Australians rushing to refinance home loans to take advantage of lower lending rates

Aussies have done something hugely beneficial for their hip pockets during the coronavirus lockdown, saving themselves thousands.

Nearly one in 10 Australian mortgage holders have taken advantage of the record low interest rate environment and are choosing to refinance their existing mortgages.

Figures from the Australian Banking Association show 500,000 home loans, or 8 per cent of all mortgages, have been refinanced in the past year.

The data from the peak banking body coincides with monthly loan commitment numbers from the Australian Bureau of Statistics that show new housing finance in September rose 5.9 per cent compared with the previous corresponding period.

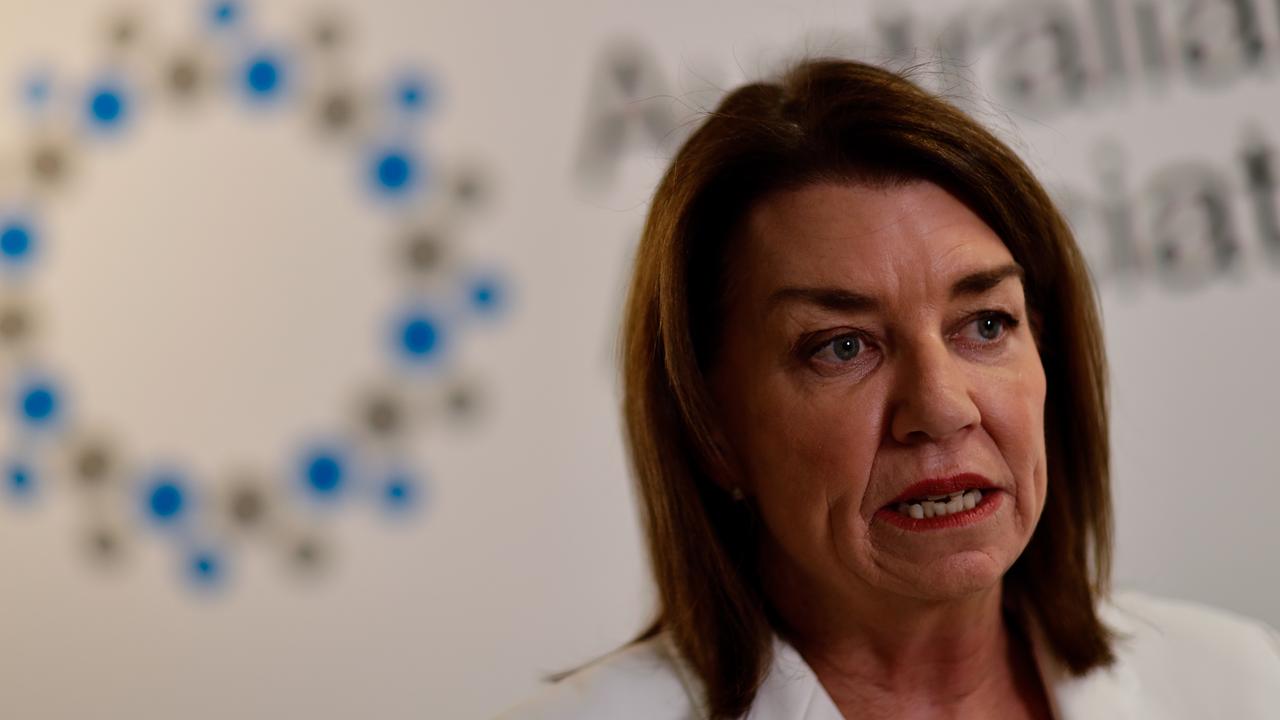

ABA chief executive Anna Bligh said the flurry in lending activity was being driven by lower lending rates, with peak refinancing activity occurring in May.

“The number of homeowners locking in a better deal on their mortgage is among the highest it’s ever been,” Ms Bligh said.

“This data shows that lower interest rates on mortgages are driving significant movement in the home loan market.”

Ms Bligh also noted new loan commitments were back above pre-pandemic levels.

The ABS said the federal government’s HomeBuilder grant was fuelling a larger rise in loan commitments for new dwellings, which increased 25.3 per cent.

“Owner-occupier housing loan commitments are at historically high levels, consistent with low interest rates and government incentives,” ABS head of finance and wealth Amanda Seneviratne said.

“For example, it is likely that the HomeBuilder grant is contributing to increased demand for construction loans.”

Housing finance for owner-occupier loans rose 6 per cent over the month, with $17.3 billion of new debt added. New investor housing loans grew 5.2 per cent.

Personal loans rose 8.5 per cent over the month of September but remain 10 per cent lower compared with the same month a year ago.

New owner-occupier loans in Victoria and Tasmania fell backwards. Victoria’s home financing commitments fell 8.8 per cent, reflecting the strict lockdowns imposed on the southern state to curb its COVID-19 second wave.

Business construction loans also soared, rising 57.2 per cent compared with the previous month.

Lending activity has been bolstered by the current low interest rate environment brought on by the Reserve Bank of Australia as an emergency economic relief measure following the onset of the coronavirus pandemic.

In March, the central bank initiated two rate cuts to alleviate the pressures on the country’s financial system during the lockdown, dropping the official cash rate to 0.25 per cent.

The RBA is tipped to cut interest rates to 10 basis points on Tuesday to further help the financial sector provide cheaper lending rates to households and businesses.