Interest rate rise will bring on pain

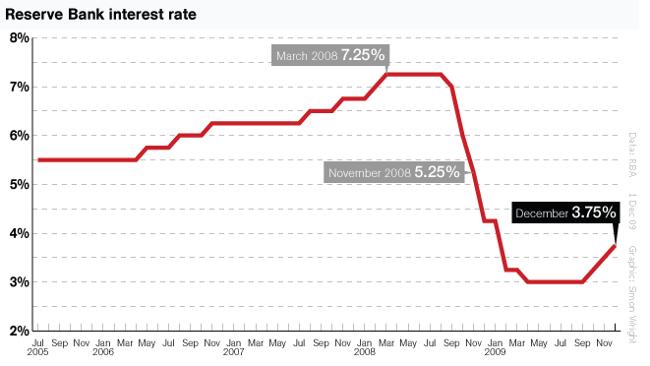

ECONOMISTS expect the Reserve Bank board to order its fourth consecutive rate rise today.

FAMILIES face yet another interest rates rise - and three of the big banks are keeping customers guessing over how much they will pass on.

Pundits are tipping a 0.25 per cent rate rise today when the Reserve Bank board meets for the first time this year.

It would be the RBA's fourth consecutive rate rise, pushing average monthly repayments up by almost $50.

The move would place an estimated 26,000 households under "severe mortgage stress", according to a key report.

Westpac, ANZ and the Commonwealth Bank yesterday refused to follow the lead of the NAB, which has pledged not to pass on a higher rise than the RBA.

Westpac hit customers with a 0.45 per cent pre-Christmas hike - 0.20 per cent above the official adjustment.

Yesterday, the bank said it never commented on likely rates movements ahead of RBA board meetings.

The ANZ and Commonwealth also declined to reassure customers.

Treasurer Wayne Swan refused to speculate about today's RBA meeting, but said over-the-top rate rises last year had dented customer confidence in the banks.

"That was totally unjustified, and the community backlash against those banks has been substantial, and I certainly hope they heed the warning," he told ABC Radio.

The NAB's weekend guarantee was highly unusual, and widely welcomed by consumers.

Analysts say it would be suicide for a bank to repeat Westpac's profit-grab in the current environment.

But at the very least, they will pass on any rise to customers in full, beginning a year of pain that is likely to see interest rates jump by 1 per cent.

A report by Fujitsu Consulting estimates there are 377,960 Australian households under mild mortgage stress -- defined as able to make loans repayments but having to cut back on spending or dangerously increase credit card use.

If a 0.25 per cent hike is delivered today, the firm estimates 26,000 of those households will be reclassified as being under severe mortgage stress.

They will join an estimated 199,000 families already struggling to make their repayments.