$32 billion trap: Banks’ gravity-defying insult to customers

It’s the great mystery of the Australian financial system — and this “dangerous burden” on consumers is about to get much, much worse.

Official interest rates are expected to come down again, and that’s great news (sound of cheers), except for those of us with credit cards (booing, hissing).

It’s the great mystery of the Australian financial system. Why is it that when mortgage rates fall, deposit rates also fall, but credit card interest rates defy gravity?

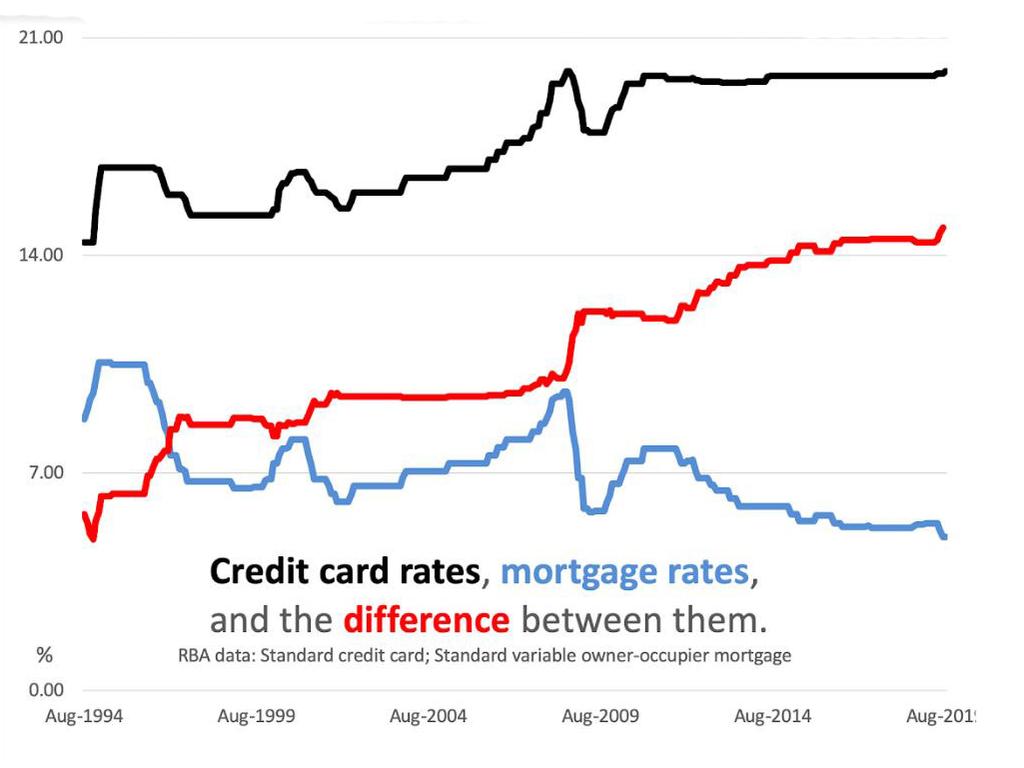

As the next graph shows, the gap between mortgage interest rates and credit card interest rates used to be small. Not anymore. The incredible levitating standard credit card interest rate has remained sky high despite the longest and deepest cycle of rate cuts in Australian history.

With interest rates of 20 per cent a year, you could be paying $200 a year to maintain a balance of $1000 on your credit card. That’s expensive, and it hasn’t fallen in years.

High credit card interest rates hit family budgets. The average credit card balance in Australia is $3000, according to Australian Bureau of Statistics data, and while many people pay off their credit cards each month (good on you if you do), the vast majority of credit card debt is the other kind, the kind that gets slugged with interest charges. According to the latest data, we have $32 billion accruing interest on credit cards

If credit cards are loaded up now, they are likely to be burdened even more soon. With Christmas coming, and wages growth weak, Aussies are set to load up their credit cards to make sure the festive season is still a joyous time.

Stretching the budget to make sure the kids’ stockings are full is an annual tradition, and this year is likely to be no exception

Because the truth is, despite the rather ordinary state of the economy, we haven’t given up spending. Spending growth is running above wages growth in Australia. We are save less and go into debt more.

That is dangerous, and the burden of credit card debt falls disproportionately on those people with the least capacity to pay it off. Credit card debt may not be the biggest kind of debt in Australia (mortgage debt is far more) but it is the kind that the least well-off people tend to have. Lower interest rates on credit cards could make a big difference to the household budgets of people for whom a few dollars really matters.

PAYBACK

Why don’t these credit card interest rates move?

I asked ANZ bank this and they explained it by reference to the risk of customers not paying back the debt.

“The risk of customer default is higher and must be priced in,” said an ANZ spokesperson, referring to the fact that for credit cards to be profitable, people who do pay back their debts must pay interest to cover for the minority who don’t.

“Due to the significantly higher risk involved, pricing decisions for credit cards are not directly affected by changes in the official cash rate. For example, in 2017 we reduced the purchase rate on the ANZ low rate credit card by 1% and on the low rate Platinum product by 2% when there was no change to the official cash rate.”

It is true that some people don’t pay of their credit card debts. According to an ASIC investigation in 2017, around 1.7 per cent of credit cards are “severely delinquent” and another 3.6 per cent have been overdue by 60 days or more in the preceding 12 months.

That’s higher than the rate of mortgages not being paid back, and unlike mortgages, credit card debt is not secured, meaning they are not able to repossess anything if you don’t pay it back. Still, people have been not paying back credit cards for many years now, and the gap to mortgage interest rates used to be a lot lower...

The credit card industry should be eager to win us over. After all, they are the target of a crackdown. Since July 1, under the new Banking Code of Practice, banks are no longer allowed to offer unsolicited credit card limit increases. They are also under siege by the new buy-now-pay-later start-ups Afterpay and Zip.

But the sad reality is that they rely on consumers ignoring the high interest rates those cards charge.

According to Finder insights manager Graham Cooke, this has to do with consumer behaviour. People get attracted to high interest credit cards because of the bells and whistles.

“Customers now take out credit cards for the insurance and bonus points features and don’t really care about the interest rate,” he said.

“Of course, the purchase rate is the most important number when it comes to your card.

“Customers should only ever take out a high-rate frequent flyer card if they are confident in paying back the spending every month.”

The smart option then is to realise that, unless you are fastidious about paying your bill every month, earning points can function as a trap. The trick is to hunt out a low-fee, low-interest card — and not just a low introductory rate, but a low actual rate.

Jason Murphy is an economist @jasemurphy. He is the author of the new book Incentivology.