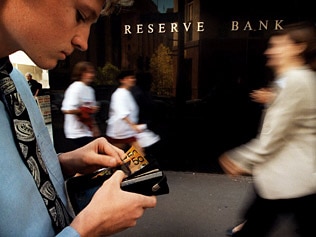

Leaders beg Reserve Bank of Australia to show restraint

A CHORUS of business leaders, led by Aussie chairman John Symond, has pleaded with the Reserve Bank to take baby steps in its push to raise interest rates away from "emergency levels".

A CHORUS of business leaders, led by Aussie chairman John Symond, has pleaded with the Reserve Bank to take baby steps in its push to raise interest rates away from "emergency levels".

A CHORUS of business leaders, led by Aussie chairman John Symond, has pleaded with the Reserve Bank to take baby steps in its push to raise interest rates away from "emergency levels".

The RBA stands to cripple thousands of homeowners if it raises official interest rates too rapidly, in increments of more than 0.25 per cent, or by lifting rates above five per cent within a year, the home loan tsar told business leaders in Sydney yesterday, The Daily Telegraph reports.

The Reserve is expected to lift its cash rate by 0.25 per cent, to 3.5 per cent, today with economists now ruling out the previously predicted "shock and awe" 0.5 per cent hike.

Relatively flat inflation figures, combined with further instability on global sharemarkets, have even raised the slim prospect of rates remaining on hold.

Despite the softening economic environment, with the Reserve regularly stating the need to quickly move rates towards more neutral levels of 5 per cent, economists are now banking that official interest rates will hit 4.25 per cent within six months.

Mr Symond told the Australia-Israel Chamber of Commerce such a rise would hurt the vulnerable.

"Hopefully Glenn Stevens follows through with only gradual increases," he said.

"That's all we need. Let's hope they don't follow through with increases as dramatic as they cut on the way down.

"An increase of 1 per cent over time is not going to make much difference, but 2 per cent and from there on, there are going to be a lot of people lose their homes."

His sentiments were backed up by the Australian Retail Association. Executive director Russell Zimmerman said retailers were calling for calm from the Reserve and a hold on rates till next year to allow the sprouts of economic recovery to bear some fruit.

"Retailers are concerned that interest rate rises now could slow down the wheels of economic recovery that are just starting to turn. Retailers are looking for a bit more momentum before higher interest rates start to take cash away from consumers," he said.

Although higher interest rates will hurt its business, Myer was left licking wounds of a different kind yesterday.

The department chain, fronted by fashion icon Jennifer Hawkins, relisted its shares on the Australian sharemarket on a day of heavy selling across the board.

Myer's shareholders, which include Hawkins, saw their initial investment in the company drop a staggering 8.5 per cent in minutes.

Meanwhile, billionaire property developer Harry Triguboff suggested that interest rates need not be on pause, but should be clipped further to levels in the UK and US.