Australian rental crisis set to deepen as rising interest rates push prices sky high

Rising interest rates has left millions of Aussie renters in a perilous financial position

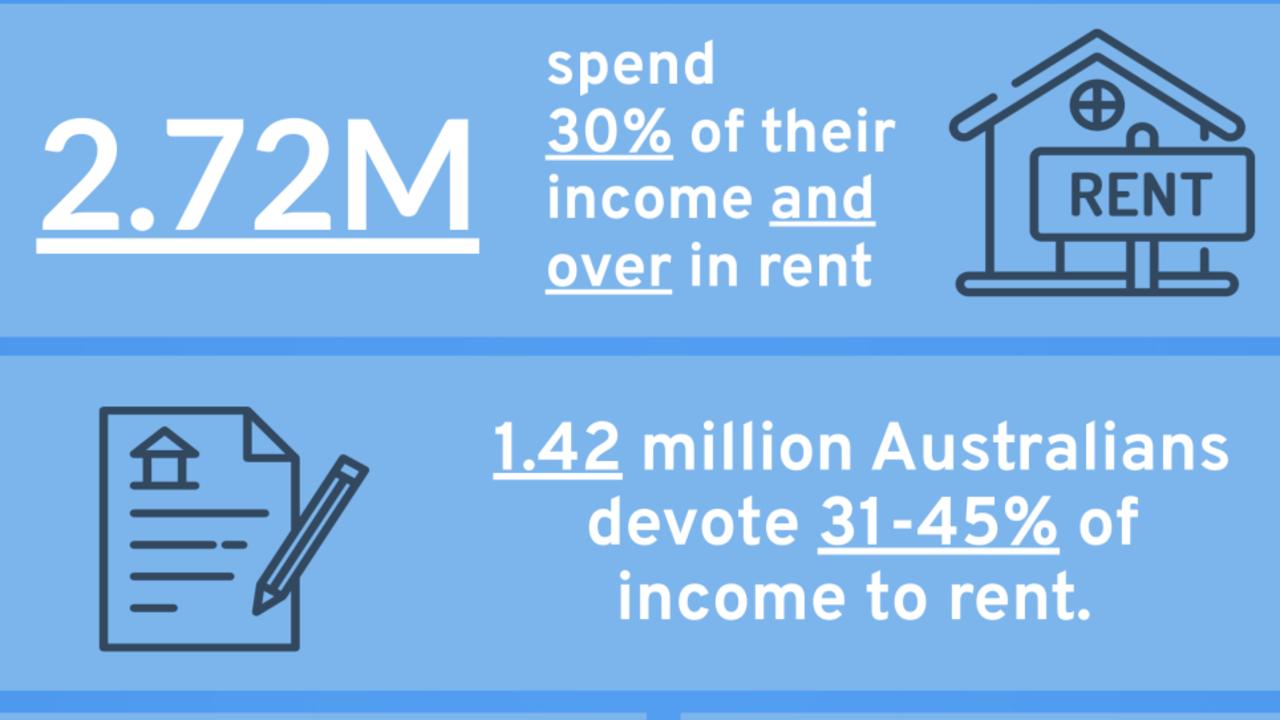

Nearly 3 million Australian tenants are at risk of rental stress in the wake of Tuesday’s interest rate spike, new data shows.

Defined as allocating more than 30 per cent of household income into rent, rental stress already affects more than 2.5 million Aussies, with cost of living pressures forcing that number higher by the month.

A new survey conducted by finance broker firm Savvy found that 40 per cent of 25-35-year-olds were stressed about meeting their future rental costs, with 33 per cent of respondents aged 33-45 saying the same.

Younger adults were the most worried however, with 50 per cent of 18-24-year-olds surveyed indicating they were anxious about rental affordability in the future.

“Rental stress isn’t just being a bit worried about a lack of money for luxuries, it’s a real and persistent financial pressure that affects your ability to pay for necessities,” Bill Tsouvalas Savvy Managing Director and personal finance expert said.

“Renters may be on edge already due to the rising cost of living (and) they may be behind the eight-ball due to COVID-19 lockdowns, reduced hours, and lay-offs.

“A sudden excess payment, repair bill, or urgent appliance replacement could set them on the edge of real financial hardship – or put them in that position almost overnight.

“It can take a toll on your wellbeing, and never really goes away.”

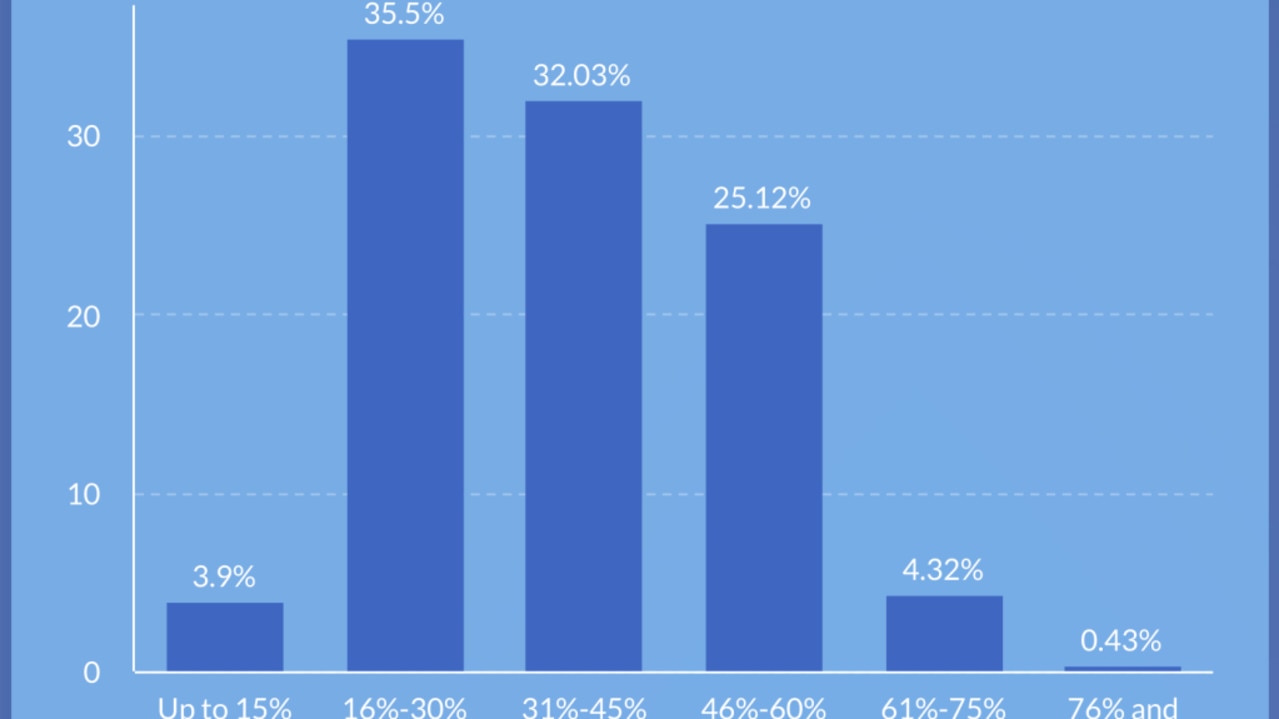

The survey found that 7.4 per cent of respondents spent 31-40 per cent of their weekly income on rent, while 5.8 per cent of participants said weekly expenses to keep a roof over their heads cost them 46-60 per cent of their pay packet.

With inflation currently hovering at 5.1 per cent and wage growth at 2.3 per cent, renters face an uphill battle to maintain control over their finances.

According to an interactive financial stress tracker created by the housing advocacy group, Everybody’s Home, which allows users to track levels of mortgage and rental stress by the electorate, multiple inner-city electorates in Melbourne, Sydney and Brisbane showed the number of renters in the “stress” zone sitting well above 50 per cent.

The southwestern Sydney seat of Macarthur was the worst nationally, hovering around 76.5 per cent, while Calwell (Victoria) was just above 60 per cent and Bowman in Brisbane saw 59.8 per cent of renters feeling the pinch.

More Coverage

Everybody’s Home spokesperson Kate Colman used a statement in April to call on the federal government to commit to an “urgent injection into social and affordable housing” to combat rising rents, bolstered by the volatile cash rate.

“Failure to do so will see the cost of housing soar even further, sending hundreds of thousands into housing stress and homelessness,” she said.

“More social and affordable housing is the fastest and easiest pathway out of the cost-of-living crisis, there is no time to waste in making that investment now.”