Morrison, Lowe? Who’s fault is it anyway?

With inflation currently at a 30-year high, the debate over who is to blame continues to rage. Read on if you want to know who to blame.

ANALYSIS

With Australian inflation currently sitting at its highest level for more than 30 years, the debate over who is responsible for letting the inflation genie out of the bottle continues to rage.

While this debate is unlikely to be settled for a long time to come, we can at least look at some of the data surrounding inflationary pressures as a whole, and you can make up your own mind as to what share of the responsibility should be directed where.

While there are many different contributing factors that drive inflation, in terms of those that could have played out differently, there are three we will look at today: excessive government stimulus, monetary policy and the changed spending habits of Australian consumers.

Naturally there are others that have played a role, such as supply chain issues and the war in Ukraine, but the focus here will be on factors that could have been avoided or minimised.

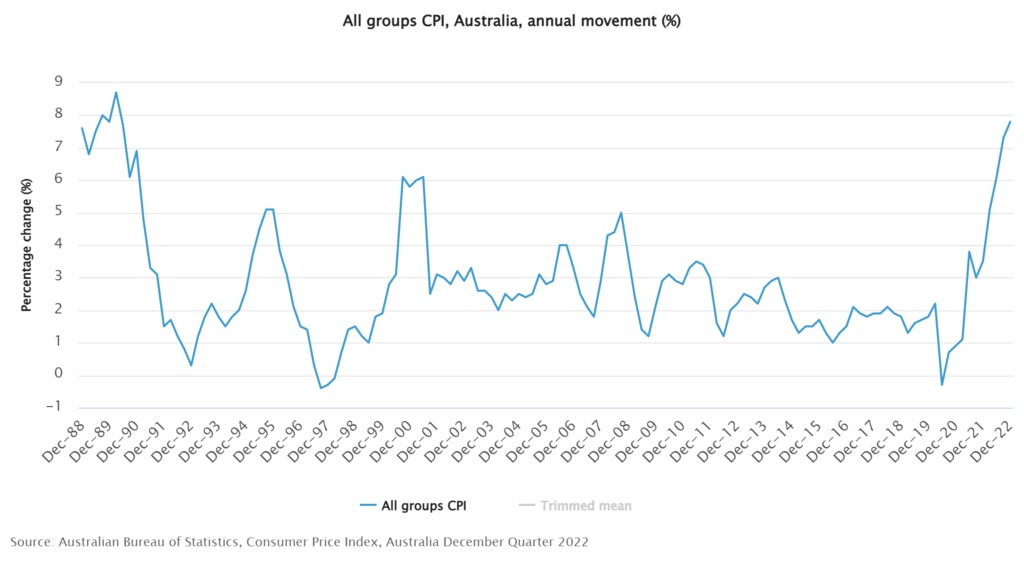

But before we explore those, it’s worth taking a moment to look at where Australia’s inflation currently sits within a historical context.

As of the last quarterly Consumer Price Index data, inflation sits at a 32-year high of 7.8 per cent.

Monetary policy

Since the Reserve Bank began raising rates back in May of last year, it has found itself increasingly in the crosshairs of the public, the media and politicians for its failure to adequately contain inflation.

Despite making more or less the same mistake as a long list of central bankers around the globe, the failures of RBA governor Philip Lowe have been seen as particularly grievous, potentially to the point where he will not be reappointed for a second term in the role.

This criticism is not undeserved

By dropping the RBA cash rate to just 0.1 per cent and facilitating the writing of hundreds of thousands of fixed rate home loans at sub-2 per cent mortgage rates, the RBA injected billions of dollars a year into the coffers of mortgage holding households.

With rates low, an increasingly large proportion of refinancers also took advantage by withdrawing home equity to do everything from renovations to provide cash injections for their business.

The mirror

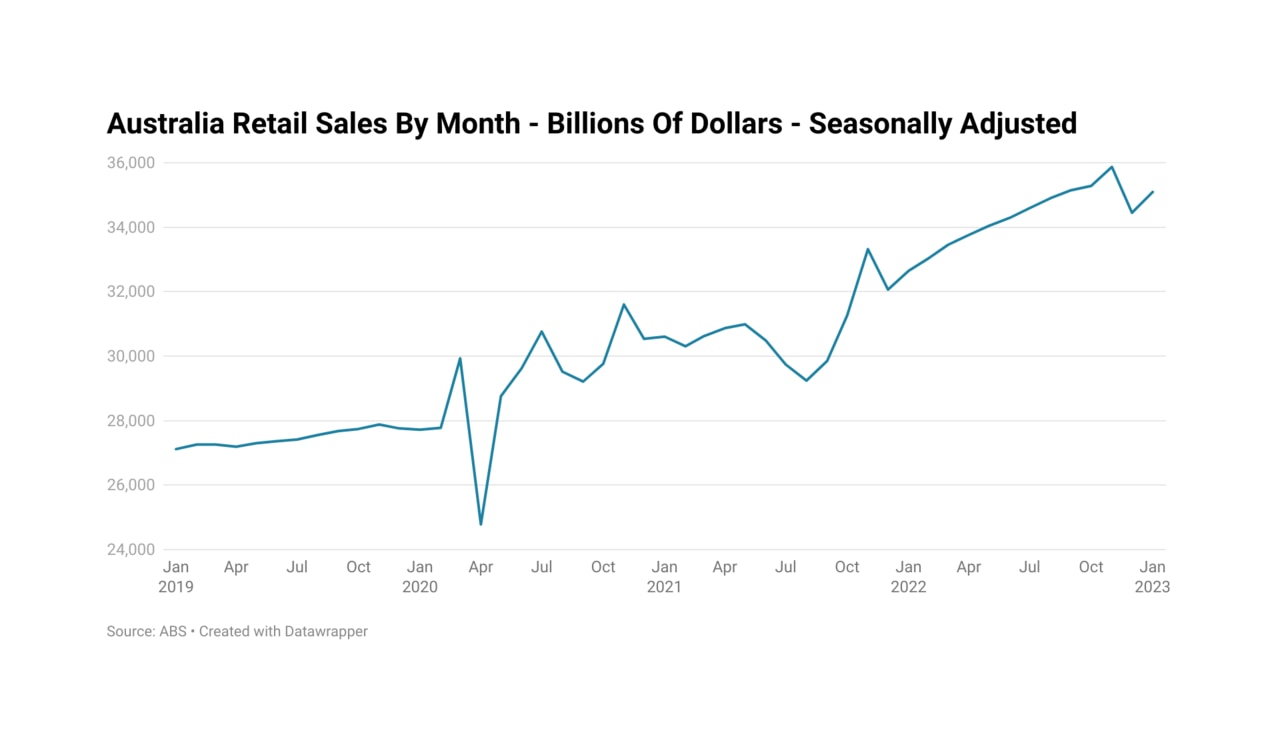

When the pandemic first arrived on Australia’s shores there were widespread concerns that the retail economy could all but collapse, as consumers and lockdowns combined to deliver a knockout blow.

What occurred in the months that followed was the polar opposite. By July, retail sales had rocketed to sit 11 per cent above where they were prior to the pandemic.

To put this into perspective, in the 12 months prior to the impact of the pandemic, retail sales grew by just 1.9 per cent on a seasonally adjusted basis.

Today retail sales are 26.3 per cent higher than where they were prior to the pandemic.

While this statistic is not adjusted for inflation and higher prices are a significant driver of this growth, it remains miles ahead of where retail sales would sit if they continued on their weak pre-Covid trend.

The government

While the necessity of the Morrison government’s actions to support the economy will be hotly debated for years to come, the impact of its policies, which were generally supported by the then Albanese opposition, is far more concrete.

During the pandemic the federal government committed to $506 billion worth of overall support or 25.6 per cent of GDP. This included $257 billion in direct economic support or 13 per cent of GDP.

But this high level of support is more akin to government expenditure during the world wars, as a percentage of GDP came at a cost.

For example, as of the latest monthly inflation data, one of the largest single contributors to headline inflation is the cost of purchasing a new home. Currently the annual rise in the cost of purchasing a new home sits at 14.7 per cent.

When looking at the ABS dwelling approval data, it is abundantly clear as to why. Between January 2020 and the peak in March of 2021, the number of homes being approved for construction each month rocketed by 73 per cent.

The impact of lockdowns and issues with the supply of materials are certainly a factor, but the sheer size of the uptick in activity played a significant role in driving this inflationary force.

As of the latest data from the ABS, there are more homes currently under construction around the nation than ever before.

Between the additional demand that stimulus programs like Home builder created and the cash that policies like JobKeeper provided to individuals and businesses who didn’t end up needing it, a huge amount of demand was created.

The big picture

So far the government has experienced a remarkably small amount of criticism for its contribution to creating the highly inflationary situation we currently find ourselves in. Part of that may be because the public see their actions as justified.

But in fairness to the RBA, the general public and others at times held responsible for high inflation, their actions also have a degree of justification.

In the case of the RBA, they faced the same uncertainty as the Morrison government and continued expansionary policy even after it was clear that the threat wasn’t as severe as initially thought.

As for the rest of us, we collectively attempted to adapt to a new world, which brought profound changes to the way we live and work.

Part of that was living in the now and not waiting for a tomorrow that at the time seemed elusive and far away.

To what degree you believe responsibility should be assigned is up to you.

Tarric Brooker is a freelance journalist and social commentator | @AvidCommentator