Jim Chalmers spruiks $177bn improvement in gross debt despite looming deficits

Labor is set to spruik its progress of lowering gross debt ahead of the federal budget, despite Australia’s bottom line set for a string of deficits over the next decade.

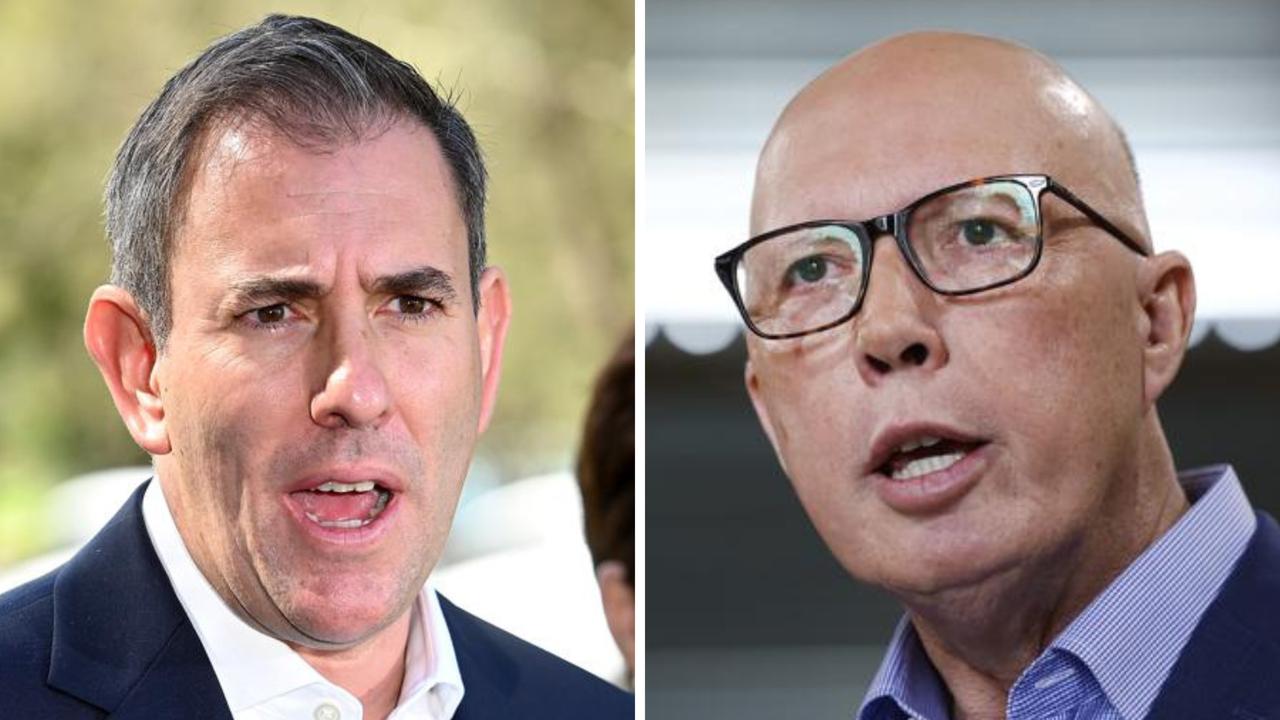

Labor will champion a $177bn reduction in gross debt it has achieved in its first term of government when Jim Chalmers hands down his fourth budget on Tuesday, despite rolling deficits forecast for the next decade.

The figures comes as Anthony Albanese declined to say whether he hoped Labor could oversee surplus return if Labor was given a second term of government, with Australians set to head to the polls by May 17.

Gross debt in 2024-25 is expected to remain at $940bn, which the government says is a stark $177bn downgrade from the $1.1 trillion figure forecast in the pre-election financial outlook forecast prior to the 2022 election.

The improvement will save the government about $60bn in interest payments in the 11 years to 2032-33.

Labor will also say they’ve managed the biggest nominal budget turnaround in a single parliamentary term, with the bottom line set to improve by $207bn between 2021-23 to 2028-29.

However gross debt is also set to surpass more than $1 trillion in the 2025-26 financial year, rising to $1.161 trillion by 2027.28, according to figures revealed in the Mid-Year Economic and Fiscal Outlook (MYEFO).

“Gross debt is expected to stabilise at 36.7 per cent of GDP at 30 June 2027, before declining to 31.4 per cent of GDP by 30 June 2035,” the documents.

It’s now expected to peak a little higher at 37 per cent of GDP, or 7.9 per cent lower than the peak put forward in 2022.

The budget bottom line is expected to remain in the red, with December’s budget update forecasting the combined deficit to increase by $21.8bn to $143.9bn over the forward estimates to 2027-28

Ahead of Tuesday’s budget, Jim Chalmers has conceded “there’s more work to do,” while spruiking Labor’s “responsible economic management,” and moves to ease cost-of-living and inflation.

“We’re paying down Liberal debt and the budget will show that’s saving taxpayers tens of billions of dollars,” he said.

“By getting the budget in better nick, we’ve been able to find room to help with the cost of living, strengthen Medicare, and invest in the future.”

With the upcoming federal election set to be fought on cost-of-living, the Treasurer said Labor had proven it could lower inflation, which is now in the Reserve Bank’s target band of 2 to 3 per cent.

Underlying inflation, the RBA’s preferred measure, is slightly above the band at 3.2 per cent.

“Together we’ve shown you can make progress on inflation without sacrificing jobs, which is remarkable compared to what we’ve seen around the world,” Mr Chalmers said.

“Inflation is down, real wages and living standards are growing again, unemployment is low, debt is down, interest rates have been cut and growth is rebounding solidly.

“This budget puts a premium on responsible economic management, helps finish the fight against inflation and ease the cost of living for Australians.”