China’s desperate 19-point plan revealed as economy seriously weakens

Chinese leaders have unveiled a multibillion-dollar plan to rescue the world’s second-biggest economy as it reels from crisis after crisis.

China has been battered by crisis after crisis in recent months, and an ambitious new plan has revealed just how dire the nation’s economic woes have become.

On Wednesday, Chinese media reported that the State Council had unveiled a new, 19-point plan designed to stabilise the economy after it suffered repeated hits from the Covid pandemic and subsequent lockdowns and the nation’s ongoing real estate crunch.

Adding to the growing problem is the record heatwave gripping the country, which has led to scores of factories in Sichuan being shut down in a desperate bid to protect power supplies – a major blow given the province is a major hub for lithium mining, solar panel production and semiconductors with a slew of household-name companies, including Apple and Tesla, already impacted.

Already, Sichuan fertiliser producer Lutianhua has predicted a $US4.4 million ($A6.3 million) reduction in net profit as a result of the shutdown, according to a notice on the Shenzhen Stock Exchange, while China’s National Bureau of Statistics spokesman Fu Linghui acknowledged in a press conference that the heatwave had already led to “adverse effects on economic operations”.

China’s desperate plan

Under the new plan, which was decided upon at the State Council executive meeting chaired by Premier Li Keqiang on August 24, a quota of more than 300 billion yuan ($A63 billion) has been earmarked for ”policy-backed and development-oriented financial instruments”.

Local governments have also been urged to use the special-purpose bond quota worth more than 500 billion yuan ($A105 billion) by the end of October, while a string of infrastructure projects will also be approved and launched.

In addition, “measures will be introduced to support the development and investment of private businesses and advance the sound and sustained development of the platform economy”, and local governments will be allowed to roll out city-specific policies, such as flexible credit loans to “meet people’s basic housing needs and the need for improved housing conditions”.

Payments of government charges will be put on hold for a quarter, and measures will also be taken to support electricity producers and agriculture.

The government noted that “swift and decisive steps” would be taken “to further strengthen the foundation of economic recovery and growth, without resorting to massive stimulus or compromising longer-term interests”.

“Given the current circumstances, we must seize the window of opportunity and maintain the appropriate policy scale. The funds available should be put to best use. This will expand effective investment, boost consumption and help keep economic activities on a steady course,” Premier Li said.

“We should expedite the delivery of policy measures. The central government will provide facilitation, and sub-national authorities be tasked with policy implementation.”

Thomas Westwater, analyst for Daily FX and IG, said: “It appears that China is prepared to offer more economic support.

“The Chinese government’s plan is a 19-prong approach, including bolstering financing tools by 300 billion yuan [$A63 billion], among other measures,” he said.

“That was reported by state media on Wednesday. China’s CSI-300 fell nearly 2 per cent.

“The renewed commitment to providing support is encouraging but China’s outlook remains clouded by sporadic Covid lockdowns and now, a power crunch amid high mercury readings.”

It comes as Chinese homeowners continue to take part in unprecedented mortgage boycotts as the property industry reels.

This month, China recorded its 12th consecutive month of plummeting property sales, as cash-strapped developers struggle to complete projects.

The country’s economic growth was just 0.4 per cent year-on-year in the second quarter – its slowest rate since the initial Covid outbreak.

So far, more than 20 major developers have defaulted on their debts in the past year alone, with S&P Global Ratings warning around 20 per cent of Chinese developers are now at risk of becoming insolvent.

As a result of the escalating crisis, hundreds of thousands of citizens have banded together and refused to make their home loan repayments on delayed housing projects, given that in China, it is common that mortgage payments are made before new properties are completed.

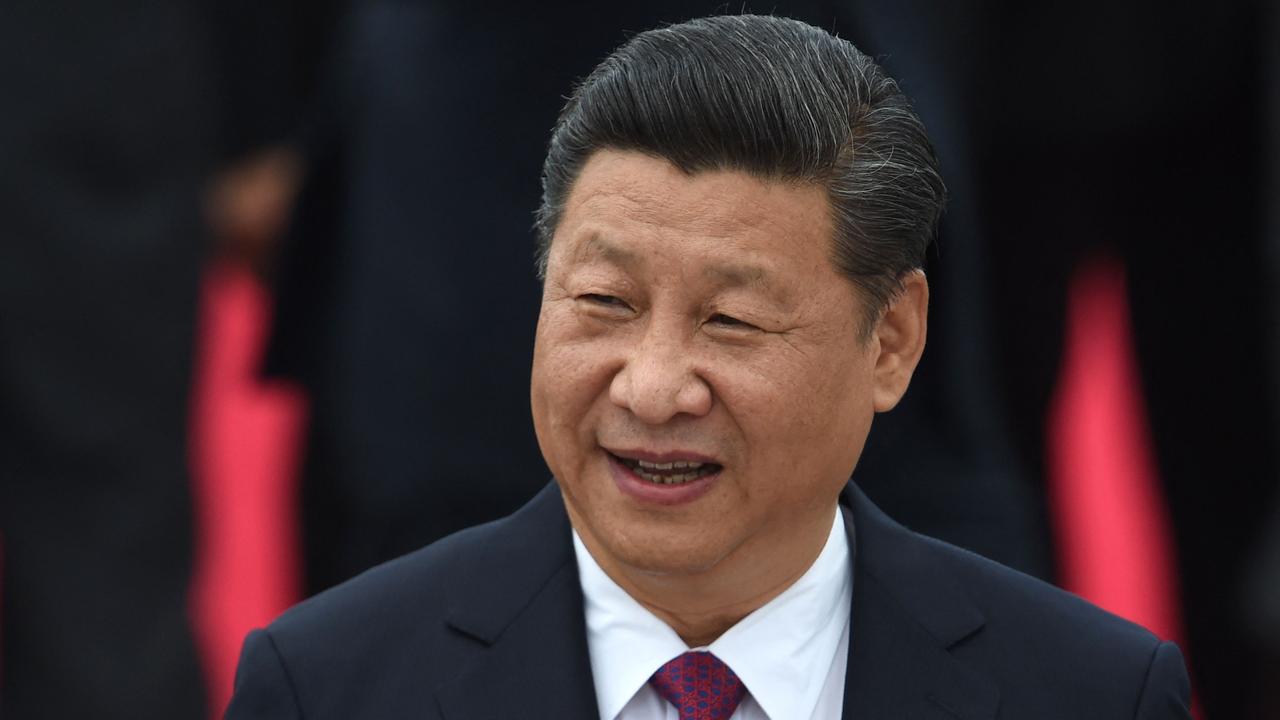

These mortgage boycotts have been held across dozens of cities in an incredible show of defiance to President Xi Jinping’s strict Chinese Communist Party regime, which often responds harshly to any form of dissent.

Recent research from ANZ estimated the boycotts could impact about 1.5 trillion yuan ($A300 billion) of mortgage loans.

– with Ally Foster