Labor forced to defend $19 billion shortfall in its calculations

ON THE day Labor was set to attack the Coalition over its Budget, the Opposition has had to explain a $19 billion shortfall in its calculations.

LABOR today is defending its tax policies as the government aggressively prepares for tonight’s Budget by pointing to what it calls a $19 billion hole in Opposition calculations.

The Opposition is making its own preparations by forecasting big and unfair spending cuts and suggesting it could fight tax cuts if they only favoured the rich.

And both sides are treating the Budget as a transit stop on the way to a July 2 election, which Prime Minister Malcolm Turnbull is expected to call at the end of the week.

Budget measures will not be legislated during the two-month election campaign but will be critical components of the election debate.

The government will use the Budget to promise jobs and economic growth without increasing spending which is now close to a quarter of the value of national economic output.

It will include limited tax cuts for full time workers on around $80,000 a year, reductions to the tax concessions enjoyed by wealthy superannuation accounts, tax cuts for business, and promises of transport improvements in major cities

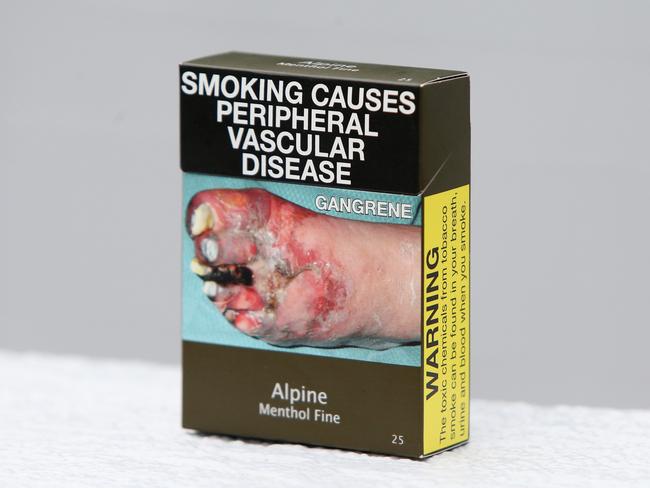

The Budget will include an increase in tobacco excise which could produce a $40 packet of cigarettes by 2020.

When Labor first proposed the excise rise the government sneered at it — former prime minister Tony Abbott called it a “workers’ tax” — but then adopted it as its own.

However, last night Treasury calculations were leaked showing the extra revenue from the 12.5 per cent annual tax rise over 10 years would be $28.2 billion.

Labor, using calculations by the Parliamentary Budget Office, had said it would be $47.7 billion.

The government is claiming the shortfall means Labor would not be able to fund its election promises, a claim firmly rejected by the Opposition.

Finance Minister Mathias Cormann today said the Opposition had not used the “most recently available information” when it asked for the calculations.

Opposition finance spokesman Tony Burke said the Labor calculations had been based on accepted Treasury assumptions.

Shadow treasurer Chris Bowen accused the government of trying to hide its embarrassment.

Mr Bowen said the leak was “a desperate attempt to cover for the fact the government will be adopting, in full, Labor’s policy on tobacco excise”.

“This is despite the fact both the Treasurer and Health Minister screamed and shouted about the sensible policy when it was announced,” he said.

On tax cuts for business, Mr Bowen said last night: “I don’t think that a cut for the company tax rate of Australia’s largest companies is a priority at the moment.

“We’d all like to see taxes lower rather than higher, but when you’ve got the AAA credit rating under pressure, you’ve got the government cutting school and health funding ...”