‘Outright stupid’: Huge ‘double whammy’ RBA can’t ignore as interest rates decision looms

Yesterday’s huge inflation update was a great result for Australians – but it still might not be enough to save us from the RBA.

ANALYSIS

Yesterday’s quarterly inflation update was a great result for Australians.

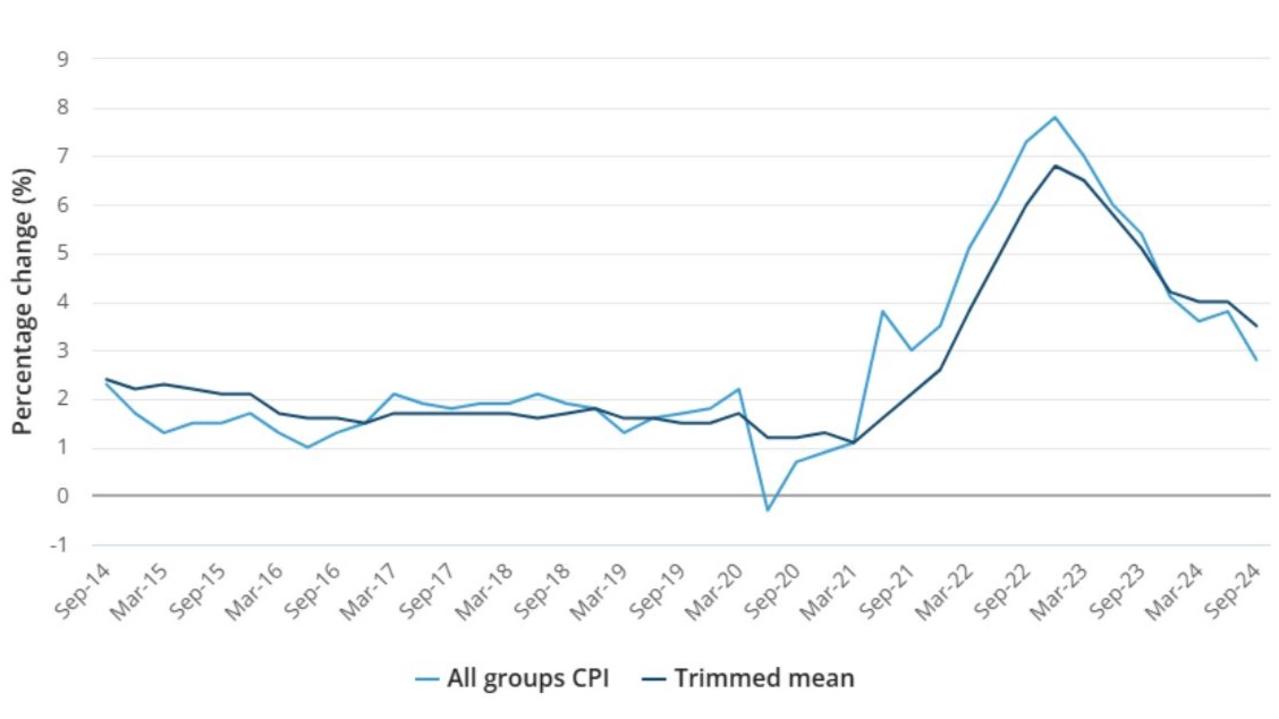

At just 0.2 per cent quarter on quarter and 2.8 per cent year on year, headline inflation is falling fast and will keep doing so as rents, administered prices, food and goods prices fall away.

Services are still sticky, but will ease eventually.

Sadly, this great news may not translate into immediate rate cuts because the Reserve Bank of Australia (RBA) is stuck in a test tube.

Trimmed mean inflation, which cuts out volatile items, was much higher at 0.8 per cent quarter on quarter and 3.5 per cent year on year.

The major difference between the two figures is the East Coast gas cartel, which delivered enormous energy bill shocks over the last few years.

These have been offset by government rebates that the RBA refuses to acknowledge.

MORE:Looming ‘threat’ if RBA fails to act

Bloody stupid

The RBA’s argument is that the cost of living rebates around energy are temporary, so it should not include them.

But this purist attitude is at best politically naive and closer to outright stupid.

With an election looming in May, who in their right mind would assume that the Albanese government will let energy rebates roll off and deliver a new round of bill shocks?

Especially so after Queensland Labor stemmed its bleeding by delivering more rebates.

Likewise, any new government after May won’t want to start its new term with energy shocks.

The alternative scenario is that, by some miracle, a government does its job and smashes the gas cartel, in which case bills will not rise anyway.

The rebates do lower inflation

The RBA would be on firmer ground if the energy rebates didn’t lower inflation, but they do.

About 20 per cent of the Consumer Price Index (CPI) is made of “administered prices” which rise and fall automatically in line with headline CPI.

These include education, health, tobacco, booze, welfare cheques and award wages.

All of these prices are going to shunt meaningfully lower in 2025 thanks to the energy rebates.

This is a looming disinflation double whammy for the RBA to ignore, such that when the energy rebates are extended, probably in the Mid-Year Economic and Financial Update (MYEFO), it will have smashed the economy to no good purpose as inflation is rubbed out to the bottom of the 2 per cent range or lower.

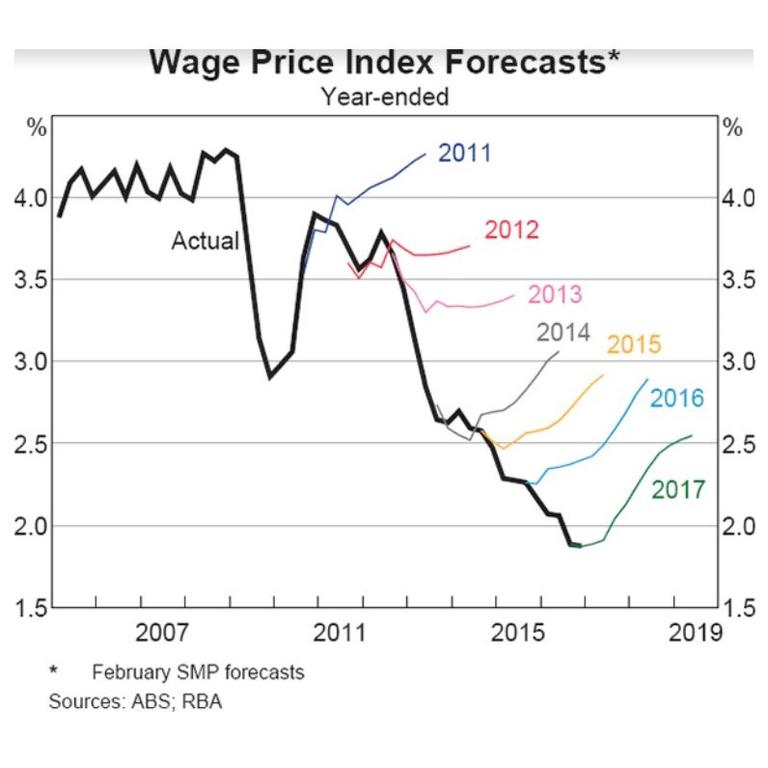

This is a return to the overly hawkish RBA of the pre-Covid years that was so ineptly deflationary that it sacked Governor Phil Lowe and triggered a major review and reform program.

Time to climb down

The RBA has cornered itself by putting too much focus on trimmed mean inflation.

The government will not extend the energy rebates in time for the central bank’s November 5 meeting. But it probably will before the December meeting.

So if the RBA sticks to its refusal to cut next week, it will then find its entire argument for doing so destroyed before the following meeting.

It can still climb down and reset market expectations between meetings via a major speech.

But it should never have gotten itself into this pickle in the first place.

A little glance out of the window at the venal politicians of the day would have told it that extended cost-of-living rebates are a near certainty.

Sadly, even after the reform process to open it up, the central bank still has its head firmly stuck up its theoretical textbook.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.