Is Scott Morrison’s generous Budget really a big risk?

TREASURER Scott Morrison delivered what looks like a wonderful Budget last night. But is it too good to be true?

THE new federal Budget looks so wonderful.

It is generous with spending on people hitting retirement, there is money for indigenous housing, and it even manages to offer tax cuts for the next seven years.

It seems like a miracle — weren’t we in a spot of economic trouble not long ago?

The answer is yes we were, and we’re not entirely out of it. Treasury is getting a decent whack of extra revenue coming in this year, and it has extrapolated that out to $26 billion in extra revenue that it expects over the next four years.

Imagine Scott Morrison romping through a swimming pool partly full of taxpayers’ money, and you have a sense of what the Budget looks like. The swimming pool is not full to the brim yet. We should ask — does he really have enough coins in there for a romp? Has he taken his eye off all the things that could go wrong?

If the economy goes pear-shaped, all the money Scott Morrison is planning to spend will never even come into existence.

One of the big risks to the Australian economy is house prices. In Sydney, the house price rot seems to have set in for good. That is going to hurt the economy, because Australian people, for better or worse, will spend a bit more when they see the price of their house go up.

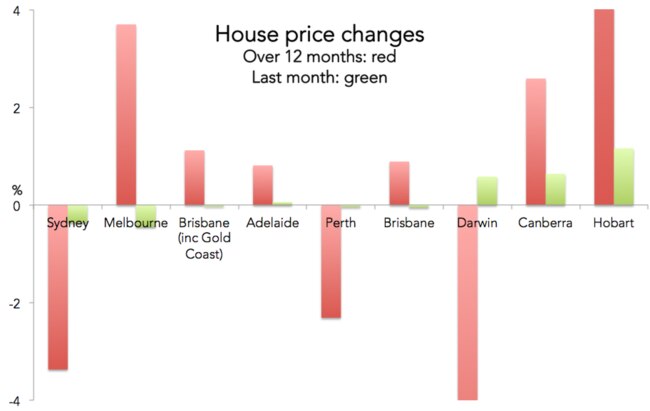

This next graph shows house price situation is still strong in Canberra and Hobart, mixed in Melbourne and Brisbane, but really quite bad in Sydney and Perth:

The risk is that those falls could get even deeper. The Financial Services Royal Commission is one of the risks facing Australia, raising the prospect that getting a mortgage could become much harder. If that happens, many people expect house prices to wobble.

Will we see a slowdown in consumer spending growth as a result? It is already happening. In Western Australia, retail spending is lower than a year ago and in most of the rest of the economy, growth is already slowing to pitiful levels. Victoria is the only state where retailers are taking in substantially more money than a year ago.

If people spend less than expected at businesses — perhaps because their house is worth a bit less now, then those businesses will pay less than expected in tax. In which case Scott Morrison’s swimming pool full of money will look pretty empty.

MISSING: JOBS AND GROWTH

Perhaps the biggest risk to the Australian economy is that our unemployment gets worse. Scott Morrison’s Budget is built on a big surge in employment that went from January 2017 to January 2018. The Budget boasts about how the Government created 1000 jobs a day in 2017. Which was terrific. But this year, the boom seemed to stop.

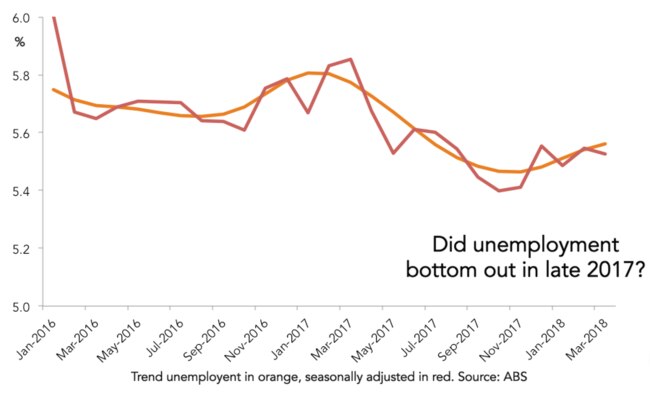

This next graph shows that Australia’s unemployment rate seemed to bottom out about six months ago. It has risen slightly since.

I like to look at job advertisements to get a sense of where unemployment might be in a few months’ time, and there’s some bad news there too.

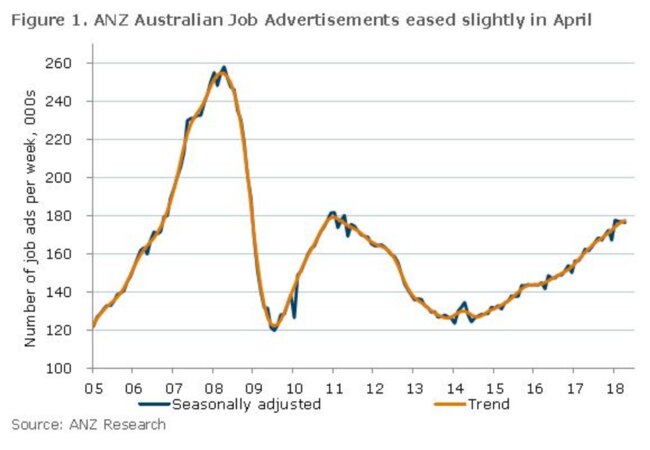

As the next graph shows, job advertisements were on a steady upward trend. But in the last little while, the number of job advertisements has stopped growing. ANZ head of Australian Economics David Plank said: “Job ads have eased slightly for the last three months.”

Given our population is still growing, the number of people in the labour force is growing, and the unemployment rate is still high, more growth in job advertisements would be very nice to see.

Rising unemployment would blow a double hole in the Budget — not only would people stop paying tax but they would start collecting welfare payments. It could make Scott Morrison’s Budget of generosity look incredibly premature.

THE BIG MUMMA

The X-factor behind all the other risks is China. They prop up our economy in so many ways, from inflating the prices of the iron ore we dig up, to buying our services exports like education and tourism, to bolstering our house prices.

The Budget forecasts continued strong growth in China — 6 per cent growth in GDP per year, or even more, all the way out to 2020. If this doesn’t happen, and China falls apart for any reason, this year’s Budget estimates will look ridiculous.

THE BIG CHEESE: COSTELLO

Ahead of the Budget a lot of people were asking if Scott Morrison measured up against the last successful Coalition treasurer, Peter Costello. Mr Costello was treasurer when John Howard was prime minister and he was famous for consistently delivering big surpluses and also giving the Australian people tax cuts. Of course Scott Morrison would like to be compared to him, and this Budget follows closely in the Costello mould.

But it is easy to forget what happened to Peter Costello in the end. In the 2007-08 Budget, just before the Global Financial crisis, he was still handing out tax cuts and spending up big. That was costly, because it meant Australia didn’t have as much surplus to draw on when things went bad. And boy did they go bad — in a way Mr Costello never saw coming.

If any of the big risks facing Australia come true, Scott Morrison will be even more like Peter Costello than he ever dreamt — he’ll be the guy who locked in tax cuts and spending just before the economy went to hell.

Jason Murphy is an economist. He publishes the blog Thomas The Think Engine.