ANZ cuts variable interest rate for new lenders as major banks brace for ‘rates war’

ANZ has slashed its variable interest rate for new customers as it jostles with other major lenders for a slice of the increasingly competitive borrowing market.

ANZ has moved to secure its place in a hyper-competitive borrowing market by slashing its variable interest rate – though only for new customers.

The move comes as Australia’s biggest lenders jostle for an increasingly precarious piece of the mortgage market, with the Reserve Bank kicking off a steep hiking cycle just three weeks ago with a 25 basis point rise to 0.35 per cent.

Borrowing costs are set to rise and place pressure on the banks’ margins over the coming year, with the RBA potentially taking the target cash rate past 2.5 per cent to rein in soaring inflation.

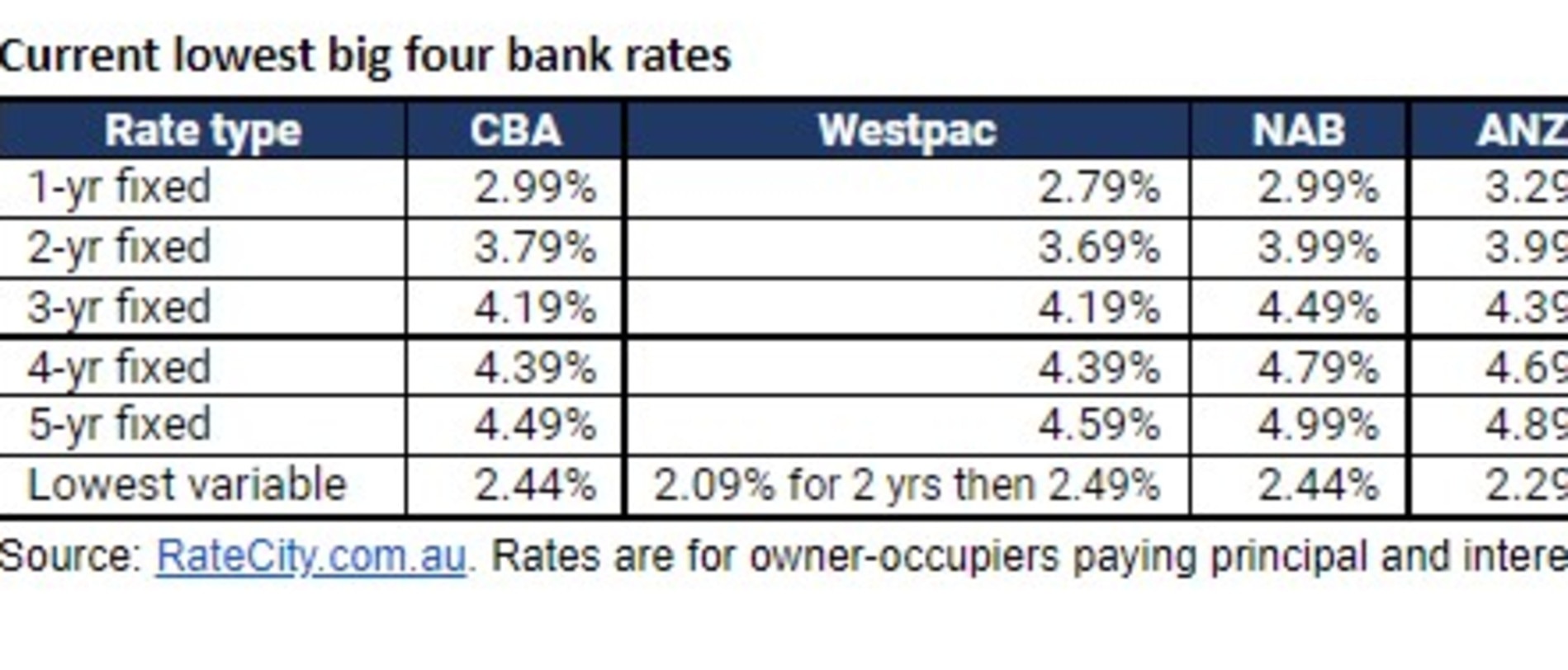

ANZ this week said it will cut the rate on its Simplicity Plus product by 15 basis points to 2.29 per cent, putting it below rivals Commonwealth Bank, Westpac and National Australia Bank.

That rate does come with conditions: it is only for new customers, and for owner-occupier paying principal and interest, with a 70 per cent loan-to-value ratio.

ANZ is not the only bank making moves to attract new customers.

Last Tuesday, Westpac hiked rates for new and existing customers by 0.25 per cent on the majority of its variable rate loans.

However, on its lowest variable rate, it reintroduced a honeymoon rate of just 2.09 per cent, which increases by 0.40 percentage points after two years.

CBA also last week launched Unloan, a new digital offering with a starting variable rate of 2.14 per cent.

RateCity.com.au research director Sally Tindall said each of these moves puts more heat on the market to keep rates competitive for new customers.

“If you’re on a variable rate that’s on the rise, don’t just accept your fate – get yourself a rate cut by switching to a lender willing to put a competitive price tag on your business,” Ms Tindall said.

“The RateCity.com.au database shows there are still at least four lenders offering variable rates under 2 per cent after the May cash rate hike, including a rate of 1.79 per cent from Homestar Finance.

“Variable rate customers with ANZ and Westpac in particular should pick up the phone and ask their bank where their loyalty lies.

“If years of paying your bank thousands of dollars in interest isn’t enough to get a better rate, it could be time to move your business elsewhere,” she said.