‘We’re almost out of ammo’: Reserve Bank considering ‘extreme measures’ to save economy

As interest rates approach zero, the Reserve Bank of Australia is considering “extreme measures” to try to avert an “emergency”.

What happens if the RBA cuts rates to near zero, and the economy still doesn’t respond?

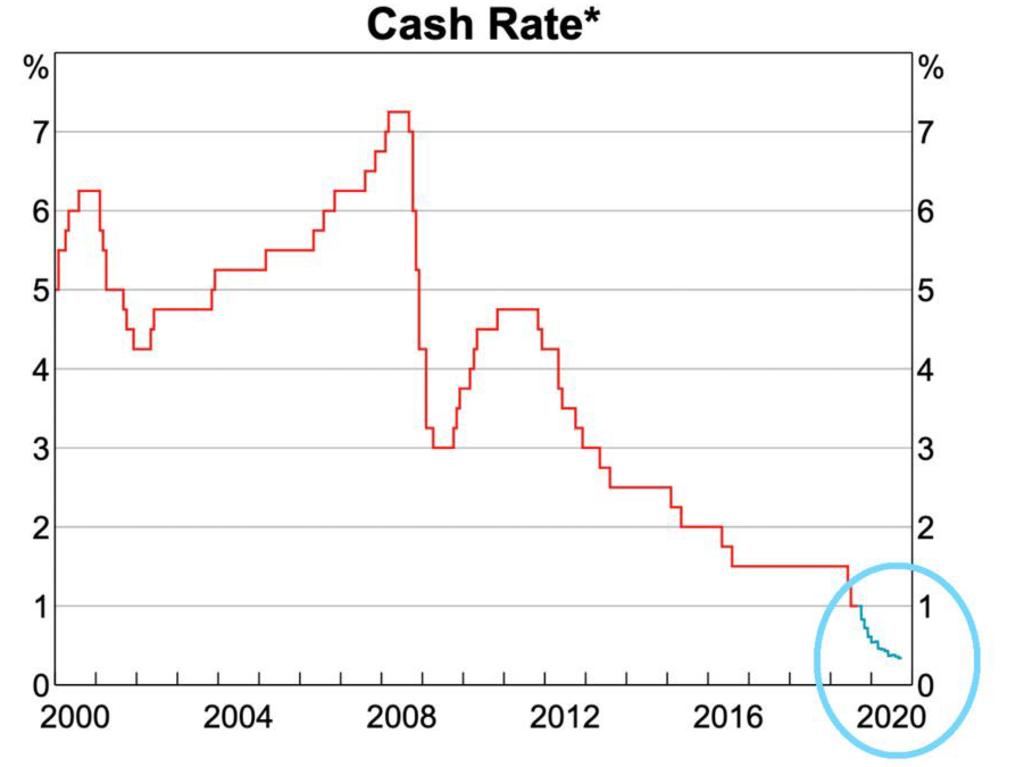

The Reserve Bank of Australia has cut interest rates to 1 per cent, and, despite what you might hope, nobody expects them to stop cutting.

The bank published this chart the other day, which shows despite interest rates at record lows of 1 per cent, the market expects more rate cuts out to late next year.

The average expectation for rates is to fall to 0.37 per cent by September next year.

That exact outcome is unlikely unless the RBA starts cutting rates by odd amounts, so think of it as a roughly 50/50 chance that the RBA will have rates at either 0.50 per cent or 0.25 per cent. After which they have either one or two cuts left before rates are at zero.

What happens then?

QUANTITATIVE EASING

Last week, the Reserve Bank gave some very timely hints on what it might do if the economy needed more stimulus but there was no more room for official interest rate cuts. It was at pains, mind you, to call that situation “unlikely”.

So what is this unlikely situation? You might remember the US instituted a program called quantitative easing during the GFC. Our program would be designed to be similar but slightly different.

The central bank would, it hinted, buy financial assets in exchange for cash. In the Australian case, the RBA is talking about buying Australian government bonds.

“We could take action to lower the risk-free rates further out along the term spectrum,” said the RBA Governor, using language that refers to government bonds.

Bonds are how the government borrows. Here’s how it works in simplified terms:

The government offers to sell a piece of paper that says, “Australia will pay you back a million dollars in 10 years” (a 10-year bond).

Someone buys that for, let’s say, $900,000.

In this way the government just borrowed $900,000 and the $100,000 difference, spread over 10 years, is the return on investment for the buyer. The return on investment in bonds is known as the yield. It is usually expressed as a percentage, and it’s really important.

Yields change constantly in the secondary market as people trade the bonds they buy at varying prices.

When the RBA buys Australian Government bonds from the people who hold them, it is expected to have an effect on bond yields. The reason? Bidding to buy bonds will push up their price. The price of a bond determines the return on it, aka the yield.

The higher the price, the lower the yield. For example, imagine if someone bought that 10-year bond mentioned earlier for $1 million, it would have a yield of 0 per cent.

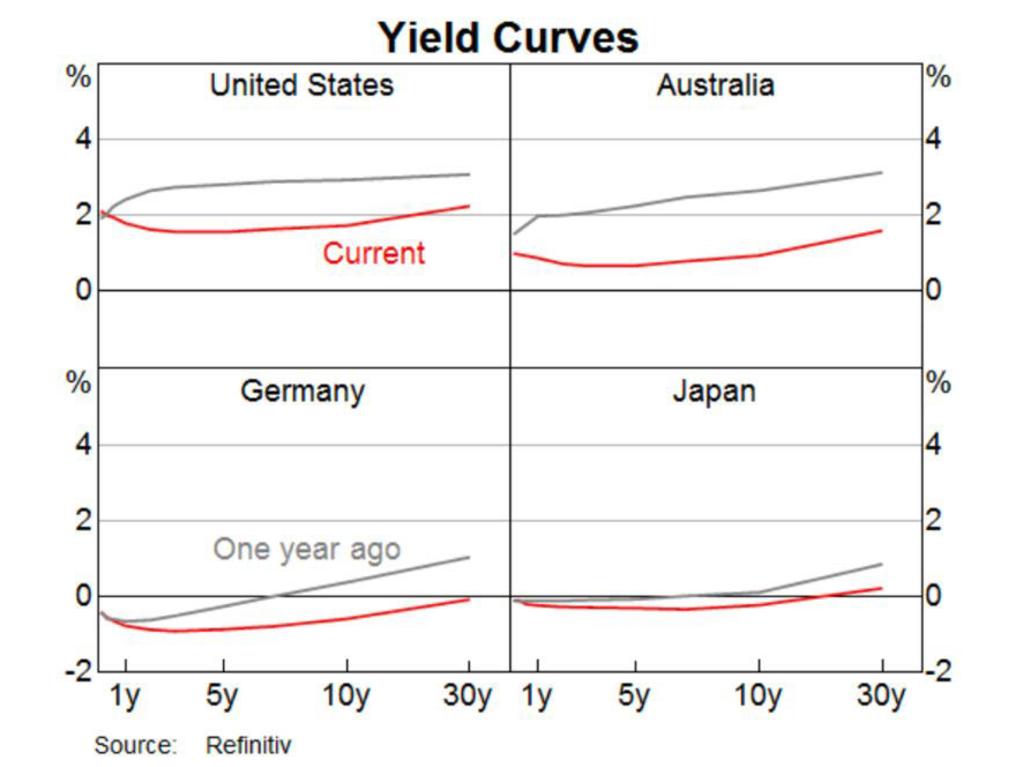

(Yields can and do go negative, for example if someone bids over $1 million for a promise to be paid $1 million in 10 year’s time. It sounds crazy but it is happening right now in Germany and Japan, as the next chart shows. Australian yields are still positive, although much lower than a year ago.)

BUT WHY BOTHER PLAYING WITH BONDS?

Interest rates for real borrowing (for example credit card interest rates, mortgage rates, business loan rates) are almost always higher than the official RBA interest rate. Even if the RBA interest rate was at zero, those interest rates would not get to zero. Buying bonds is an attempt to get them closer to zero.

By buying bonds, the RBA hopes to directly reduce bond yields in government bonds and indirectly, via spill-overs in the market, push down other interest rates in the economy. In that way, they hope to encourage economic activity.

“Europe’s the best example … They’ve also had success in lowering government bond yields, which is a risk-free rate, and therefore they’ve had success in lowering interest rates across the economy for private borrowers as well,” said the RBA Governor.

It’s a convoluted process but this is what you’re left with when your normal monetary policy runs out of ammo.

THE WEIRD THING ABOUT THIS

What’s crazy about all this is we are talking about an extraordinary kind of monetary policy when the economy is not extraordinarily bad.

Yes, growth is a bit low, underemployment is a bit high, wages growth is weak. But it’s not exactly a crisis. When the US brought in its quantitative easing policy, it was in the midst of a severe recession.

Australia is talking about bringing it in now. There’s something disconcerting about that. It’s like we have to have the accelerator slammed flat to the floor just to go through a 60km/h zone — and we’re still not even doing 60km/h.

One answer might be for the Reserve Bank to get extra help from the Treasurer. While we are approaching emergency measures on the monetary policy side, he is running a comfortable budget surplus.

It would probably be wise to use some of that budgetary space spending to prop up the economy rather than getting to extreme measures like quantitative easing.

Jason Murphy is an economist. He is the author of the new book Incentivology. Continue the conversation @jasemurphy