Is it time to start panicking about China?

CHINA has just achieved something remarkable, but there are signs the golden run is about to end. Australia will feel the consequences.

THE Chinese economy is like a cricketer who’s scored a triple century. They’ve done an incredible job and they’re still out there batting, but the odds suggest it can’t go on much longer.

37+ years of growth is a record akin to Brian Lara’s 375 against England in 1993-94. Everyone knows the knock can’t last forever.

In the last few years and months we’ve seen China look wobbly for the first time in ages.

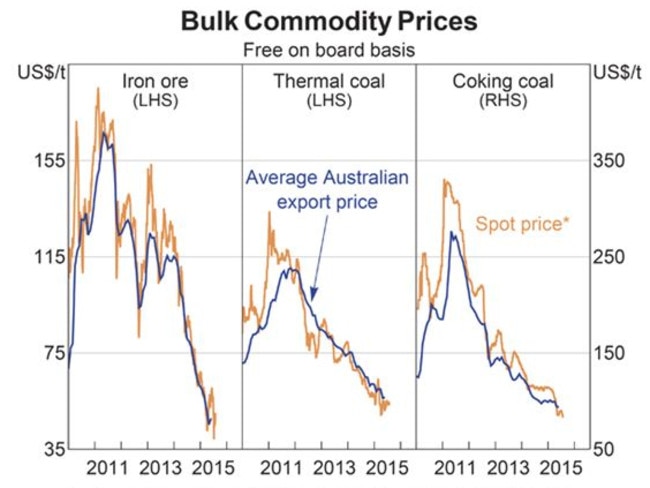

First, its demand for commodities dropped off causing prices to drop.

Then its housing market went from a roar to a whimper.

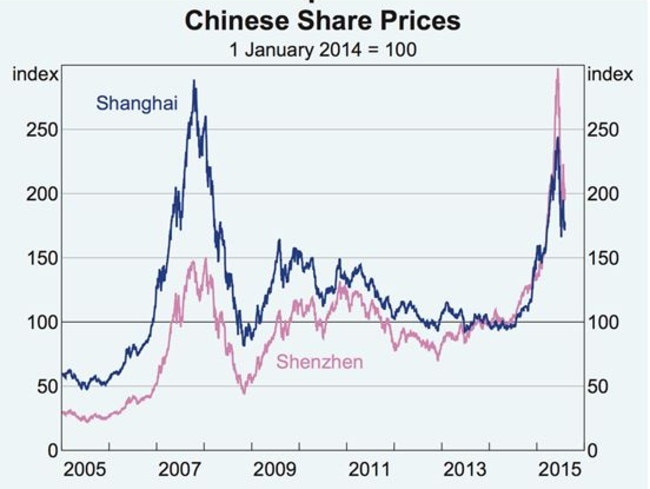

Then, its stock market shot up and immediately crashed again.

And on Wednesday, the Chinese yuan was suddenly devalued. That caused major drama on global markets.

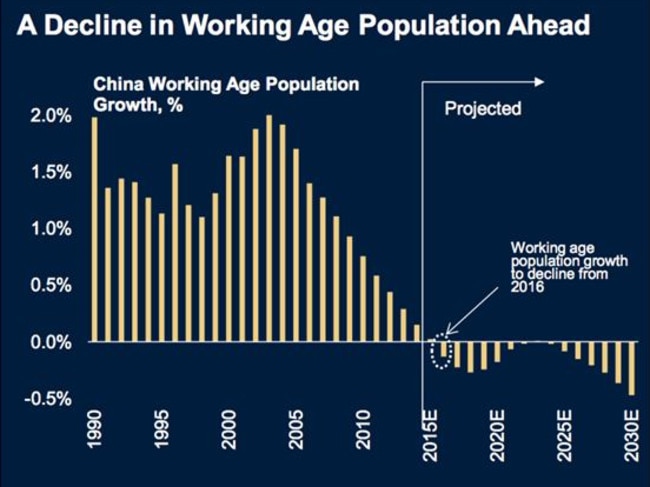

That’s just the short-term problems. China’s economy is facing serious long-term demographic problems that are coming to a head right now as well.

For years it had spare workers that could move to cities and take jobs in factories. Now the one-child policy is starting to bite. The Chinese workforce is shrinking at the exact moment its demographic bulge starts to retire.

That’s the cricket equivalent of missing a few balls with wild swings then getting your stumps knocked over.

All of this is very, very important to Australia. Whether or not we should start panicking is another question though.

There are several threads in this argument. Several moving parts.

To understand the effect of China’s economy on Australia you actually need more than just a cricket analogy. Sorry.

But it is worth trying to understand. Because reading the future correctly could be the difference between being rich and poor.

If China’s economy evolves in one way and you go the other, you could be worse off. But if you pay close attention and anticipate things correctly, China’s evolution could help make you rich.

These are the key things to watch:

1. If China’s share market keeps crashing, that could actually cause Chinese money to flow out of China and into Australian shares, keeping prices high.

Alternatively, if China’s shadow banking sector has made too many margin loans, Chinese share market drama could cause a global financial contagion that leads to a credit crunch, forcing debt-funded entities to go broke worldwide and making the GFC look like a teddy-bear’s picnic.

2. If China’s economy goes belly-up, a lot of people that might otherwise have been in China or Hong Kong for work might come back to Australia. That could prop up property prices too.

Alternatively, the Chinese student population that’s already in Australian property could head home and that could see property prices slip off a precipice.

3. If China devalues its currency, it might make Australia’s raw materials exports to China more expensive and less desirable; or it might make Chinese exports to the world more affordable and so increase demand for our raw materials.

4. Even bigger issues could be in the pipeline if growth in China stalls and the Chinese people decide that’s all the authoritarian communism they’ve got time for. That’s a real x-factor to be aware of, especially with the rise of online activism in China.

Figuring out which way the ball is swinging is about watching carefully. If you bet on the innings ending too soon, you might miss out. But if you bet on it going forever, you might get burnt.

The only way to play is to keep your eye on the ball.

Jason Murphy is an economist. He publishes the blog Thomas The Think Engine. Follow him on Twitter @jasemurphy.