Housing market: How to take years off your mortgage

Experts say the wisest path to financial security is to pay down your home loan faster. Here’s a guideline on the best way to do that.

Record low interest rates means Aussies can pay off their home loan debt sooner by making slight extra payments.

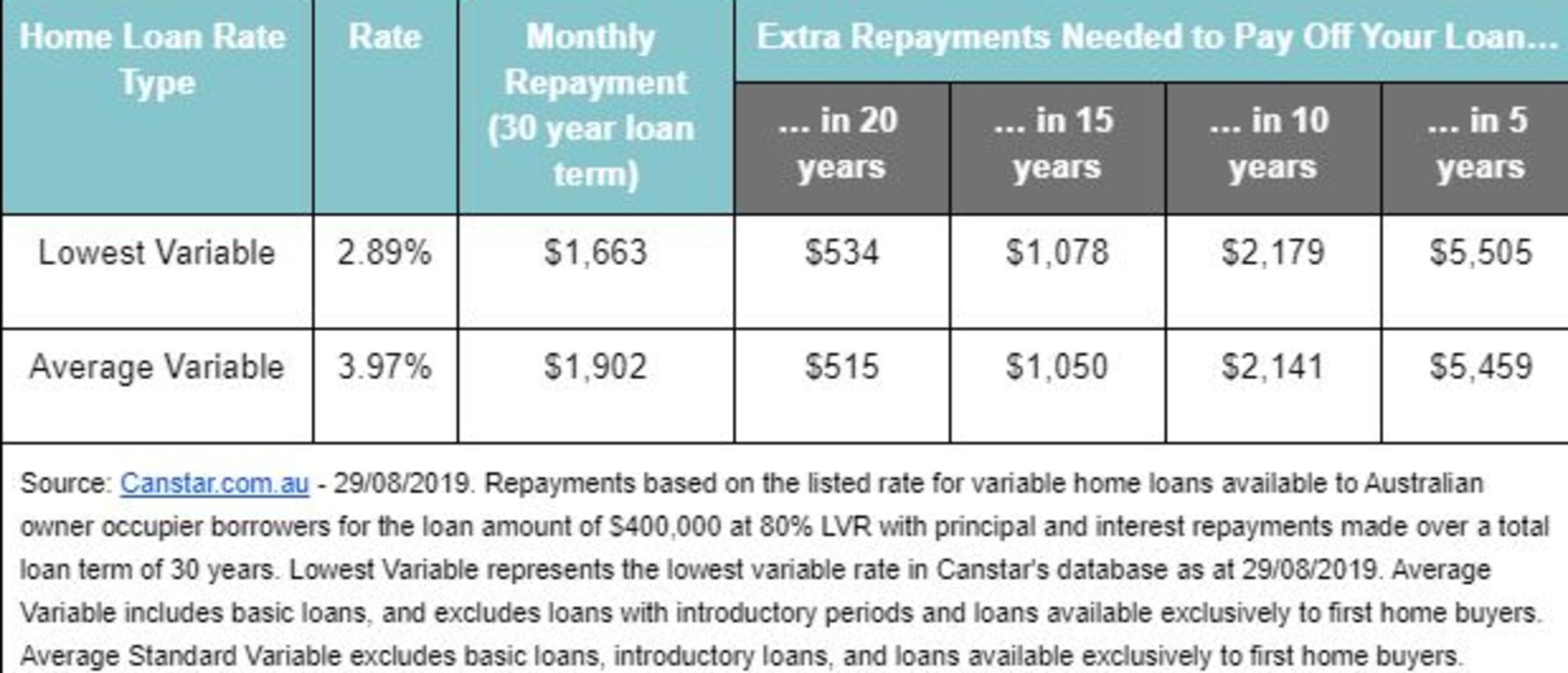

Paying an extra $534 per month at an average variable rate would allow a $400,000 mortgage to be paid off 10 years faster.

But new data from comparison site Canstar shows the simple difference between the average and cheapest loans could be half-a-decade after RBA governor Philip Lowe cut the official rate to 1.0 per cent in July.

“Getting into the right loan will get you debt free sooner,” the site’s finance expert Steve Mickenbecker said.

“Shifting from the average variable rate of 3.97 per cent to the lowest rate in the market at 2.89 per cent will save $239 in monthly repayments on a $400,000 loan over 30 years.

“If and when you move to a lower rate loan, keep making the old, higher repayment.

“That’s what you are used to and chances are you won’t notice the difference, but it can knock over 5.5 years off the life of your loan.”

For those with a little extra lying around at the end of each month, the loan can be knocked off significantly faster.

Paying an extra $1000 a month will cut the life of the $400,000 loan in half. An extra $2000 would pay it off in about 10 years and $5500 would mean you’ll be debt free in just five years.

“A $1600 home loan repayment looks and feels like $400 a week or $800 a fortnight,” Mr Mickenbecker said. “To knock off your debt faster, if you’re paid weekly, actually make the payment $400 a week.

“Set up a recurring $400 payment from your salary account each payday. This alone will take almost 4 years off the life of your loan, as you end up making an extra monthly repayment each year.”

RELATED: The mortgage fine print you need to know

RELATED: Homes in Sydney’s premium suburbs are surging in value

Mr Mickenbecker says one of the wisest ways to achieve financial security is to pay down your home loan quickly.

“When freed from debt, you can start using your earning power for some serious wealth creation,” he said.

“Paying extra into your loan requires discipline and motivation.

“Take motivation from the goal of clearing your home loan early and the discipline by putting the whole process into autopilot.

“Set up a recurring direct payment to your home loan for the day that you get paid, both for the regular payment plus the extra that your budget says you can afford.

“If you treat the extra repayment amount as if the money is not yours to spend, and you will stay focused on the big picture, you’re likely to be less distracted by smaller incidental spends.”

The financial expert says there are other options to help you get ahead if you’re concerned about spending all extra cash on your mortgage.

“Almost all variable rate loans have redraw facility and 65 per cent have an offset account, meaning you’re able you to reclaim the amount you are ahead on your loan if you need the funds to deal with the unexpected emergencies,” he said.

“This eliminates the risk.”

Continue the conversation on Twitter @James_P_Hall or james.hall1@news.com.au