What you need to know: Your five-minute guide to the federal budget

Check out our five-minute guide as we break down what is included, and who will benefit from the latest federal budget measures.

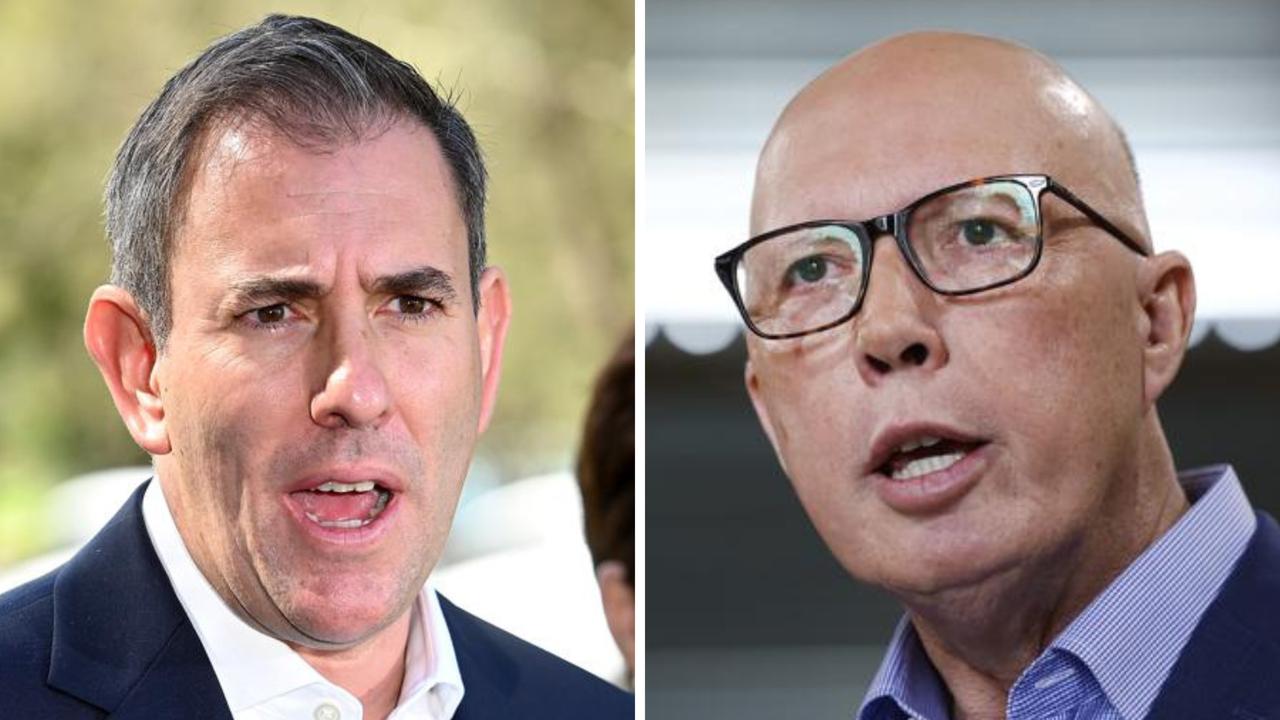

The recent federal budget announcement from Treasurer Jim Chalmers has promised a $14.6 billion centrepiece of cost-of-living relief, with the aim of helping with power bills, out-of-pocket health costs, supporting vulnerable Australians, creating affordable housing, and boosting wages. However, not all Australians will benefit equally.

This guide breaks down what is included and who will benefit from the budget measures.

COST OF LIVING

The budget includes $14.6 billion in relief, which includes $500 energy rebates for 5.5 million households and 1 million businesses. However, there is an income threshold cut-off, and some families will miss out on this electricity bill relief worth up to $500.

For families with one child, the Family Tax Benefit is cut off after you reach a combined income of more than $108,000. Relief will be targeted towards pensioners, Commonwealth Seniors Health Card holders, and households receiving income support, including Family Tax Benefit A and B.

The budget also includes measures to support vulnerable Australians, including an $11.3 billion investment to fund a 15 per cent pay rise for aged care workers, $9 billion in additional childcare subsidies, $2.2 billion for primary healthcare, and $1.9 billion to extend sole parent payments until children turn 14.

TAXES

The budget does not include changes to impending Stage 3 tax cuts, which have been legislated to start in July 2024 and will deliver annual savings of up to $9075 for high-income earners.

However, the budget includes changes to the Petroleum Resource Rent Tax to bring in another $2.4 billion, a minimum 15 per cent tax for large multinational companies, and a tobacco tax increase of 5 per cent every year for three years.

There are also brakes on the amount small businesses can claim for a piece of new equipment, down from $150,000 to $20,000, making it impossible for companies to instantly claim the cost of new commercial vehicles as a tax deduction.

HEALTH AND AGED CARE

The budget also includes measures to improve health and aged care, including $3.5 billion to help GPs provide free, bulk-billed consultations to around 11.6 million pensioners, concession card holders, and those under 16.

Additionally, people with chronic illnesses will be able to get 60 days’ worth of medicine for the price of a single prescription from September. There is also $50 million allocated for the Medical Research Future Fund, including long Covid research.

The Medicare rebate is to be extended for heart health assessments until June 30, 2025.

Health costs are forecast to rise to an estimated $29.6bn, up from $24.8bn in 2022 and 11.3bn over the next four years has been allocated to fund a 15 per cent pay rise for 250,000 aged care workers from July 1.

WELFARE

For welfare recipients, the budget includes a $40 per fortnight increase for JobSeeker recipients – plus those on Youth Allowance, Austudy and other income support payments.

Single parents will be able to receive the single parenting payment until their youngest child turns 14 – up from the current age of eight.

The Parents Next program that forced parents with young kids to train or risk losing their payments will be axed, and $1.9 billion has been committed for First Nations’ health, housing, education, employment and other essential services.

HOUSING

Commonwealth Rent Assistance is to be increased by 15 per cent or $31 extra a fortnight for people renting in the private market and community housing.

The first-home guarantee scheme’s expansion allows family and friends to purchase a home together with a 5 per cent deposit.

And a new tax break for build-to-rent projects will cut the managed investment trust withholding tax from 30 to 15 per cent

ENVIRONMENT

The government has allocated $1 billion to provide low-cost loans for double-glazing, solar panels, and other home improvements that will make it easier and cheaper for homeowners to keep their homes warm in winter and cool in summer.

Additionally, $845 million has been allocated to enhance biosecurity measures, $302 million to help farmers transition to a low-emissions future and improve agricultural sustainability, and an extra $262.3 million for national parks. The budget also includes $121 million to establish Environment Protection Australia and $200 million for disaster prevention projects across Australia, such as levee and drainage system upgrades, seawalls, and bushfire risk reduction projects.

JOBS AND WORKERS

The budget includes support for Australians aged 55 and over who are seeking employment, with extra JobSeeker support available from the age of 55 instead of 60. The government has also allocated $200 million for place-based partnerships and projects that are delivering measurable success.

SUPERANNUATION

Employers will be required to pay superannuation at the same time as wages from 2026. The budget also includes $40 million to fund an ATO compliance program targeting unpaid super, as well as a broader crackdown on unpaid tax and super by medium and large businesses, forecast to net $440 million over four years. The government will also increase the tax on super over $3 million from 2026.

EDUCATION AND CHILDCARE

The government has allocated $4.9 billion to boost support for around 1.1 million Australians looking for work, studying, or doing apprenticeships. Additionally, $32 million in grants will be used to upgrade infrastructure and equipment at 1300 schools, and $18.7 million over four years will be used to expand existing higher education student support programs. The budget also includes $55.31 billion across the next four years to make childcare more affordable, and $72.4 million over five years to support the skills and training of workers in the early childhood education and care sector. Approximately 1.2 million families will benefit from subsidy rate increases from July 1, and $2.8 million over four years will be allocated to streamline the delivery of the Additional Child Care Subsidy (ACCS).

ENERGY

The budget includes $2 billion in a new ‘Hydrogen Headstart’ program, allowing Australia to be a world leader in producing and exporting the zero-emission future fuel. Additionally, changes to Petroleum Resource Rent Tax have been made to deliver a greater return on the sale of Australia’s natural resources sooner.

DEFENCE

In terms of defence spending, the government has allocated $2 billion to “harden” ADF bases in the north, including Darwin, RAAF Base Townsville, and Cocos (Keeling) Islands. Additionally, $1.6 billion has been allocated for more long-range strike missiles and systems, and $2.5 billion for manufacturing of guided weapons and 155mm artillery and sea mines. There is also $591 million for the Advanced Strategic Capabilities Accelerator for Defence innovation, science, and technology programs, and $1.9 billion in economic and security assistance for the Pacific.

TRAVEL

Revenue generated through the lifting of the passenger movement charge to $70 on every departure from Australia will reach $1.38 billion in 2024/25.