‘No guarantees’: Donald Trump’s massive risk revealed as recession fears explode

The Aussie PM and US President have taken radically different approaches in one key area - and both could spectacularly backfire.

ANALYSIS

Amid a news cycle dominated by US President Donald Trump and the upcoming Australian federal election, one can’t help but be struck by how different the approach of the Trump administration and the Albanese government is to their respective economies.

On one hand, the newly-minted US administration is attempting to rein in government spending and slash the size of the federal government workforce.

On the other, the Albanese government is talking up the benefits of increased levels of government spending and taxpayer-funded job creation.

DOGE and the Treasury

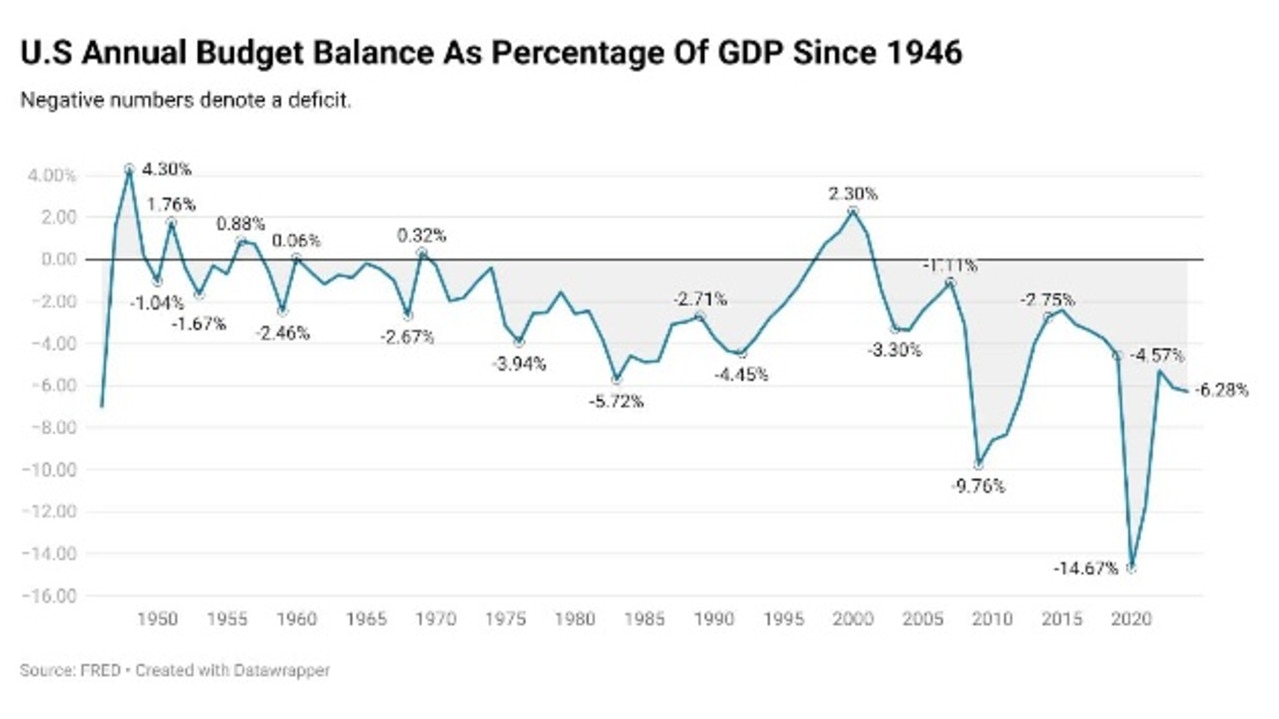

Between the push to cut government spending from the Elon Musk-headed Department Of Government Efficiency (DOGE) and the plans of new Treasury Secretary Scott Bessent to cut the budget deficit to 3 per cent of GDP by 2028, the Trump administration has taken a very different approach to government spending than its predecessors, at least in terms of its rhetoric.

During the last year of the Biden administration, the deficit amounted to 6.3 per cent of GDP, larger than any recorded in the past century outside of World War 2 or a major crisis (such as the Global Financial Crisis and Covid-19 pandemic) and the aftermath.

Given the headwinds tariffs and the reduction of a near-record peacetime deficit will bring to the US economy, there are growing concerns that this could result in an American recession, which would have implications for the broader global economy.

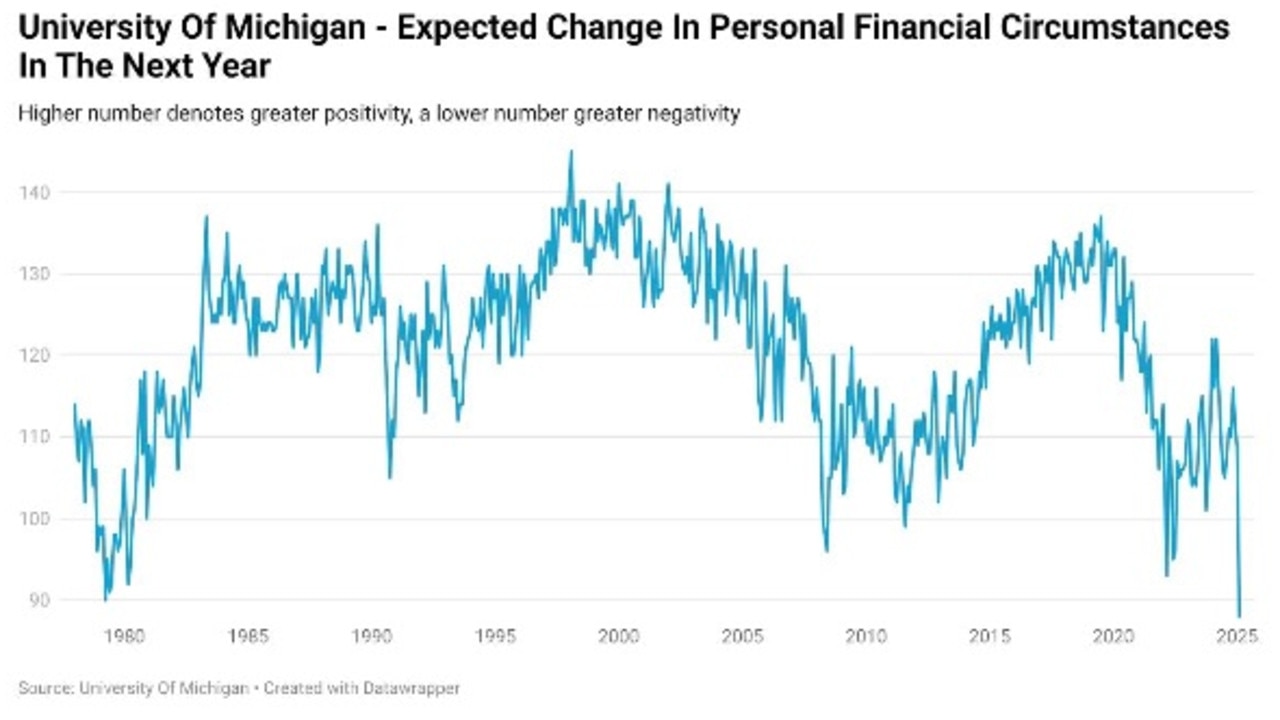

President Trump’s rhetoric and policies have also resulted in a significant hit to US consumer sentiment.

According to figures from the University of Michigan, more Americans are expecting a deterioration in their personal financial situation over the next year than at any other time since records began in the late-1970s.

Considering this encompasses a period in 1979 and 1980 where oil prices rose to 166 per cent above the previous all-time high, which is today the equivalent of a barrel of oil reaching $533 per barrel ($US336), it’s perhaps safe to say this could have an impact on the consumer spending of households.

Trump administration Treasury Secretary Scott Bessent also has a very different perspective to the Albanese government.

In a recent interview, Mr Bessent stated that the US needs to be weaned off what he called “massive government spending” and that there were “no guarantees” that the US economy would avoid recession.

Government is good

While the budget razor gang is well and truly busy on one side of the Pacific, on our side of the world’s largest ocean, the Albanese government is taking a very different approach to the role of government on the economy.

According to analysis from the Sydney Morning Herald’s Shane Wright, if not for the expansion of government spending in the first and second quarters of 2024, there would have been a recession.

Despite the at times controversial nature of government spending in Australian federal politics, Treasurer Jim Chalmers has repeatedly defended higher levels of government spending.

Former Opposition leader and National Disability Insurance Scheme (NDIS) Minister Bill Shorten took that school of thought several steps further in his final major interview before retiring from politics.

Mr Shorten made the case that the NDIS was the “unsung hero” of “employment growth”, adding that more than half a million Australian workers make an income from the $49 billion scheme.

“The NDIS employs more people directly than the mining industry,” Mr Shorten said.

“It is an unsung hero of low unemployment and employment growth over the last decade since its creation.”

By the numbers

Whether or not the extensive growth in the size of the NDIS is welcome is a matter of ongoing debate between economists and policymakers alike, but Mr Shorten is absolutely correct that government-funded employment has become a huge element in the nation’s labour market.

It’s here an important distinction needs to be made.

Federal governments from both sides of the parliamentary aisle generally like to focus on the division of employment from the perspective of public versus private.

But what this overlooks is the growing number of jobs in industries where employment is generally overwhelmingly funded by government, even though the individual employees may not be directly employed by government authorities.

The Australian Bureau of Statistics makes a distinction between market and non-market jobs. Non-market jobs are those in public administration and safety, education and training, and healthcare and social assistance, with market-based jobs representing those in all other industries.

Since the June quarter of 2022, the nation’s economy has created 402,300 market-based jobs, with a further 760,900 created in non-market based roles.

However, this result somewhat masks the weakness seen in market-based job creation since the halfway point of the government’s tenure so far in the September quarter of 2023.

Since that point in time, 86,500 market-based jobs have been created.

The balance

How one views the approach of the Trump administration and the Albanese government to economic governance is very much in the eye of the beholder and it has been at the core of the ideological debate among policymakers for over a century.

It’s likely to be quite some time before we know which approach was the superior one.

Both have very different long term and short term impacts.

The underlying theory of the Trump approach is that a return to broad based prosperity in the long term has short term costs and that the administration is willing to take that sizeable risk.

Meanwhile, the Albanese government’s approach is that economic downside is to be avoided using the resources of Treasury coffers, despite the longer-term cost of committing to additional spending and the expenditure of finite resources.

The basic premise of both approaches has been used in the past and history has seen both fail – quite badly at times.

Ultimately, which strategy will prove to be the superior one will be a matter for the history books – and if the path so far is any guide, one that will remain hotly contested for decades to come.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator