CommBank’s big move on interest rates

One of Australia’s big four banks has unveiled a major interest rate move that comes with an unexpected catch for existing customers.

CommBank has offered some relief to Australians battling the cost of living crisis by slashing its Extra home loan interest rates for new borrowers.

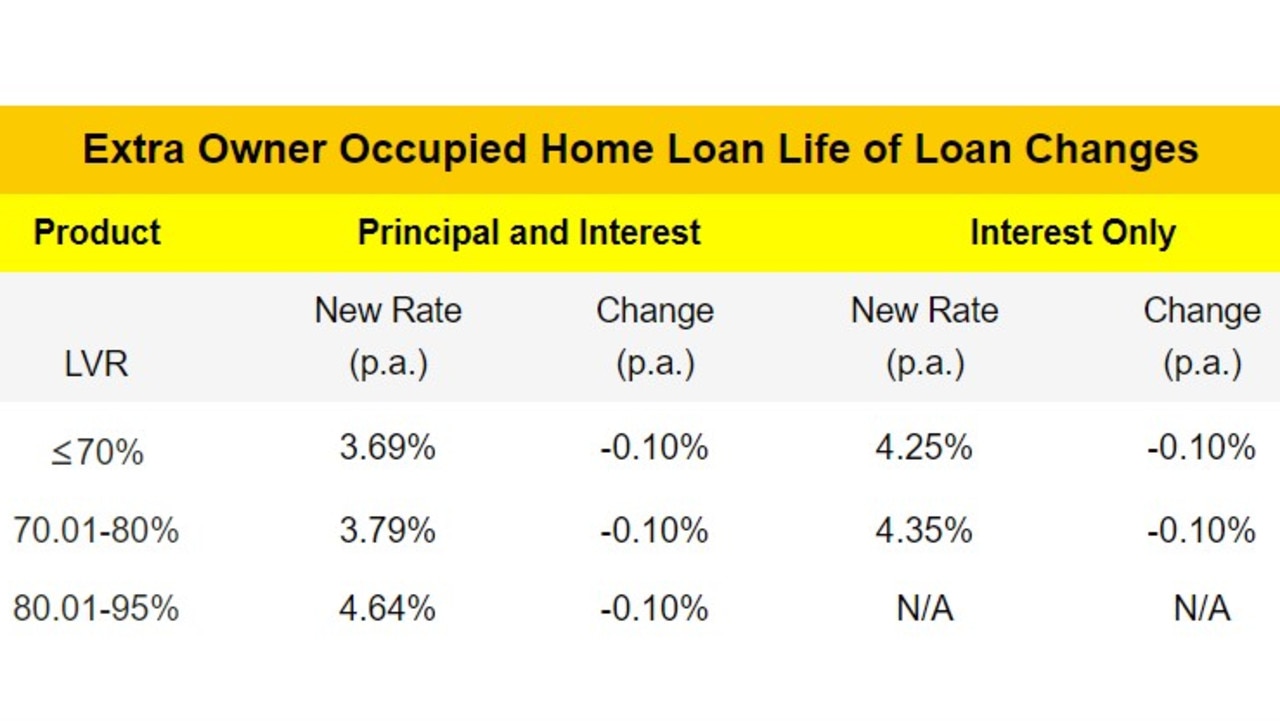

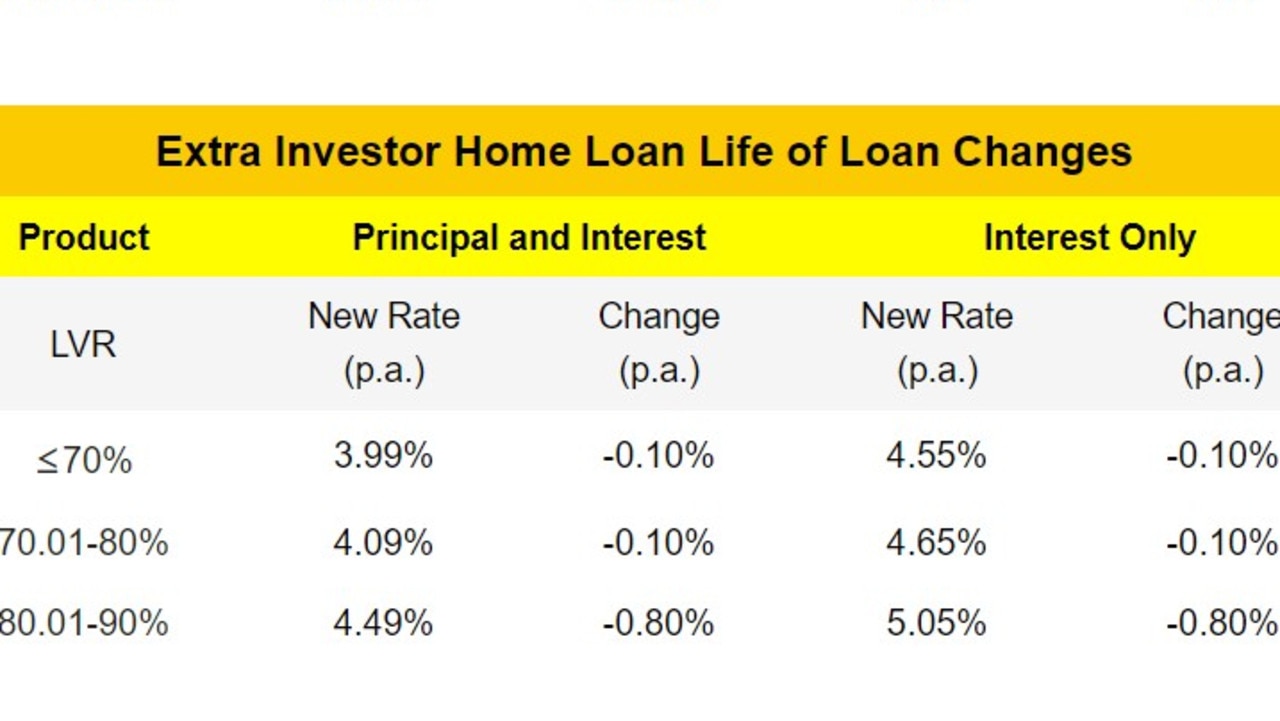

The increased life of loan discount, effective as of Friday, September 2, means owner-occupiers will save 0.1 per cent, while investors could experience drops of up to 0.8 per cent.

The lowest variable rate is now 3.69 per cent, down from 3.79 per cent. Investors with a loan-to-value ratio between 80.01 and 90 per cent can also expect their rates to drop from 5.29 per cent to 4.49 per cent.

CommBank said the changes were part of its ongoing review of interest rates and market conditions.

“We continually review our interest rates to ensure they remain competitive and meet customer needs,” it said in a statement.

It’s the second time CommBank has discounted its variable rates for new customers since the RBA hikes began.

The bank also cut its Extra home loan rates by 0.15 percentage points in late June.

While the announcement is welcome news for new borrowers, the discount does not extend to existing customers.

Rate City research director Sally Tindall said it should prompt existing CommBank borrowers to have a hard conversation with the bank.

“CBA has cut its lowest variable rate down to a competitive 3.69 per cent, yet not a single existing customer will get this discount unless they do something about it,” she said.

“You might have had a Dollarmites account since you were knee-high to a grasshopper, but at what cost? The nostalgia only runs in one direction.

“CBA is not alone in offering up discounts to new business. A total of 24 lenders have now cut some variable rates for new customers since the RBA began hiking in May.

“Don’t bother getting mad with your bank, get even, by entering into some hard negotiations or switching to a lender that values your business more.”