Screenshot detailing China’s reported plan to scale back Covid-19 policies sparks market boom

A single screenshot detailing China’s plans to roll back its widespread Covid-zero policies has sparked a market firestorm.

Most Asian markets rose on Friday after a single screenshot detailing China’s plans to reopen society was leaked to social media.

The nation is still being restrained by the ruling party’s ongoing zero-Covid policies, almost three years after the pandemic began.

Hong Kong’s stock exchange jumped more than five per cent on lingering hopes that China will soon begin rolling back its zero-Covid strategy of lockdowns that has hammered the world’s second-largest economy.

Shanghai was up more than two per cent Friday.

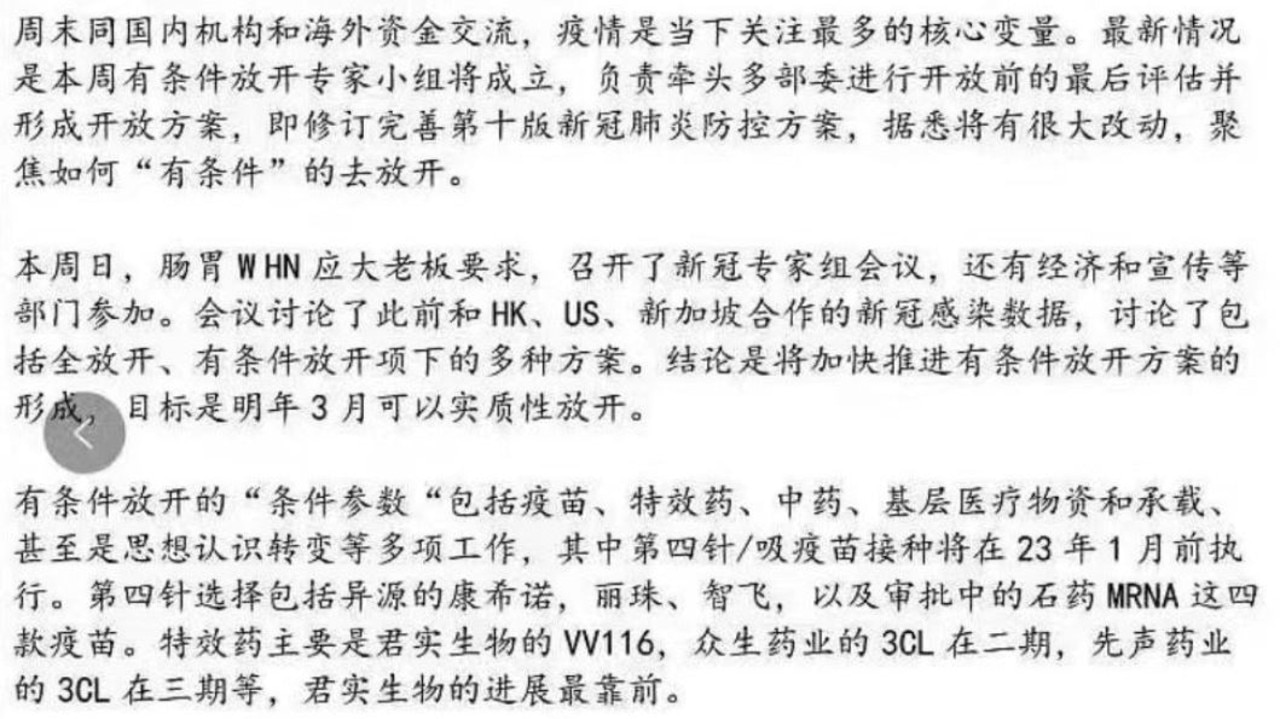

Analysts believe the major spike came after the screenshot of an alleged government meeting held by a top leader of the Communist Party prompted speculation over the government’s plan to scale back most measures by March 2023.

The screenshot claimed China would be “speeding up a conditional opening plan, with the goal of substantially opening by March next year” in the meeting with Wang Huning, who has been described as the nation’s fourth most powerful man.

The Government has however denied its planning to relax Covid rules.

The image was shared to WeChat before making its way to Twitter and other social media platforms, generating a wave of interest from investors.

The MSCI China Index posted a US$450 billion (A$697 billion) rise in the two days following.

The ongoing optimism about an easing of China’s Covid policy also lifted oil prices on an expectation that demand will build as the giant economy picks up speed again.

It’s rumored that Beijing will soon establish an expert team to put together a “conditional reopening plan.†The goal is to materially reopen the country by March next year. The upcoming 10th edition of covid guideline is widely expected to provide upside surprises. pic.twitter.com/5gwK0tIMCD

— Shanghai Macro Strategist (@ShanghaiMacro) November 1, 2022

Analysts say the process of “returning to normal” will be a long and careful process.

“Reopening is not a decision that can be made overnight,” a chief economist at hedge fund Grow Investment Group said via theSydney Morning Herald.

“It has to be through careful study and communication. That is why most of us think that after the Twin Sessions (the yearly meetings of China’s National People’s Congress) in March is a good time to reopen.”

Chinese authorities though have scotched the rumours.

CPC chief Ma Xiowei subsequently said Covid Zero remained the goal, reported Bloomberg.

“We must resolutely maintain the general approach of ‘preventing imported cases and domestic resurgence’ and the overall strategy of ‘dynamic Covid Zero’,” Mr Ma said.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer available for a limited time only >

Many indexes slid slightly after Beijing tried to hose down those suggestions.

However some still believe China will eventually be forced to live with Covid.

“What we are guessing is China in the future will model the reopening on the back of Hong Kong,” Jack Siu, Greater China chief investment officer at bank Credit Suisse, told Bloomberg Television.

“To fully reopen, we are still at least nine months away from today.”

Tech firms were the big winners in Hong Kong, with Alibaba and Tencent up by double digits on reports of progress in US auditing of Chinese firms listed in New York.

Alibaba and Tencent among others have faced delisting from Wall Street owing to a standoff between securities authorities as part of the wider China-US row.

Elsewhere, Sydney, Seoul, Singapore, Mumbai, Bangkok and Wellington markets rose. However, Tokyo was deep in the red as traders played catch-up with Thursday’s losses after returning from a one-day holiday. Taipei, Manila and Jakarta also fell.

— with AFP