The great Australian dream has changed

EXCLUSIVE new research has revealed the real reason gen Y aren’t buying property. The great Australian dream has changed.

KOBI Rogers doesn’t dream of owning her own home. Like many of her generation she’d rather spend the equivalent savings of a house deposit travelling the world.

The 25-year-old has spent about $80,000 in five years on life adventures in Hawaii, Japan and Canada as she works to live and enjoy greater opportunities, rather than join the indebted treadmill of the Australian property market.

“I don’t really value assets over experience at this stage in my life. I love being a free spirit travelling around the world in the search of the next big adventure,” says Kobi.

“One day I may buy a house but for now I am having way to much fun changing locations every six months.”

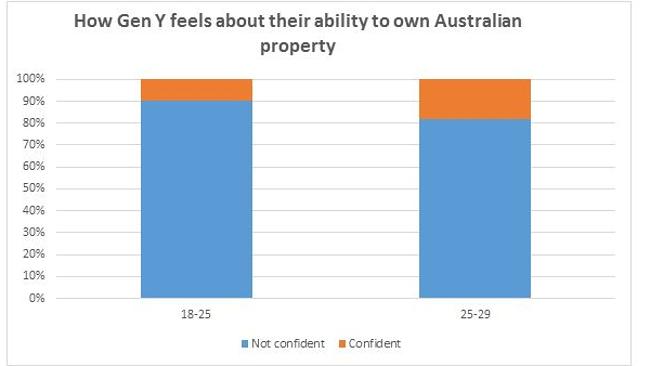

The disinterest in the great Australian dream of home ownership comes as a new survey commissioned by consulting firm Urbis, seen exclusively by news.com.au, found that only 10 per cent of people under the age of 25 years think they’ll actually own their own home in the future. Compared to 90 per cent of people who doubted whether it would be possible.

The results get slightly better for 25-29 year olds with 18 per cent of respondents saying home ownership was highly likely.

The survey of 1000 people adds weight to the view among some economists that the changing attitudes of younger Australians towards property ownership could exacerbate the price falls currently underway in the property market.

“With more housing supply coming on and a softening of lack of affordability, there is already downward pressure on property prices, and if there’s less interest from younger Australians, that will only add to the correction,” said Urbis chief economist Nicki Hutley.

Emma Smith is another gen Y’er who’s actually fallen out of love with the dream of buying property despite being fortunate enough to have a small deposit already.

“Even with some inheritance from grandparents, once you add up all the costs, it’s just very uninspiring,” said the 26-year-old human resources professional from Sydney.

“Everyone says, just get your foot in the door, or go out west of Sydney to buy. But I would rather buy in an area place where I actually want to live.”

The size of a deposit could be one factor affecting the attitudes of younger generations.

If you’re a first homebuyer in Sydney where the median house price is around $1 million, the loan to valuation ratio (LVR) that you’re likely to get from the bank is 80 per cent, which means you’d need about $200,000 as a deposit, and that’s without paying stamp duty.

“All of a sudden the affordability and attitudes to home ownership are different to what they have been in the past,” she said, adding that the survey also confirms that the average age of home buyers is over 38 years.

“Generation Y have greater access to travel the world, and they don’t feel as constrained to stay in a job,” said Hutley.

“That means, the decisions that are being made on home ownership are based on different parameters than that of their parents.”

Bianca Hartge-Hazelman is the founder of women and money website Financy.com.au.