The Aussies about to take a big income hit

About eight million Australians will be worse off when tax changes come into effect this year — find out if you are one of them.

The so-called “lamington” tax offset has been a Budget sweetener many Aussies have become used to but once it’s removed there’s one simple way to tell if you’ll be better off.

The Low and Middle Income Tax Offset (LMITO) — worth up to $1,080 for individuals or up to $2,160 for couples — was always meant to be a temporary measure but was extended during the COVID-19 pandemic.

This year the Morrison Government has again extended the payment so people earning up to $126,000 will still be allowed to claim the offset in their 2021/22 tax returns.

Those earning between $48,000 and $90,000 are eligible to claim the maximum $1080 offset — providing a significant sugar hit in their tax returns.

They will also benefit this financial year from some tax changes as part of the government’s Stage 2 changes.

Most people would already have seen their paypackets go up from late last year due to tax bracket adjustments that came into effect once budget legislation passed parliament. They will also likely see more money in their 2020/21 tax return because the change will be applied from July last year.

These tax changes include lifting the cut-off for the bottom tax bracket from $37,001 to $45,000, with any income under $45,000 taxed at 19 per cent.

The upper limit of the 32.5 per cent tax bracket was also lifted from $90,000 to $120,000. This means people now have to earn more than $120,000 before they start paying 37 per cent tax.

The Stage 3 changes, which are due to begin in 2024/25, will see everyone earning between $45,000 to $200,000 paying 30 per cent in tax. The 37 per cent bracket will be discarded.

Australians earning $180,000 will no longer have to pay the top 45 per cent rate of tax, as the threshold will be lifted to $200,000.

With all these changes, it’s hard to know whether you will be better off.

The Australia Institute senior economist Matt Grudnoff has crunched the numbers and says for those who are earning a wage of less than $88,000 a year, they will be worse off once LMITO ends as they won’t benefit as much from the Stage 3 tax cuts.

For example, Mr Grudnoff said someone earning $80,000 loses $1080 from the scrapping of the LMITO but gains only $875 from the Stage 3 tax cuts.

“So they’re worse off by $205 per year,” he told news.com.au.

RELATED: Find out how much you’ll get using income tax calculator

Mr Grudnoff said the median wage in Australia is $67,193 — which means half of all full and part time income earners are on wages lower than this. Someone on $60,000 would be $705 worse off if LMITO is scrapped and Stage 3 tax cuts are introduced.

In contrast, someone earning $100,000 losses $780 from the scrapping of the LMITO but gains $1,375 from the Stage 3 tax cuts. So they’re better off by $595 per year.

Those earning $90,000 are $45 per year better off.

One of the biggest winners from the Stage 3 tax cuts are those earning $200,000. They have not been receiving LMITO because they earn too much but once the Stage 3 tax cuts kick in, they will be better off by $9050 a year.

RELATED: Where money is being spent in Budget 2021

Mr Grudnoff said he believes the government should abandon the Stage 3 tax cuts completely.

“We were told at the time the tax cuts were announced (in 2018/19) that we could afford them because the economy would grow strongly,” he said.

The COVID-19 pandemic has since impacted Australia’s economy and Mr Grudnoff said there was even less reason for the cuts, which would go mainly to high income earners.

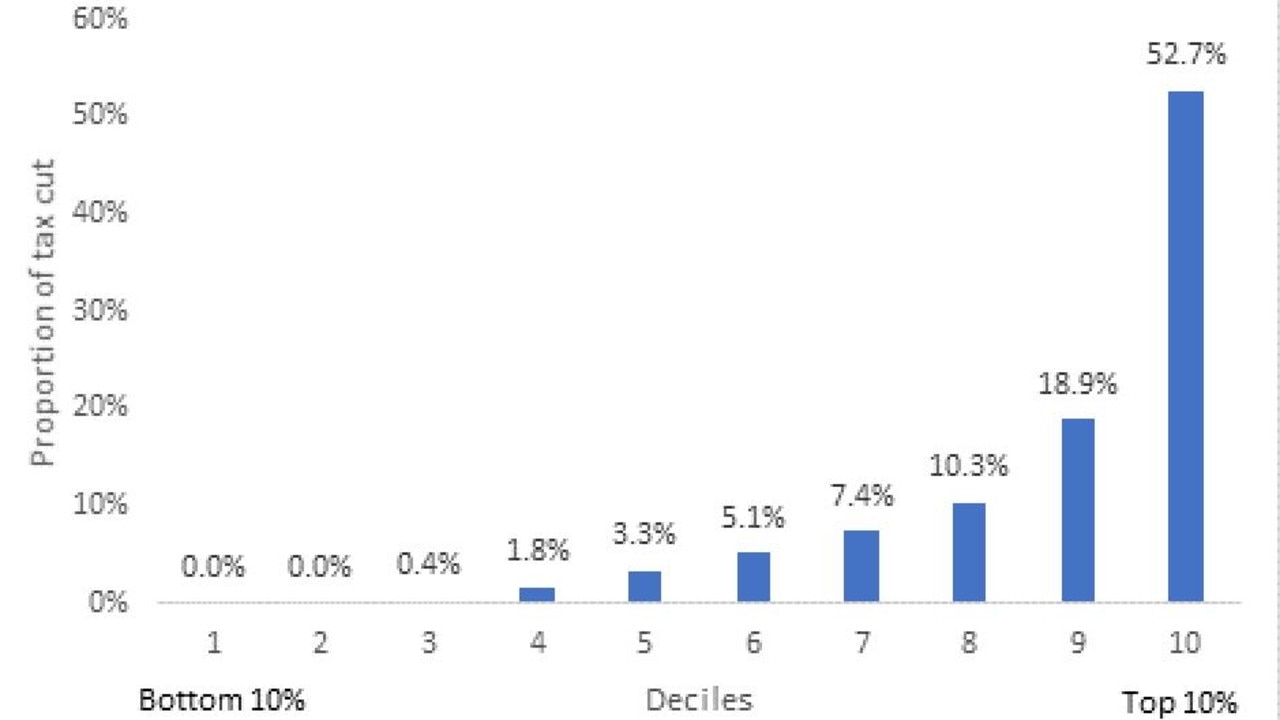

“They go mostly to the top 10 to 20 per cent of taxpayers and the bottom 20 per cent get nothing,” he said.

“Most people on average or medium incomes will be worse off.”

During an appearance on Insiders, Treasurer Josh Frydenberg struggled to explain the economic benefit to Australia of the Stage 3 tax cuts.

When Insiders host David Speers put to him that he didn’t know what the “growth dividend” was, Mr Frydenberg said the “economy is still continuing to grow” and the growth numbers were baked in the budget, based on the legislated tax cuts.

“What you’re doing is you’re rewarding effort, you’re encouraging aspiration, you’re returning more of people’s hard earned money back to them,” he said.

Mr Frydenberg also insisted lower income earners would be better off compared to what they had been in 2017/18 prior to all the tax changes and that LMITO was always intended to be a temporary measure.

RELATED: Australia’s debt to rise to almost $1 trillion

WATCH: David Speers asks @JoshFrydenberg to explain how Australians would be better off under the planned stage 3 tax cuts #Insiders#auspolpic.twitter.com/mpKBy8K5az

— Insiders ABC (@InsidersABC) May 15, 2021

RELATED: Australia’s plan to wipe out massive debt

According to the 2017/18 taxation statistics, Mr Grudnoff said about 20 per cent of Australia’s 10.8 million taxpayers were earning $100,000 or more.

“That means the number of taxpayers who will be worse off will be around 8 million if LMITO is removed and replaced with Stage 3,” he said.

Instead Mr Grudnoff said he was open to the government keeping LMITO as it was better targeted.

“I’ve heard a lot of criticism of LMITO but I think it’s good because it’s well targeted to middle income earners,” he said.

“If you give a tax cut, those on higher incomes get it too, so an offset is better targeted to those on middle incomes.

“When it comes to LMITO, those in the top 10 per cent get nothing, most of LMITO goes to those in the fourth to seventh income deciles.

“And you can phase it out if you want.”