Greek Prime Minister Alexis Tsipras and his government ‘ready to quit’ if they lose vote

GREECE’S left wing government says it may resign if it loses a make-or-break referendum that could decide if the country leaves the eurozone.

GREECE’S radical left government suggests it could resign if it fails to get its way in a make-or-break referendum that could decide the country’s financial future.

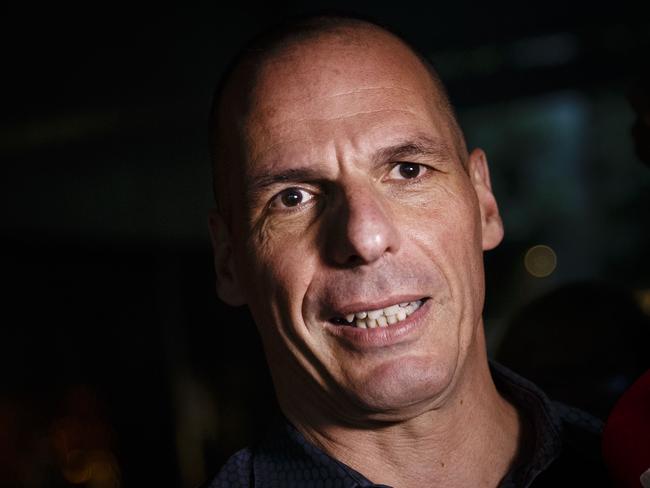

Greek Finance Minister Yanis Varoufakis said in a radio interview on Thursday the government “may very well” quit.

He also said: “We are on a war footing” to ensure the rushed referendum on Sunday happens in time.

But exasperated EU leaders warned the eurozone would be plunged into “unknown” territory unless a ‘Yes’ vote prevailed.

Q&A — What the Greek crisis means for Australia

International creditors and markets are stepping back after days of dizzying drama over the Greek crisis to watch the outcome of the consultation at the weekend.

Ordinary Greeks, though, are left in financial limbo under capital controls imposed all this week to stem a bank run.

Although Athens insists the referendum is narrowly on tough austerity conditions attached to a bailout that expired on Tuesday, EU leaders say it is a vote on whether Greece wants to remain in the euro.

The Greek government led by Prime Minister Alexis Tsipras is fiercely campaigning for a “no” vote, believing rejecting the bailout conditions would strengthen its hand in negotiations with creditors.

EU leaders, including those of Greece’s biggest creditors Germany, France and Italy, have all said they would view a ‘No’ result in the referendum as a rejection of Europe. It would send the eurozone “into the unknown,” French President Francois Hollande said on an African visit.

Greece has no way to print own money

With speculation swirling that Greece might be forced out of the euro and have to print its own money after a weekend referendum, Mr Varoufakis said the country no longer has the presses to make drachmas, its currency before it converted to the euro.

“We don’t have the capacity,” Mr Varoufakis told ABC on Thursday.

In 2000, the year before Greece joined the eurozone, “one of the things we had to do was get rid of all our printing presses” as part of the bloc’s assertion that “this monetary union is irreversible”, he said.

“We smashed the printing presses - we have no printing presses,” he said.

Referendum a close call

If the “yes” wins, Varoufakis told ABC, the government could hand over to a caretaker administration.

“Yes, we may very well do that. But we will do this in the spirit of co-operation with whoever takes over from us,” he said.

A survey published in the Greek press on Wednesday said 46 per cent of voters intended to vote no, down from the 57 per cent recorded just days earlier before the banking restrictions.

“I’m going to vote yes because we’re more secure in Europe.... I blame Tsipras for this crisis, and certainly hope he steps down if the yes vote wins,” said Marin Bouboura, a 38-year-old former banker who lost her job in the crisis and now works as a secretary.

Elizabeth Markos, a philosophy student, said she was “definitely voting no”.

She added: “All the creditors care about is getting the money back, they are suffocating us. If we don’t free ourselves it will be the pensioners, the poor, the students who pay, and there will be no future for Greece.”

Opposition move to block vote

Meanwhile, a legal attempt has been made block the referendum.

Greece’s top administrative court, the Council of State, is set to rule on the legality of the government’s rushed bailout referendum.

A petition was presented on Wednesday by two individuals, one of whom is a former Council of State judge who is reported by Greek media to have ties to the centre-right New Democracy, who are campaigning for a ‘Yes’ vote in Sunday’s referendum.

The claim calls on the court to cancel the plebiscite on the grounds it violates the constitution by posing a question regarding “public finances”.

Greece needs 50 billion euros: report

According to the International Monetary Fund (IMF) Greece needs at least 50 billion more euros ($72.30 billion), including 36 billion euros from EU lenders, to stabilise its finances even under existing creditor plans.

In a new report on Greece’s financing needs published on Thursday, the IMF also cut the country’s economic growth prospects for this year to zero per cent from 2.5 per cent previously forecast, in estimates that do not include the impact of this week’s banking shutdown and capital controls.

‘We’re exhausted by Greek drama’

If a ‘yes’ vote did force the current Greek government out of office it would bolster EU partners who say they are exasperated with what they see as the erratic behaviour of the current Greek government.

“We’re exhausted,” said one of the 18 eurozone finance ministers who had been negotiating bailout terms with Greece before its sudden referendum announcement last Friday.

“We tried right to the end to find a collective solution,” said the minister, who asked not be identified.

He added that a letter Tsipras sent on Tuesday offering concessions towards what the creditors had been demanding in return for a new bailout opened a “possible” path to agreement - but that was trashed when the Greek prime minister within hours gave a television speech urging his citizens to reject those conditions by voting no.

The chief of the European parliament, Martin Schulz, told the German newspaper Passauer Neue Presse that Greece’s negotiating strategy was “very frustrating and disappointing, but especially dramatic for the Greek people”.

Tsipras’s changing tack so often “is really tiring and a lot of people have had enough”, he said.

The rest of the European Union is relieved to see the Greek crisis has had relatively little impact on the markets, suggesting any contagion from a possible Greek exit from the eurozone - a Grexit - is contained, so far at least.

Q&A — What the Greek crisis means for Australia

Are we going to see another GFC?

That doesn’t appear at all likely at this stage. While there are concerns about a domino-effect — in which the fall of Greece topples other economies such as those of Portugal and Spain — movements in bond markets indicate investors are far from panicked. For now. The broader banking system is much less exposed to this threat than it was to the dodgy deals that triggered the GFC. Investment bank JP Morgan has estimated European banks’ exposures to Greece is now just €5 billion ($7.2 billion) of total balance sheet value of €32 trillion.

Is my superannuation at risk?

Super funds set to “balanced” lost about 2 per cent in June, mainly due to share market falls caused by concerns about Greece. But if you look at 2014-15 overall, a typical fund still gained nearly 10 per cent. Greece’s debts are not a new problem. They emerged in 2009. According to super fund analysts Chant West, since then we’ve had six straight years of positive returns, adding up to about 73 per cent growth. Try to look past day-to-day movements on the markets. You wouldn’t do it for your house. Why do it for your super?

What will happen to interest rates?

Futures markets suggest there’s not much chance of a rate cut, whether it be next week, next month or next year. If the souvlaki does hit the fan, the RBA has scope to reduce the official interest rate to stimulate the economy. We are one of the few significant developed economies with a cash rate that isn’t set to barely above zero. If financial strife was to prompt the RBA into action, it shouldn’t be assumed that borrowers would be winners and savers, losers. If banks were struggling for wholesale funds they may have to offer more attractive rates to those with cash to deposit. And banks may not pass on to mortgagors RBA cuts in full.

Will a holiday in the Greek islands become cheap?

If Greece has to revive the world’s oldest currency, the drachma, then you may want to set your sights on Santorini. Not only would you have a good time for less, you’d be helping the Greek economy. However, it’s worth keeping in mind that there is the potential that levels of crime would increase if the economy totally collapsed.