Russian rouble bounces back to pre-invasion levels

Russia’s rouble has recovered all of its value after crippling sanctions sent the currency plummeting last month.

Russia’s rouble has recovered nearly all of its value after crippling sanctions in the wake of the invasion of Ukraine last month sent the currency plummeting to less than one cent against the US dollar.

The rouble was trading at around 84 per dollar most of Wednesday after gaining around 20 per cent in the previous two sessions, and touched the 82.55 level for the first time since February 25 – the day after Moscow launched its “special operation” sending tens of thousands of troops into Ukraine.

Russian President Vladimir Putin’s invasion sparked an unprecedented financial response from the US and Europe – including the freezing of the Russia’s foreign currency reserves and its expulsion from the SWIFT interbank messaging network – aimed at crippling the country’s economy and crashing its currency.

The rouble went into free fall as a result, bottoming out at around 150 per dollar on March 7 after Joe Biden announced a ban on US imports of Russian oil and gas – with the President boasting that the rouble had been reduced to “rubble”.

But the currency has steadily regained ground over the past month, spurred by Mr Putin’s announcement last week that Russia would demand payment for natural gas in roubles from European countries.

“When you look at it in a non-geopolitical sense but just the basic economic building blocks of the currency, it’s extremely bullish for the rouble,” said currency forecaster Clifford Bennett, chief economist with ACY Securities.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

Rouble ‘could go to 50’

Mr Bennett said the rouble’s recovery was being fuelled by a near-total collapse in imports, even as Russia continued to export essential commodities including natural gas, oil and nickel.

While the pre-crisis level of 76-72 “is probably about right” considering the geopolitical risks and trade account imbalances, Mr Bennett said it was possible the rouble “could go to 50 to the US dollar”.

“Given the volatility we’ve seen, given the extraordinary imbalance that now exists between imports favouring exports with ever higher commodity prices, and the requirement to be paid in roubles – we’re living in extreme times,” he said.

“That would be a modest swing in the opposite direction compared to what we’ve seen. It’s not an extreme or outlandish consideration given this is perhaps the most significant crisis the world has faced for some time.”

Some have also attributed the rouble’s recent rise to the announcement by Russia’s central bank that it was resuming gold purchases at a fixed price of 5000 roubles per gram – in effect pegging the currency to gold.

“I think some commentators may be overplaying it a bit, but it’s certainly a factor,” Mr Bennett said. “It’s major commodities like nickel. I wouldn’t say the rouble is gold-backed, I tend to say it is hard metal-backed.”

‘Rouble reduced to rubble’

Speaking in Poland last week, Mr Biden misstated the value of the rouble while hailing the effect of the international response.

“As a result of these unprecedented sanctions, the rouble almost is immediately reduced to rubble,” he said. “The Russian economy – that’s true, by the way. It takes about 200 roubles to equal one dollar.”

At the time of Mr Biden’s Warsaw speech, the exchange rate was closer to 100 per dollar.

He made the same claim that “you need 200 roubles to equal one dollar” on March 11, when the rate was around 126 per dollar.

"The ruble was almost immediately reduced to rubble."

— Forbes (@Forbes) March 26, 2022

President Biden speaks about the effect sanctions have had on Russian currency, saying the exchange rate from rubles to USD is 200 to 1, although the current rate is closer to 100 to 1. pic.twitter.com/H3FV9PAmlH

Speaking to a conference of House Democrats in Philadelphia, Mr Biden also predicted that Russia’s stock exchange, which shut down shortly after the sanctions hit to prevent a mass sell-off, would “blow up” the moment it reopened.

“[The] Moscow stock exchange is closed for a simple reason,” he said.

“Why is it closed? Because for the last two weeks, because the moment it opens, it will be disbanded. Hear me? It will blow up. Credit rating agencies have downgraded Russia’s government to junk status. Junk status.”

The MOEX Russia Index closed 4.3 per cent higher on Wednesday in its fifth trading day after a nearly month-long hiatus, ending a three-day losing streak marked by wild swings in stock values.

Russian authorities have maintained strong restrictions in place to prevent a major sell-off, with a ban on short selling and nonresidents prevented from selling stocks and government bonds until April 1.

Strengthening may be ‘temporary’

Natalia Orlova, chief economist at Alfa Bank, told Reuters the rise in the rouble was being driven by export-focused companies being obliged to sell foreign currency, as well as monthly and quarterly tax payments boosting demand for roubles.

“This created an imbalance on the currency market as a result of which foreign currency supply substantially exceeds demand and thus leads to the firming of the [rouble] rate,” she said. “I see the current [rouble] rate strengthening as temporary.”

Naeem Aslam, chief market analyst at AVATrade, said in a note on Wednesday that the rouble was seeing massive moves on the back of easing geopolitical tensions, “and it is likely to remain immensely volatile as traders are hoping for no further sanctions against Russia”.

“In addition to this, Russia has been meeting all of its debt obligations so far, and energy producers and government officials have made it clear that their debt holders must accept Russian rouble if they want to get paid,” he said.

The Kremlin planned to tell energy companies on Thursday how to pay for fuel in roubles – even as European nations indicated they would not give in to the demands, raising the prospect of energy supply disruptions.

Europe relies on Russia for around 40 per cent of its natural gas and 25 per cent of its oil.

On Wednesday, Germany activated an emergency plan to brace for a potential cut to Russian gas supplies, with Austria following suit.

France was also preparing for potential shortages with the government likely to outline plans for possible gas rationing.

Putin demands roubles for gas

Mr Putin on Wednesday told German Chancellor Olaf Scholz that Moscow’s demand that Europe switch to paying for gas in roubles should not mean contracts would be on worse terms.

“The decision taken should not lead to worsening of contractual terms for European importer companies of Russian gas,” the Kremlin said in a statement summarising Mr Putin’s comments in a phone conversation with Mr Scholz.

Mr Putin said the payment method was needed because the Russian central bank’s currency reserves have been frozen by the European Union. The leaders agreed that experts from each country would hold discussions, the Kremlin said.

Speaking on behalf of the G7 energy ministers on Monday, Germany’s Robert Habeck said Russia’s request was a “unilateral and clear breach of the existing agreements”. Mr Habeck said payments in roubles were “unacceptable” and called on energy companies not to comply with Mr Putin’s demand.

The Kremlin said on Wednesday that Russia will not immediately require its natural gas buyers to pay in roubles.

“Payments and deliveries are a time-consuming process,” Kremlin spokesman Dmitry Peskov told reporters. “It’s not like … what will be delivered tomorrow, must be paid for by the evening.”

The Kremlin suggested it could extend the rouble payment measure to other exports.

“This is an area in which our government is also working,” Mr Peskov added.

But on Thursday, Mr Putin signed a decree ordering gas supplies to “unfriendly” states to be halted unless they switch payments to roubles from April 1. “To buy Russian gas, they need to open rouble accounts in Russian banks,” Mr Putin told officials in a televised speech, Bloomberg reported.

“It is from those accounts that gas will be paid for starting April 1. If such payments aren’t made, we will consider this a failure by the client to comply with its obligations.”

Russia, China hail new ‘world order’

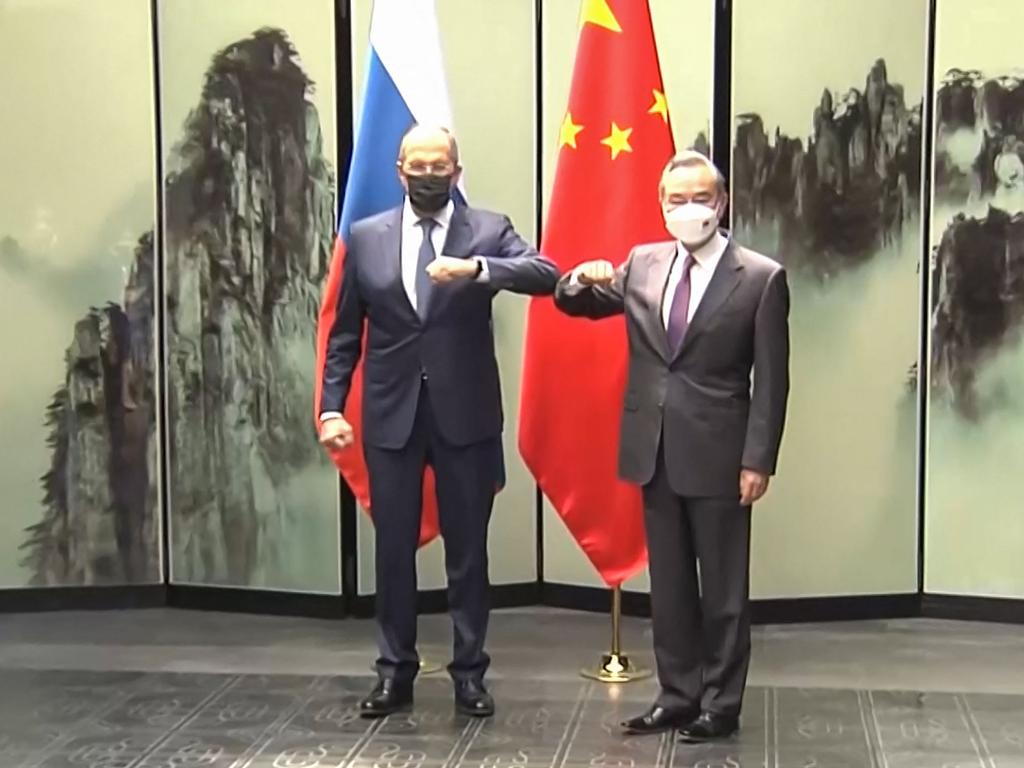

Meanwhile, Russia’s foreign minister Sergei Lavrov says there is a new “world order” emerging, as the country moves to shore up economic ties with China and India – which has to date abstained from UN resolutions sanctioning the invasion of Ukraine and continues to buy Russian oil and other goods.

Mr Lavrov will visit India for a two-day trip beginning on Thursday, amid reports New Delhi is working with Moscow on a rupee-rouble trade mechanism.

A team from Russia’s central bank is in India this week to discuss payment mechanisms, the Hindu Daily reported.

“When the highest god of the West, US President Joe Biden, has already said that India is shaky on Russia and we have ignored it already, why should we be worried about the way some in the West see this visit?” New Delhi-based Russia expert Nandan Unnikrishnan from the Observer Research Foundation told AFP.

“We should look at everything from the prism of our own national interests. The Western perspectives won’t determine our national interests.”

Mr Lavrov was due to arrive in India from China, which has also refused to condemn the invasion and has provided a level of diplomatic cover for an increasingly isolated Russia.

In a video released ahead of a meeting with Chinese Foreign Minister Wang Yi, Mr Lavrov said the world was “living through a very serious stage in the history of international relations”.

At the end of this reshaping of global relations “we, together with you, and with our sympathisers will move towards a multipolar, just, democratic world order”, Mr Lavrov said.

US dollar dominance ‘ending fast’

While crippling Western sanctions may have successfully dented Russia’s economy, some analysts warn that they may have also hastened the decline of the US dollar as the world’s reserve currency.

Earlier this month, The Wall Street Journal reported Saudi Arabia was in active talks with Beijing to price some of its oil sales to China in yuan, in what would be a devastating blow to “petrodollar” regime established in 1974.

One Chinese economy expert told Insider last week the yuan could eventually develop into a reputable global reserve currency, after Western sanctions freezing $US300 billion ($A400 billion) of Russia’s foreign exchange reserves underscored the risks of relying heavily on the dollar.

“Some countries feel their economies could be held hostage to US policies because the dollar is dominant, and countries want to diversify their risk,” said Baizhu Chen, professor of clinical finance and business economics at the University of Southern California.

In a note on Wednesday, Goldman Sachs said the dollar today faced many of the same challenges as the British pound in the early 20th century.

“A small share of global trade volumes relative to the currency’s dominance in international payments, a deteriorating net foreign asset position, and potentially adverse geopolitical developments,” the investment bank said.

“The bottom line is that whether the dollar retains its dominant reserve currency status depends, first and foremost, on the US’ own policies. Policies that allow unsustainable current account deficits to persist, lead to the accumulation of large external debts, and/or result in high US inflation, could contribute to substitution into other reserve currencies.”

Mr Bennett from ACY Securities said the sanctions had set off a “definite shift”.

“What it has done is highlight to all global citizens that diversification away from one currency could be a good way to go,” he said.

“We are going to see a greater diversification of currency within central bank portfolios, there’s no doubt about that. This is a kind of tipping point where in the next five, 10 years, trade will increasingly be done in more direct terms.”

He added, “The age of US dollar dominance is coming to an end and it’s coming to an end fast.”

– with AFP