prices explode

Based on the median sold price of US detached houses, the Harris proposal (solely the down payment assistance) accounts for 5.4 per cent of the purchase price. Including the additional $US10,000 ($A14,900) in proposed tax credits, it comes to 7.6 per cent of the purchase price or roughly equal to the 8 per cent average down payment required for US first home buyers.

When the Howard government introduced its $A14,000 first homebuyer grant in 2001, it equated to an average of 7.7 per cent of the purchase price of the median capital city house. In Sydney, what was and remains the nation’s most expensive housing market, it accounted for 4.3 per cent of the purchase price of the median house. At the other end of the spectrum, it accounted for 11.6 per cent of the median Hobart house.

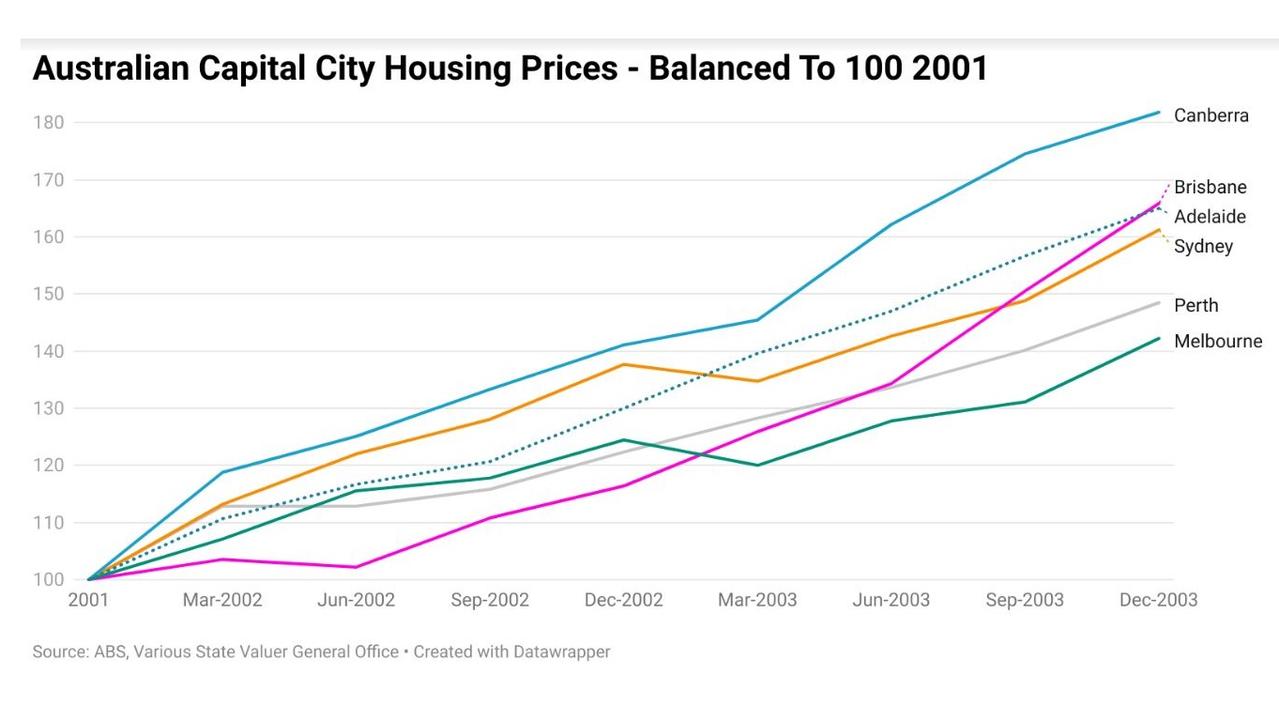

Between 2001 and the end of 2003, capital city housing prices rose by an average of 54.5 per cent, with Canberra leading the way, up by 81.8 per cent in less than three years.

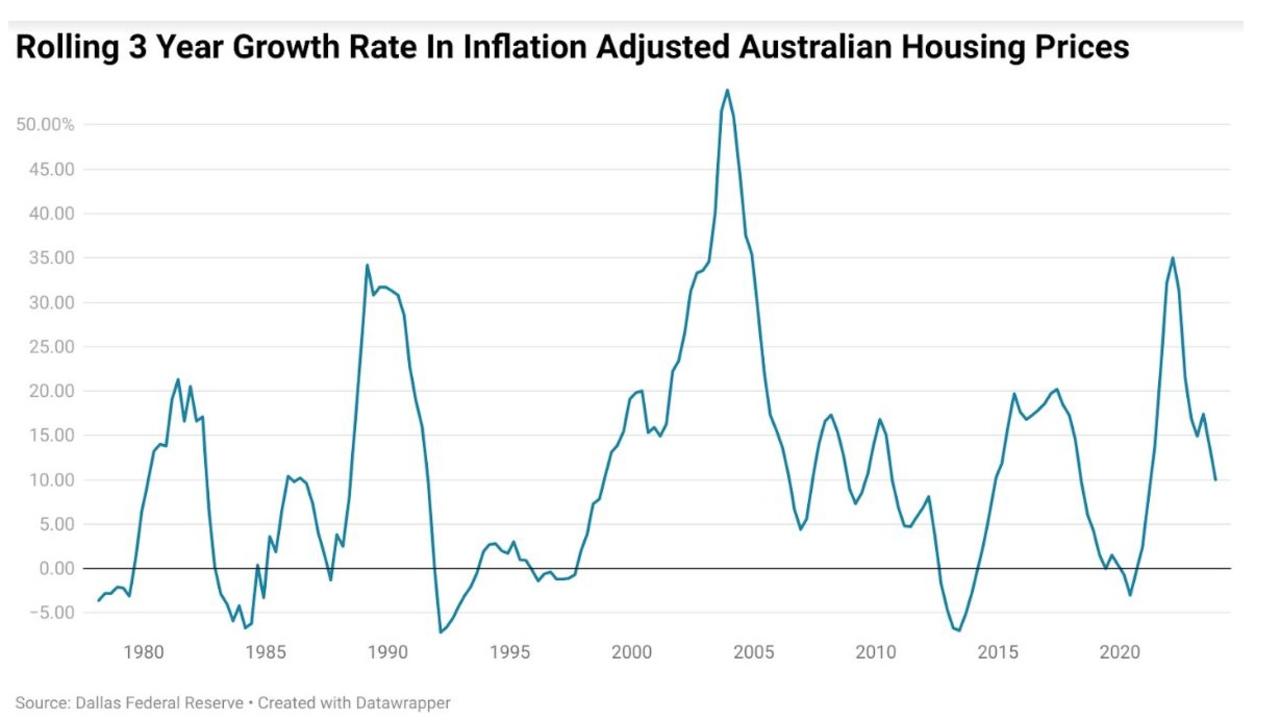

While it’s worth noting that this did not occur in a vacuum and there were several other major factors at work, the period between December 2000 and December 2003 represents the largest three-year rise in inflation-adjusted Australian housing prices in history, rising by a total of 53.9 per cent.

Baby Bonus versus Newborn Tax Credit

When the Howard government introduced the lump sum version of its $A3000 baby bonus program for the parents of newborn children in 2004, it represented approximately 6 per cent of the median household income at that time.

Vice President Harris’s policy is significantly more generous based on the proportion of median household income it represents, with the $US6000 ($A8900) tax credit equating to 7.7 per cent of household income.

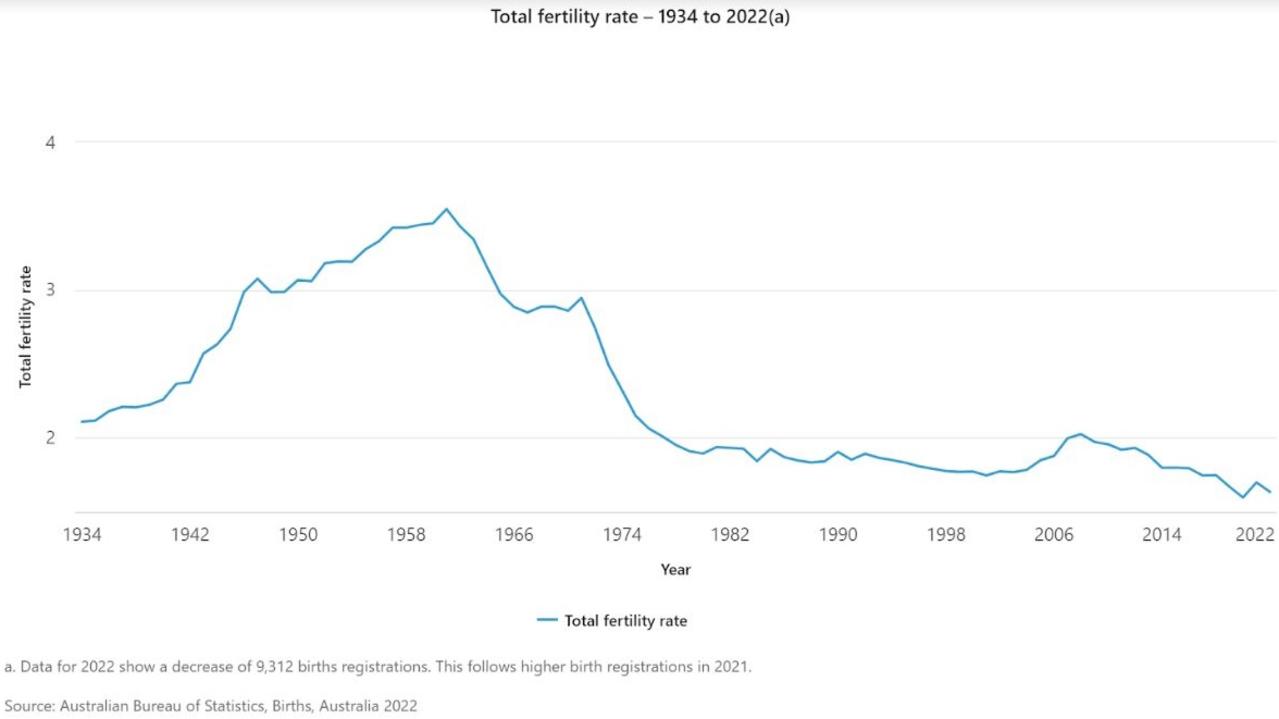

Academic research on the impact of the baby bonus from RMIT University concluded that it was indeed successful in encouraging Australians to have greater numbers of children. Across the 10 year duration of the lump sum cash payment version of the policy, RMIT researchers estimate that Victoria alone had an additional 24,072 births.

At a national level, from the time of the implementation of the lump sum version of the baby bonus until its peak impact, the fertility rate rose from 1.78 babies per woman to 2.02.

As of the latest data which covers up until the end of 2023, the US fertility rate is estimated at 1.62 babies per woman.

Howard and Harris

To think that John Howard and Kamala Harris would share a sizeable proportion of their socially focused economic policies is certainly an amusing confluence of events. But ultimately, the baby bonus was a successful policy that achieved its intended purpose and was a politically popular initiative throughout much of its life span.

While there is a large amount of evidence from academia and even from within government agencies that first homebuyer support mechanisms are generally counter-productive as long-term tools, they remain a politically popular tool despite the damage they have done.

Given the very different makeup of US housing markets compared with Australia, it’s likely that the implementation of the proposed first homebuyer grants will place strong upward pressure on housing prices.

But ultimately, in the immediate future, the promise of being able to get into the housing market could be enough to convince some voters to send Kamala Harris to the White House.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator