Russia Ukraine: Economic shockwaves in Russia as US responds to invasion

Russia’s invasion of Ukraine has sent shockwaves through financial markets around the world as stock markets plunge.

The Russian stock market has plunged and the ruble has crashed to its lowest level ever after President Vladimir Putin ordered the invasion of Ukraine.

The military action has sent economic shockwaves around the world.

Global equities tumbled on Thursday and oil prices breached $100 for the first time in more than seven years.

Asian, European and US stock markets nosedived.

Yesterday the Australian share market plunged $73 billion. The ASX is set to open lower today, with futures down 3 per cent.

Follow our live coverage of the Russia-Ukraine conflict here

Frankfurt and Paris both shed as much as 5 percent during part of the trading session as investors fled risky equities.

Gold, a safe haven in troubled times, rose to over US$1923 an ounce.

More than $150 billion was wiped off the Russian stock market. The MOEX Russia Index fell off a cliff. It’s down about 50 per cent from its record high in October.

The market capitalisation of Russia’s largest bank Sberbank was almost cut in half.

Stream more finance news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 14 days free now >

Bloomberg journalist Tracy Alloway noted, “Russian assets are fast becoming untradeable.”

Meanwhile shares in Russian metal giants Polymetal and Evraz tanked by 38 percent and 30 percent respectively in London.

The cost of insuring Russian debt against default has also soared. The Bank of Russia said it plans to intervene in the foreign exchange market.

Yesterday the US, European Union and Australia imposed new economic sanctions on Russia.

Latvian Prime Minister Krisjanis Karins describing Russian President Vladimir Putin as “a deluded autocrat creating misery for millions”.

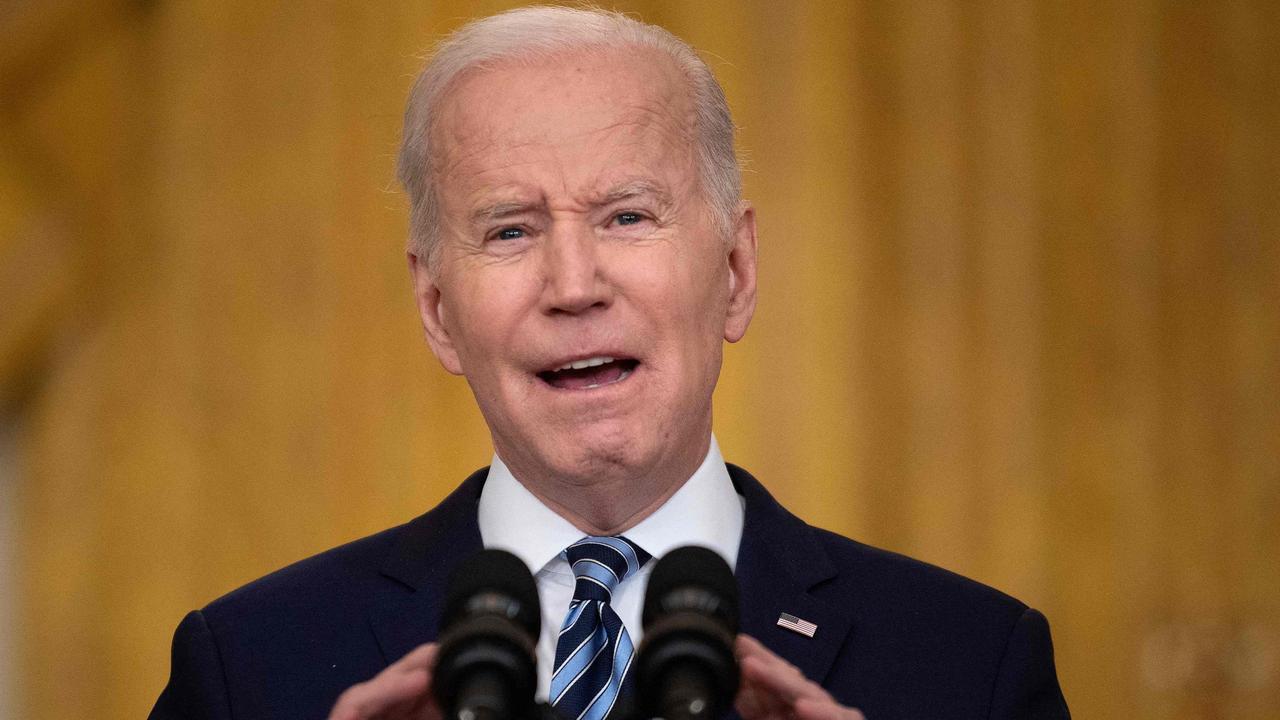

US President Joe Biden announced tough new sanctions this morning. But he didn’t pull the trigger on what some consider his most powerful economic weapon — cutting Russia off from SWIFT, which is used to facilitate financial transactions between banks worldwide.

Russian assets are fast becoming untradeable.https://t.co/lWofkyRE9Upic.twitter.com/qpE5vfkp6C

— Tracy Alloway (@tracyalloway) February 24, 2022

Oil price skyrockets

After weeks of warnings from the United States and other powers, Russian President Vladimir Putin ordered a wide-ranging offensive into its neighbour, sparking fury from world leaders and vows to ramp up sanctions on Moscow.

The price of oil has since rocketed.

European benchmark Brent prices briefly shot past $105 per barrel for the first time since 2014. Aluminium and wheat have surged to record peaks on fears over output from major exporter Russia.

Petrol prices in Australia are already high, pushing close to $2 a litre in many places — and they are set to rise higher.

“The latest twist in the Russia-Ukraine crisis is likely to keep commodity prices elevated over the coming weeks and months,” analysts at Capital Economics said.

“And if the situation spirals into a more serious and wide-ranging conflict between Russia and the West, commodity prices could rise further from here.”

Biden announces tough sanctions

Russia was hit with painful new sanctions this morning.

The measures target Russia’s two largest banks, which will have their assets frozen and will be cut off from US dollar transactions, while state energy giant Gazprom and other major companies will not be able to raise financing in Western markets.

“This is going to impose severe cost on the Russian economy, both immediately and over time,” US President Joe Biden said in an address at the White House.

I spoke with the G7 leaders today, and we are in full agreement:

— President Biden (@POTUS) February 24, 2022

We will limit Russia’s ability to be part of the global economy.

We will stunt their ability to finance and grow Russia’s military.

We will impair their ability to compete in a high-tech, 21st century economy.

However, the penalties fell short of what some observers were expecting, including failing to cut Russia off from SWIFT, the global messaging system used to move money around the world.

That would have hindered the country’s ability to profit from the global energy market, which operates largely in US dollars.

“It is always an option but right now that’s not the position that the rest of Europe wishes to take,” Mr Biden told reporters.

But he said “the sanctions we’ve imposed exceed SWIFT. The sanctions we imposed exceed anything that’s ever been done.”

And Mr Biden said penalties directly targeting Russian leader Vladimir Putin remain an option.

“It’s not a bluff, it’s on the table,” he said in response to a question.

Russia’s massive stockpile of cash

Moscow has taken steps to shield its economy after it was hit with sanctions starting in 2014 when it invaded and annexed Crimea in southern Ukraine, including stockpiling cash and gold.

Russia’s public debt amounts to just 18 percent of the country’s GDP, far lower than most major economies, and it has foreign reserves of $643 billion as of the end of last week, according to official data.

Elina Ribakova of the Institute of International Finance, a global banking association, told AFP that the stockpiling was “a very deliberate shift in macroeconomic policy to accommodate geopolitical ambitions.”

“They have a piggy bank that can protect them, and support the economy even if they go into deficit,” she said.

IIF Executive Vice President Clay Lowery said Russia would feel pain, and while some steps were omitted there was room to escalate.

“The bottom line is that these sanctions will have a significant impact on Russia’s overall economy, and average Russians will feel the cost,” Mr Lowery, a former senior US Treasury official, said in a statement.

The sanctions target Sberbank and VTB Bank, the country’s two largest accounting for about half the banking system and “$46 billion worth of foreign exchange transactions globally” every day, the Treasury said.

— with AFP