‘It’s worth it’: Mega property investor defends billions of dollars in tax perks for landlords

A prominent real estate investor who owns 21 properties worth $35 million says ditching generous perks for landlords would see Australia crumble.

Australia’s rental market would crumble if generous tax perks for landlords worth tens of billions of dollars were rolled back, a top property investor believes.

Community groups and affordable housing advocates have been left disappointed after last night’s federal budget maintained the status quo on negative gearing and capital gains tax (CGT) allowances.

They had been lobbying the government to either wind back or scrap the concessions, which the budget revealed will cost up to $49 billion this year.

According to the budget papers, the public purse will miss out on $22.7 billion in taxation revenue in 2024-25 due to the capital gains tax (CGT) discount offered to property investors.

On top of that, tax deductions on rental income account for another $26.5 billion in foregone revenue this year.

“With an election coming up … we are calling on parties and candidates to scrap investor tax handouts, like negative gearing and the capital gains tax discount,” campaign group Everybody’s Home spokesperson Maiy Azize said.

“It is unfair to spend billions of dollars propping up investors and pushing up costs while people on low and middle incomes are left behind.”

Daniel Walsh, a buyer’s agent and founder of the consultancy Your Property Your Wealth, said negative gearing and the CGT discount incentivise investors to provide the rental stock Australia needs.

About a third of Aussies rent the home they live in and virtually all of those are owned by landlords, Mr Walsh pointed out.

“So, negative gearing is important to tax payers and tenants needing rentals,” he said.

“It allows investors to offset their losses in the first few years, which helps keep rents lower than they otherwise would be.

“Not to mention that these properties overtime turn to positively geared houses meaning they now pay tax on the income derived from the property.”

Nerida Conisbee is chief economist at Ray White Group and said rent price growth is largely driven by supply and demand – not the decisions of individual landlords.

“When there are plenty of rental options available, tenants can simply choose cheaper properties, forcing landlords to keep rents competitive or risk having empty properties and no income,” Ms Conisbee said.

“Landlords generally can’t raise rents above market rates because tenants will move to more affordable options.”

Strong price hikes seen over recent years had more to do with supply shortages than anything else, she said.

Ms Conisbee also said it’s “too simplistic” to blame negative gearing for Australia’s high home prices.

“Many countries without negative gearing also face significant housing affordability challenges. The main drivers of Australian house prices include limited housing supply in desirable areas, strong population growth, strict planning regulations, and the concentration of jobs in major cities.”

The CGT discount provides another incentive for investors to take on the risk of putting their cash into bricks and mortar, Mr Walsh said.

“No incentive means a lot less rentals, more rental pressure on everyday Australians as competition for rentals increases, and homelessness for those that can’t afford to [rent], nor find a rental.”

For decades now, governments have slashed their investment in public and affordable housing, instead turning to the private market to pick up the slack.

Should governments divert course now, Mr Walsh said it would require an enormous amount of money.

“Let’s assume each property is about $700,000 on average. If we were to get the government to fund the homes needed to [supply] rentals, it would be [hundreds of billions, if not a few trillion] dollars.

“I don’t think people understand how much cheaper it is to have private rentals. It’s costing us all a lot less.

“Not only does the government save, they also collect revenues from landlords [when they’re] buying and selling plus maintaining properties over time.”

In the mid-1980s, the Hawke Labor Government scrapped negative gearing provisions but they were abruptly reintroduced a few years later.

“It’s been tested and we have the results,” Mr Walsh said. “Lose the incentives, lose rentals, create higher rental prices and homelessness.”

Instead of taxation reform, he said government should be focusing on boosting the supply of new dwellings by cutting red tape and addressing labour shortages and soaring construction costs.

“The issue isn’t current supply, it’s the ability to create future supply. If you want to fix housing, stop making it harder to build.”

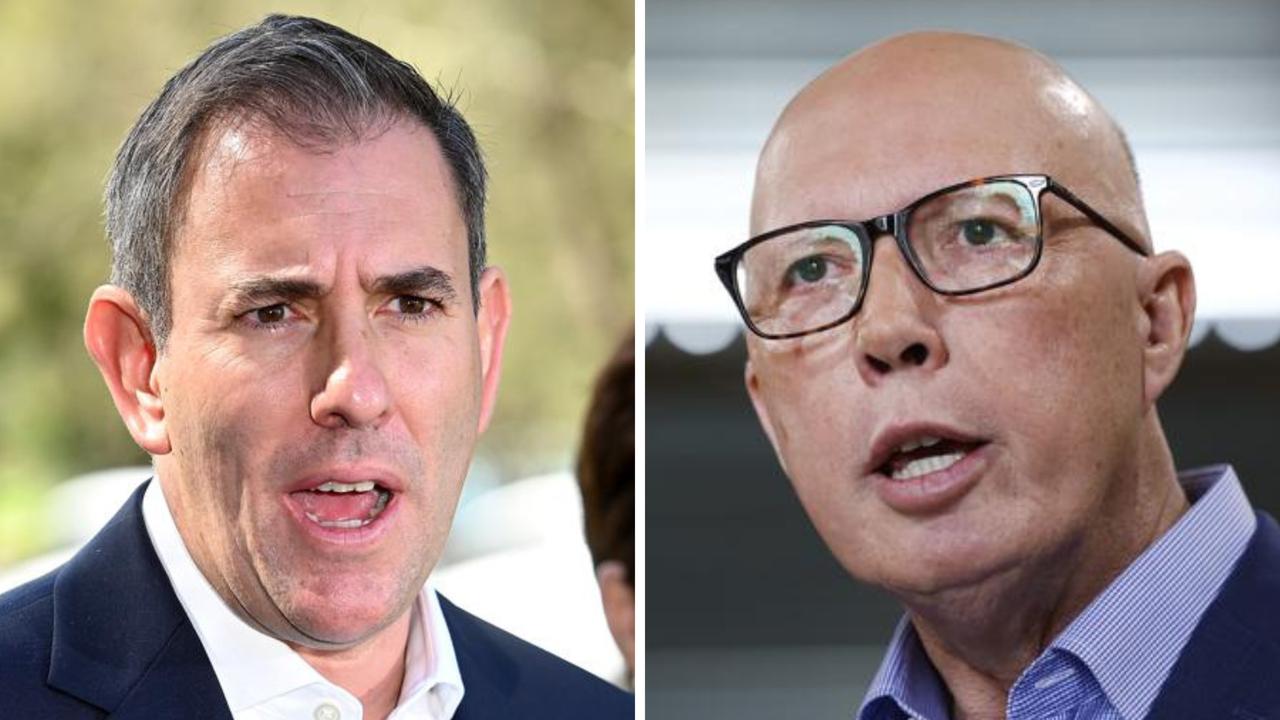

Late last year, Treasurer Jim Chalmers requested modelling on the impacts of reforming perks for property investors.

But the government was quick to water down speculation it was about to tinker with the arrangements.