Russians stash crypto as noose tightens on billionaire oligarchs

Russia sparked a jump in cryptocurrency this week as sanctions strangle their incomes. But there’s one flaw in it becoming a complete exit strategy.

ANALYSIS

Life is about to get harder for billionaire Russian oligarchs.

It was pretty easy to stash their cash away in the past. Simply buy a London football club and a super yacht, then settle down in Mayfair. Recent events are changing that playbook.

Chelsea FC owner Roman Abramovich tried to move his ownership of the club under the “stewardship and care” of a charitable foundation to protect his asset from sanctions but only days later it’s up for sale.

The US and their allies have only just begun their crackdown on Russian assets and its banking network. This will make moving money around the world increasingly difficult, particularly for super wealthy Russians who live outside of the Russian Federation.

Enter cryptocurrency.

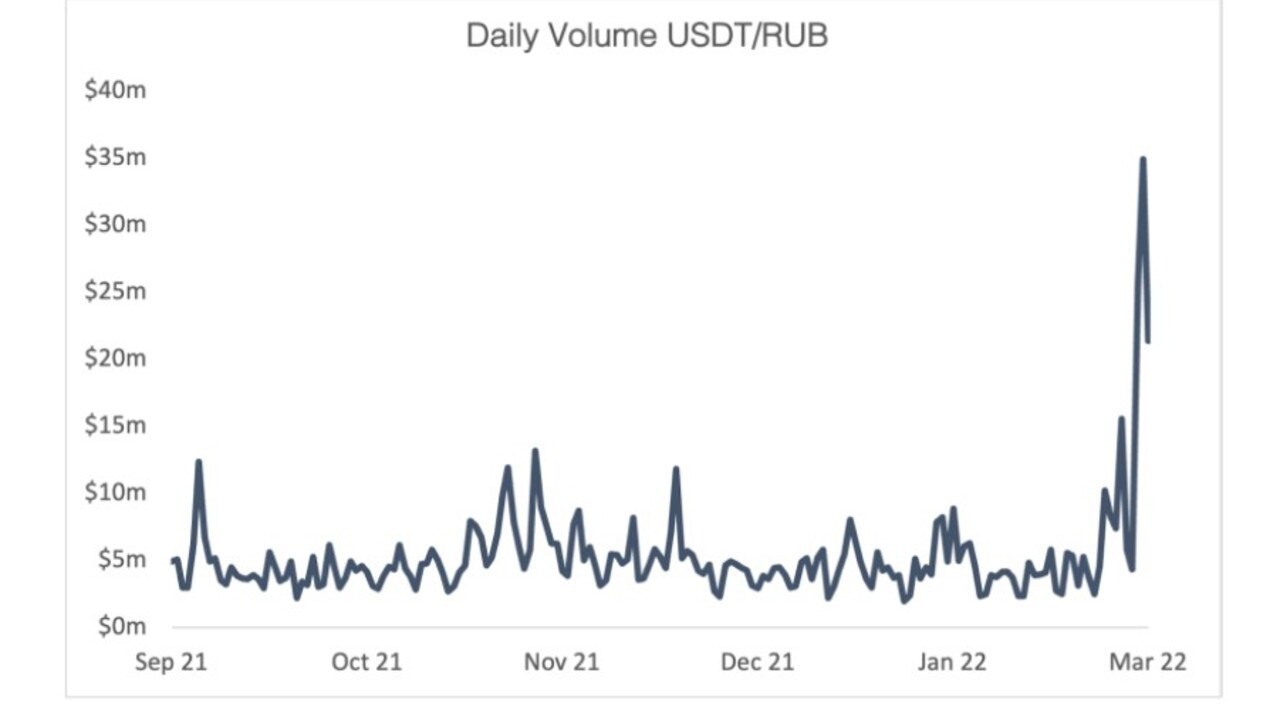

It’s hard to hide a football club under the rug, but much less hard to hide digital assets. Volumes entering bitcoin and US dollar stablecoins (the cryptocurrency version of a US dollar) were spiking this week on both sides of the conflict. Russians are clearly looking to skirt sanctions, as well as the collapse of the Rouble.

Trading volumes between the Russian ruble and bitcoin has jumped to a nine-month high.

The volume of ruble-denominated bitcoin surged to nearly 1.5 billion RUB on Thursday, Coindesk reported.

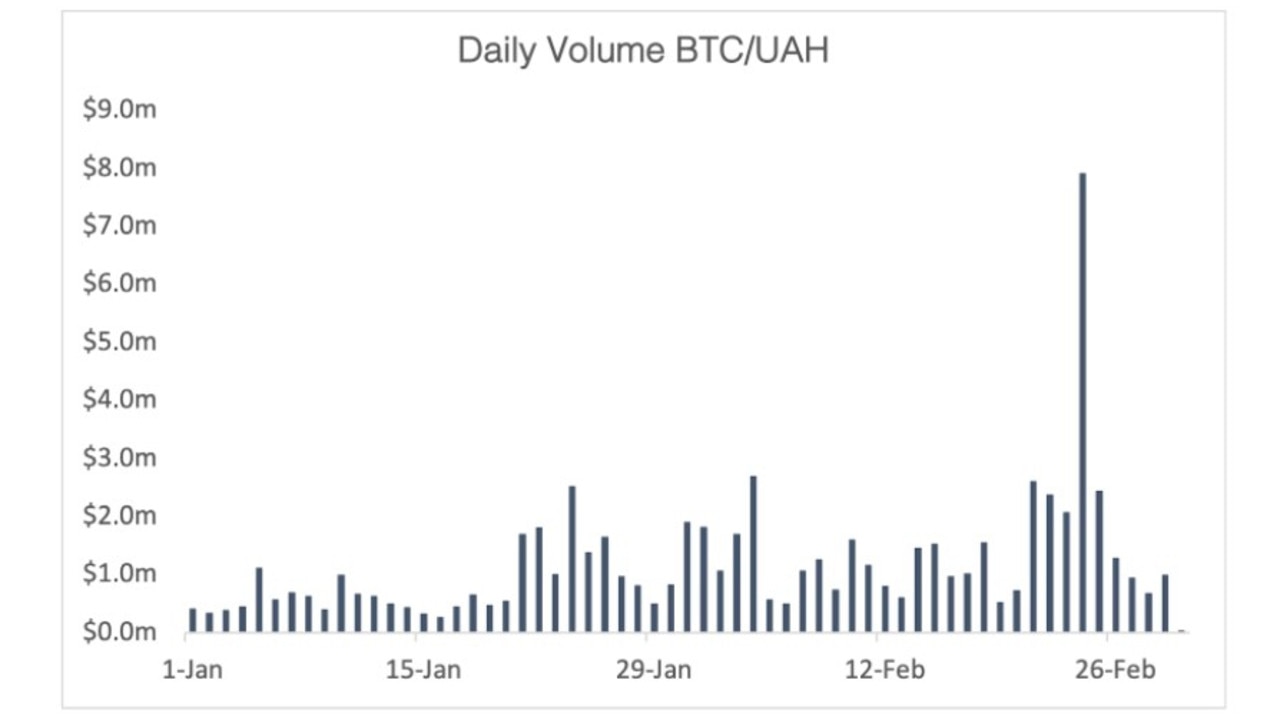

It’s not just Russia, though. Ukrainians are buying cryptocurrency in record amounts too.

It makes sense; war is not good for local currency values and gold is hard to keep safe as bombs start falling and people migrate. The cold reality of war means you cannot carry your valuables around with you if you are forced to leave your home.

There is a real case for wealth protection in crypto and Ukrainians concerned about the next few months are moving their assets across.

Is crypto Putin’s Saviour?

Is it possible that cryptocurrency could save Putin from sanctions? The answer is no.

Russian exports in oil alone total around 5 million barrels, worth $0.5 billion, per day. While the crypto market could easily cope with that volume, it’s highly unlikely that Russia’s customers are sitting on cryptocurrency at that scale.

What’s more, the infrastructure for settling oil contracts in cryptocurrency doesn’t exist. That’s not to say it won’t be built, but it will take years, not months.

Which oil buyer could confidently send bitcoin to Moscow at the moment in the hope that the oil tanker turns up on time? Once you hit send on bitcoin, there is no going back. You can’t trace the transaction like you can on SWIFT, so it would be a hit and hope. That’s fine for $5 but you might think twice for $500 million.

Cracking down on Russian buying of cryptocurrency might not even help. It is buyers of the oil that need the crypto, the Russians are simply on the receiving end. So, to the extent there are buyers willing to evade sanctions, they will be able to trade.

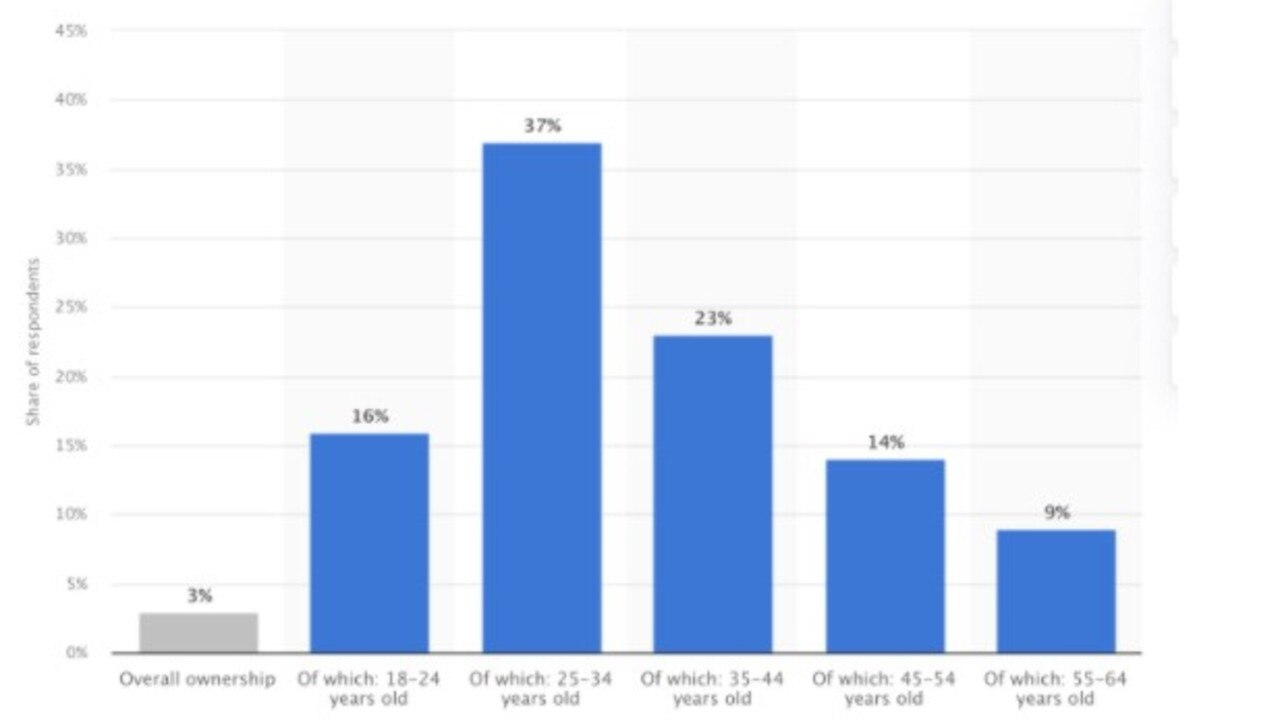

Crypto adoption in Russia

Across Russia as a whole cryptocurrency ownership is quite low. Only 37 per cent of 25-35 years olds own some cryptocurrency and every other group is lower. It certainly isn’t sufficient to run an economy or service the missing imports that will result from sanctions.

There is also a significant difference between “owning some crypto” and having sufficient access to digital assets to run your life.

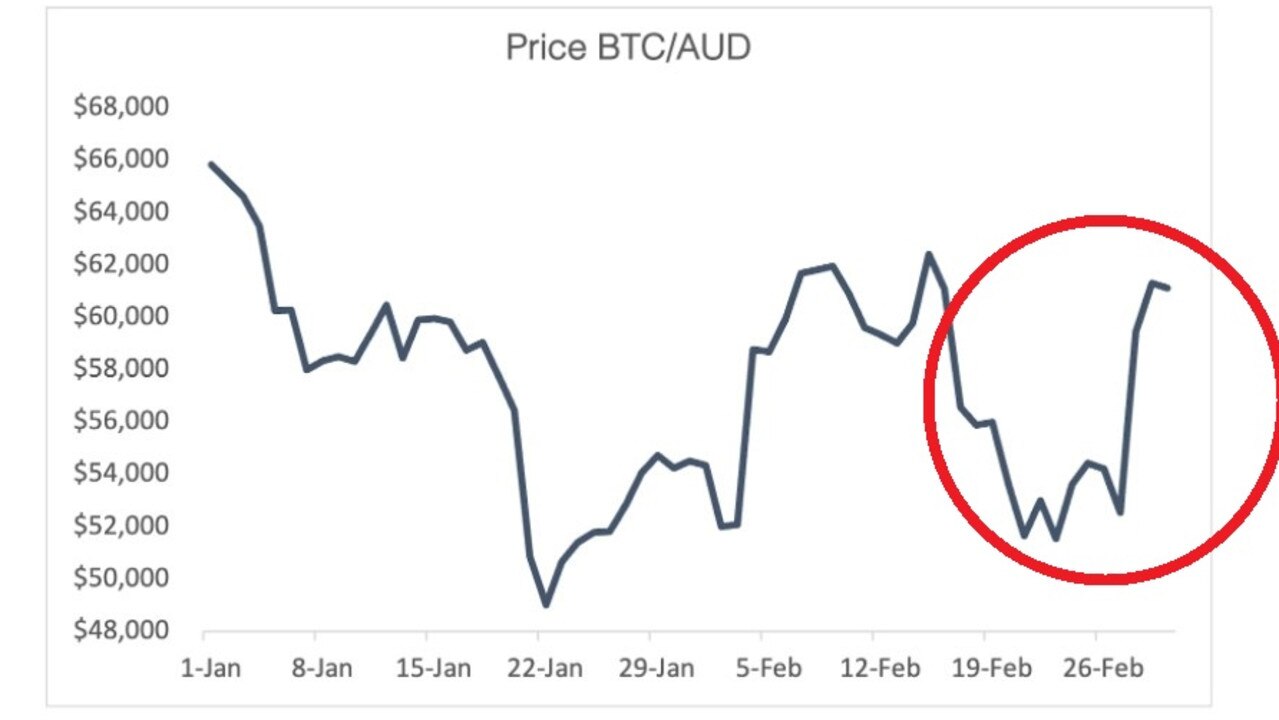

In fact, this week’s crypto-trade numbers in Russia were tiny when you consider the reach of sanctions, but it has been enough to alert politicians on both sides of the Atlantic who are now calling for action. That might blunt the recent bitcoin price surge.

The White House also chimed in with requests for help from American exchanges to ensure that cryptocurrency is not being used to evade sanctions. The prospects here are rather alarming because crypto has inadvertently wandered into a geopolitical crisis and the outcome, at least in the short term, might be quite unpleasant. Particularly for US-based exchanges.

The longer term case is being made on both sides of the war though. People want to control their own wealth. Both the oppressed and the oppressor find digital currency useful. Like it or not, if something is useful, everyone will want to use it. Even people we might not like.

We can see the impact on the bitcoin price this week which has surged. The market is speaking and government’s won’t like it, as we will very shortly find out.

Daniel Pickering is the Chief Investment Officer of ListedReserve, an investment management business based in Sydney specialising in digital assets and cryptocurrencies. ListedReserve runs regular webinars for wholesale clients on investing in digital assets. You can find more details on the website ListedReserve.com and register for their weekly update here.