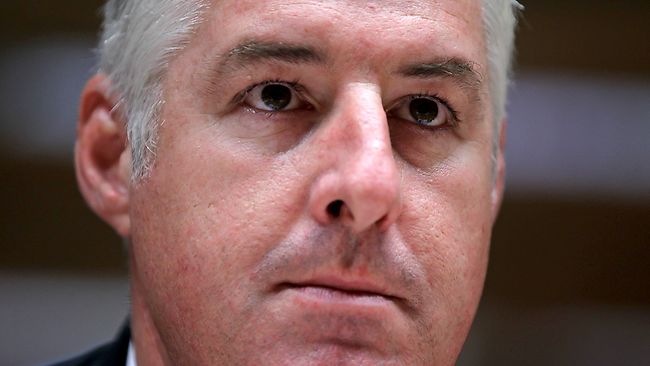

NAB chief Cameron Clyne calls for banks to shift rates independently of RBA

AUSTRALIA'S banks should shift interest rates independently of the Reserve Bank, NAB chief Cameron Clyne has said.

AUSTRALIA'S banks should shift interest rates independently of the Reserve Bank, NAB chief Cameron Clyne has said.

The suggestion, aired at a Senate inquiry into banking competition, would end the perception that credit costs hinge on the official interest rate, Mr Clyne said.

Such a move would also reduce the power of central bankers to control economic growth.

Australia's banks had fuelled a perception that the Reserve rate was a proxy for credit costs by shifting mortgage rates in lockstep with the central bank, Mr Clyne said.

Speaking at the Senate banking inquiry yesterday, he said the Reserve Bank and Treasury's analyses of funding costs - which heavily influence prices for mortgages and other loans - were wrong.

"They don't have all the data that we can see," said Mr Clyne, the first major bank chief to face the inquiry.

NAB finance director Mark Joiner said the gap between the official cash rate and the bank's funding costs had blown out by 1.1 to 1.2 percentage points during the global financial crisis.

Reserve Bank analysts have said the gap could be as low as 0.9 of a percentage point.

"The banks have made a problem for themselves here by continually moving in line with the Reserve Bank," Mr Clyne said. "If the banks continue to move in line with the RBA, up or down, then we are continuing to compound the view that our funding is related to those movements in cash rates.

"There is some merit in each bank looking at their own circumstances and making interest rate moves independent of the RBA."

Mr Joiner revealed that the NAB's move to aggressively cut fees was so far costing it about $220 million a year in lost income.

Interrogated by senators on the robust profitability of the major banks, Mr Clyne acknowledged that NAB's $4.6 billion profit this year was "a big number".

But the bank's profit was modest relative to the sum invested in the business by shareholders, he said.

Defending the big four banks against accusations that they effectively acted as an oligopoly, Mr Clyne said competition between the major banks and across the wider sector was robust.

Earlier, Reserve Bank governor Glenn Stevens told senators that Australia's banking market "remains a good deal more competitive than it was in the mid 1990s".

"Moreover, the overall availability of finance to purchase housing in particular seems to be adequate," he said. The growing cost of credit had fuelled "various players" to call for government regulation of the sector to control costs, Mr Stevens said.

He warned that some reform proposals would see the taxpayer "shoulder more risk, one way or another".